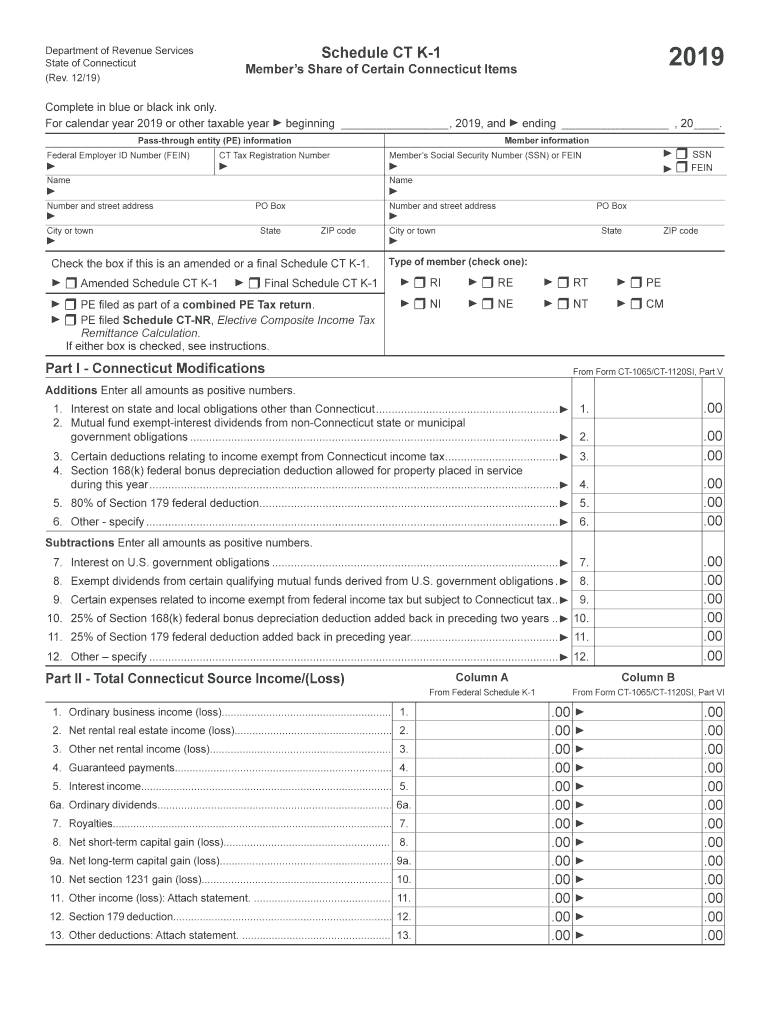

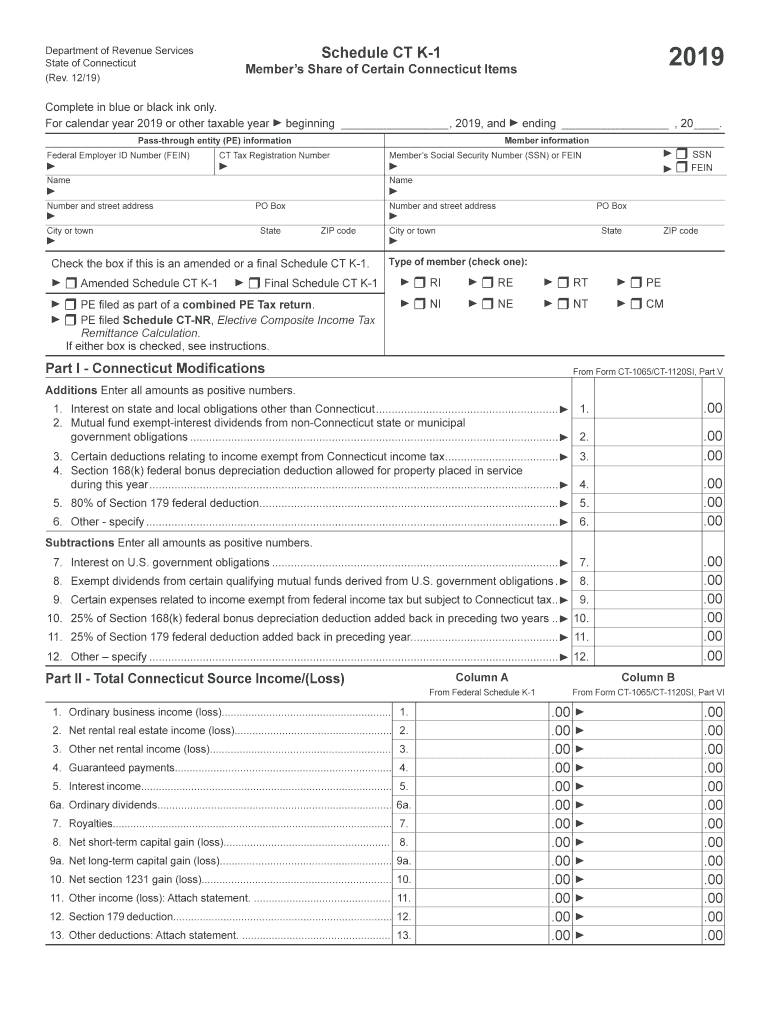

CT DRS Schedule CT K-1 2019 free printable template

Get, Create, Make and Sign CT DRS Schedule CT K-1

Editing CT DRS Schedule CT K-1 online

Uncompromising security for your PDF editing and eSignature needs

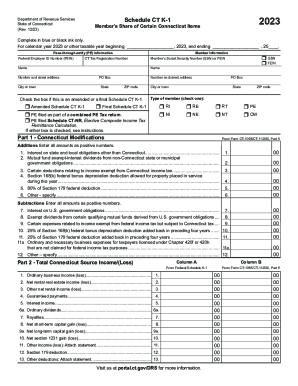

CT DRS Schedule CT K-1 Form Versions

How to fill out CT DRS Schedule CT K-1

How to fill out CT DRS Schedule CT K-1

Who needs CT DRS Schedule CT K-1?

Instructions and Help about CT DRS Schedule CT K-1

Music this is coming to you again from everyday Preppers once again were going to do another little product review I know it's been a little while since we've done one we've got some more knives coming to you again fall of 2018 from Cobra take knives they've sent us some new knives to check out this is some new body knives that they just released, and we wanted to talk to them about their new knives, and they've sent up some new products for them too for us to check out and review, so I wanted to bring them to you today, and they've sent us the lightweight version that we talked about in a previous video and now that they've sent us another one this is their replacement of their CTK this is a new bodied CTK that's a new bodied embossed version that were going to talk about let me back up here roll briefly see if I can get this zoom out a little see if I get my camera to operate right you know say that this replaces the older bodied CTK this is the new version Cobra Tech with the embossed on the body itself if you can see right here they've got the Cobra Texan ache you've got the Cobra tech name embossed into the scale of the body right here you've got the new Cobra scales all the way down you can see that I know its black my camera will focus on that good its on both sides black-on-black is not doing too well is it you've got the belt clip class break this is the interchangeable belt clip, so you loosen the glass-break and this will rotate around for left hand or right side carry to emboss two blades they've gone the extra mile with the new bodies they've engineered it where one they have to engineer it with a built-in safety we've talked about this before so if anything's in front of the blade as it deploys it doesn't necessarily jump off track, but the blade is engineered to stop so if you need things in front of the blade will actually stop, and it acts like he jumps off track, but it goes into a free-floating mode and the blade will free float and the switch won't work its engineered to do that and that's a safety feature that what makes it illegal here you reset it by pulling on the spine right there is free-floating mode right there you grab it by the back of the spine gently tug on it and till go right back to working its made to do that folks that's what makes it legal this knife compared to the previous versions the older bodies it's got stronger Springs in my opinion compared to some others on the market, and I'm not going to name any names but some of the other ones that were similar to their older body style this is hands down ten times better one than their older body style two than the competitions that were similar to the previous versions he got stronger Springs better glides they've engineered the blades where the blades I know some people thought that they could get away with some slick, and they were trying to put these blades and other bodies or other blades in these bodies well that can't happen any more they've engineered...

People Also Ask about

What is the CT pass-through entity tax credit?

Does CT 1065 accept federal extension?

What is Schedule CT K-1?

What is a pass-through tax credit?

What is pass-through entity tax benefit?

What is Form CT 1065 CT 1120SI?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT DRS Schedule CT K-1 online?

How do I edit CT DRS Schedule CT K-1 straight from my smartphone?

How do I complete CT DRS Schedule CT K-1 on an Android device?

What is CT DRS Schedule CT K-1?

Who is required to file CT DRS Schedule CT K-1?

How to fill out CT DRS Schedule CT K-1?

What is the purpose of CT DRS Schedule CT K-1?

What information must be reported on CT DRS Schedule CT K-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.