NE UI Form 1 2015 free printable template

Show details

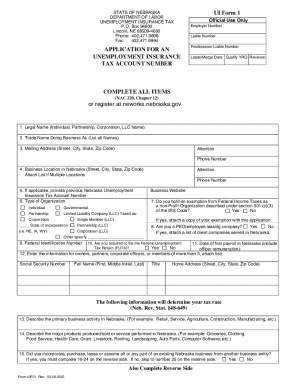

STATE OF NEBRASKA

DEPARTMENT OF LABOR

UNEMPLOYMENT INSURANCE TAX

P.O. Box 94600

Lincoln, NE 685094600

Phone: 402.471.9898

Fax:

402.471.9994APPLICATION FOR AN

UNEMPLOYMENT INSURANCE

TAX ACCOUNT NUMBER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE UI Form 1

Edit your NE UI Form 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE UI Form 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE UI Form 1 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NE UI Form 1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE UI Form 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE UI Form 1

How to fill out ui form 1?

01

Start by providing your personal information, such as your name, address, and contact details.

02

Next, indicate your employment status and income details if applicable.

03

Proceed to fill in the required fields regarding your educational background and any relevant certifications or qualifications.

04

If the form requires you to submit previous work experience, provide accurate details about your past employment, including job titles, dates of employment, and key responsibilities.

05

If there are any additional sections or questions related to your specific industry or profession, ensure you answer them accurately and comprehensively.

06

Once you have completed all the necessary sections, review your answers to ensure they are correct and complete before submitting the form.

Who needs ui form 1?

01

Individuals who are applying for a job or seeking employment opportunities.

02

Employers who require detailed information about potential candidates during the hiring process.

03

Educational institutions that collect profile information from students for various purposes, such as admissions or internship placements.

Fill

form

: Try Risk Free

People Also Ask about

Does nebraska have state unemployment tax?

2022 SUI tax rates For calendar year 2022, Nebraska's average combined SUI tax rate is 0.49%, a reduction of 0.01% compared to the average 2021 combined rate of 0.50%. See the Department's Guide to Understanding Nebraska's Unemployment Insurance Combined Tax Rates for 2022 for more information.

How long do you have to work in Nebraska to draw unemployment?

You must be totally or partially unemployed through no fault of your own, and you must have earned sufficient wages in your base period (the first 4 of the last 5 completed calendar quarters before the start date of your claim, or alternatively the last 4 quarters for some).

What is the new employer UI rate in nebraska?

For calendar year 2023, Nebraska's Unemployment Insurance (UI) average combined tax rate (category 12) will be . 34% of the first $9,000 in wages for employers in categories 1-19. The rate is a reduction from the 2022 rate of 0.49%.

How do I apply for an unemployment insurance tax account number in nebraska?

Application for an Unemployment Insurance Tax Account number can be completed through the internet by using UIConnect or completing a paper tax application. If the employer is determined liable, a tax account will be established.

Can you draw unemployment in Nebraska if you quit your job?

If you quit your job voluntarily, you won't be eligible for unemployment unless you had "good cause" to quit. In Nebraska, you will have good cause if you quit for a compelling work-related reason, such as dangerous working conditions that you employer refused to improve.

How long can you collect unemployment in nebraska?

You may be eligible for up to 26 weeks of benefits during a 12-month period that begins with your claim's effective date. How will I receive my payments? You are required to select a payment method of direct deposit or debit card when filing your initial claim. We do not issue paper checks.

What disqualifies you from unemployment in nebraska?

You must be able to work four or more days of the week in order to be eligible for unemployment insurance benefits. You are not considered able and available if circumstances such as lack of transportation, childcare problems, family care issues, sickness, injury or incarceration would prevent you from working.

How is unemployment calculated in nebraska?

Unemployment benefits in Nebraska are 50% of your average weekly wage from your highest paid quarter, up to a maximum weekly amount of $456 (in 2021). Benefits are available for 26 weeks or until you've received one-third of your base period wages, whichever is less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NE UI Form 1 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your NE UI Form 1 in minutes.

How do I edit NE UI Form 1 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NE UI Form 1 right away.

How do I edit NE UI Form 1 on an iOS device?

Create, modify, and share NE UI Form 1 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NE UI Form 1?

NE UI Form 1 is a document used for reporting unemployment insurance information to the state of Nebraska.

Who is required to file NE UI Form 1?

Employers who have employees in Nebraska and are liable for unemployment insurance taxes are required to file NE UI Form 1.

How to fill out NE UI Form 1?

To fill out NE UI Form 1, employers must provide accurate details about their business, including payroll information and employee details, ensuring all sections of the form are completed as per the instructions.

What is the purpose of NE UI Form 1?

The purpose of NE UI Form 1 is to report wages and determine unemployment insurance tax liabilities for employers in Nebraska.

What information must be reported on NE UI Form 1?

NE UI Form 1 must report information such as employer identification details, employee wages, and employee counts for the reporting period.

Fill out your NE UI Form 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE UI Form 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.