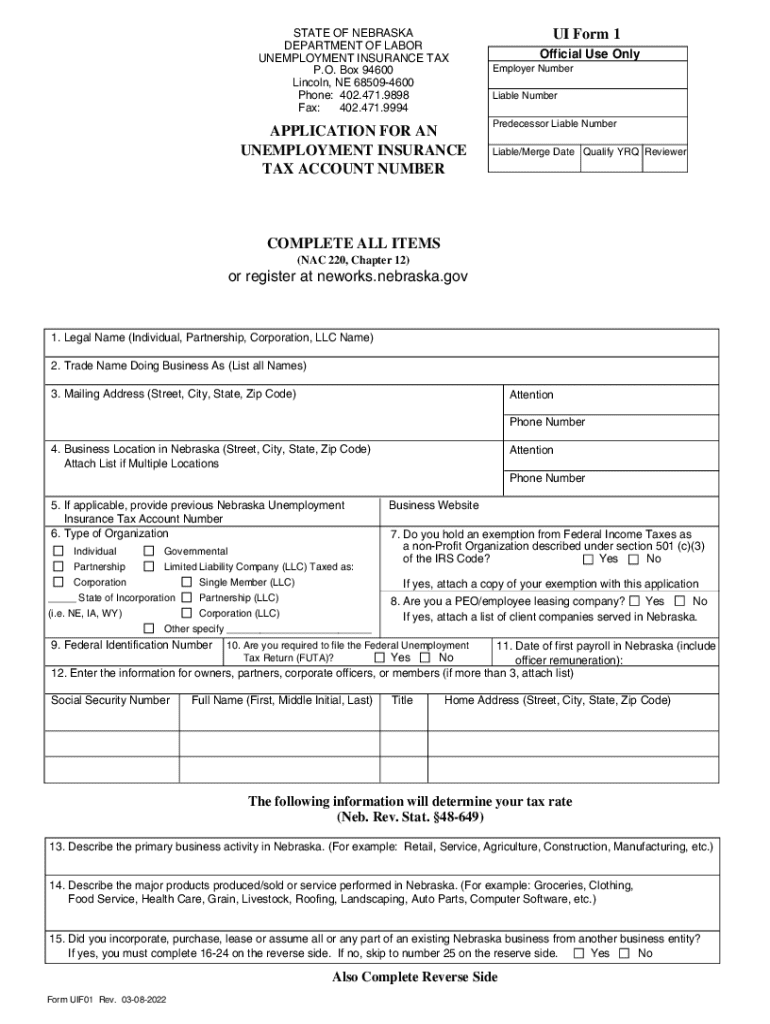

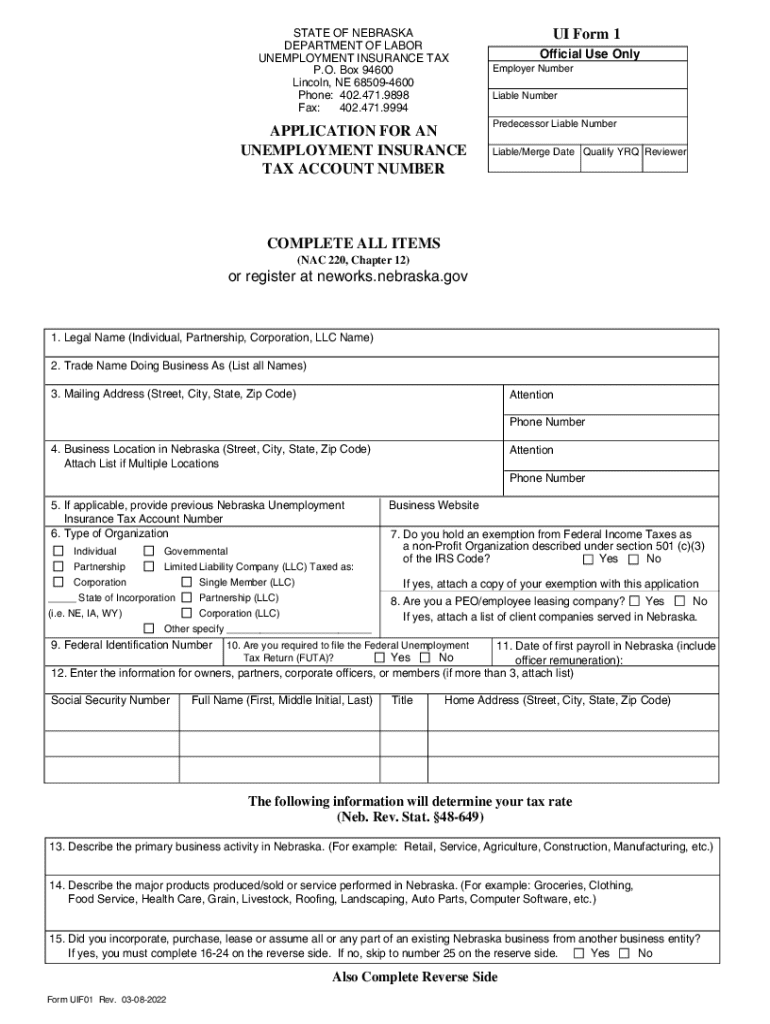

NE UI Form 1 2022-2025 free printable template

Get, Create, Make and Sign NE UI Form 1

How to edit NE UI Form 1 online

Uncompromising security for your PDF editing and eSignature needs

NE UI Form 1 Form Versions

A Comprehensive Guide to the Dol Nebraska Form

Understanding the Dol Nebraska Form

The Dol Nebraska Form is a crucial document required by the Nebraska Department of Labor for individuals seeking to file unemployment claims or report income. This form plays a vital role in ensuring that claimants receive the appropriate benefits they are entitled to, based on their employment history and financial status.

Completing the Dol Nebraska Form correctly is essential not only for the swift processing of claims but also to avoid unnecessary delays or denials of benefits. It's important for both employees and employers to understand when this form is needed and how it impacts their financial situations.

Where to Access the Dol Nebraska Form

Accessing the Dol Nebraska Form is straightforward, with several official resources available. The primary source is the Nebraska Department of Labor website, which offers various forms and supplementary information related to unemployment claims.

Additionally, users can download the Dol Nebraska Form in PDF format directly from the website. This makes it easy to print and fill out manually, ensuring that all necessary information is provided.

For those preferring a digital format or editing tools, pdfFiller provides an efficient platform to access the Dol Nebraska Form. Users can fill, edit, and sign the document online, making it a versatile option for busy individuals.

Step-by-step instructions for filling out the Dol Nebraska Form

Filling out the Dol Nebraska Form requires careful attention to detail. Start by gathering all necessary personal information, including your Social Security number, contact details, and employment history. Have your last paycheck stub or relevant tax documents ready, as this information will be crucial for accurately reporting your earnings.

Next, follow these detailed instructions for each section of the form:

To avoid common mistakes, double-check each section for accuracy and ensure that all required fields are completed before submission.

Editing and managing the Dol Nebraska Form

Once you have filled out the Dol Nebraska Form, it's important to review and manage your document effectively. PdfFiller offers numerous editing tools that allow you to enhance your form, including adding text, signatures, and correcting any mistakes prior to submission.

Managing your documents is made easy with pdfFiller’s cloud storage options. You'll be able to save and access your completed form from anywhere, ensuring your sensitive information remains secure with the platform's robust security features.

Submitting the Dol Nebraska Form

After completing the Dol Nebraska Form, the next step is to submit it. There are two primary methods for submission: online through the Nebraska Department of Labor's official website and by mail. If you're submitting online, ensure that you’ve followed all guidelines to confirm that your form is correctly processed.

For mail submissions, package your form securely, include any additional documents required, and send it to the provided address on the form. Always keep a copy of the form for your records.

Understanding the response to your Dol Nebraska Form submission

After submitting the Dol Nebraska Form, you will receive a response regarding your claim. The Department of Labor will process your submission and inform you if any additional information is needed. Understanding these responses is crucial to ensuring you stay on track with your benefits.

If you receive an unfavorable response or one that requires additional documents, take prompt action to address the issues. Keep records of all communications with the Department of Labor.

FAQs related to the Dol Nebraska Form

Navigating the Dol Nebraska Form process can raise questions. Here are some frequently asked questions that may provide clarity to those filling out the form.

Tips for successfully navigating the Dol Nebraska Form process

To navigate the Dol Nebraska Form process successfully, preparation is key. Gather all required information before beginning the form, as this will save time and effort. Double-check your entries, especially in crucial areas such as your Social Security number and employment dates.

Utilizing resources available through the Nebraska Department of Labor and sites like pdfFiller can significantly ease the process, providing guidance and support to users.

Final thoughts on the Dol Nebraska Form

The Dol Nebraska Form is a vital component for individuals navigating unemployment benefits. By understanding its purpose, accessing the form easily, and filling it out accurately, users can help ensure their claims are processed efficiently.

Leveraging tools such as pdfFiller not only facilitates the completion of this form but also enhances document management solutions for future needs. Staying proactive and informed will empower users throughout their journey in managing their unemployment claims.

People Also Ask about

Does nebraska have state unemployment tax?

How long do you have to work in Nebraska to draw unemployment?

What is the new employer UI rate in nebraska?

How do I apply for an unemployment insurance tax account number in nebraska?

Can you draw unemployment in Nebraska if you quit your job?

How long can you collect unemployment in nebraska?

What disqualifies you from unemployment in nebraska?

How is unemployment calculated in nebraska?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NE UI Form 1?

How do I execute NE UI Form 1 online?

How can I edit NE UI Form 1 on a smartphone?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.