OR 150-101-062 2014 free printable template

Show details

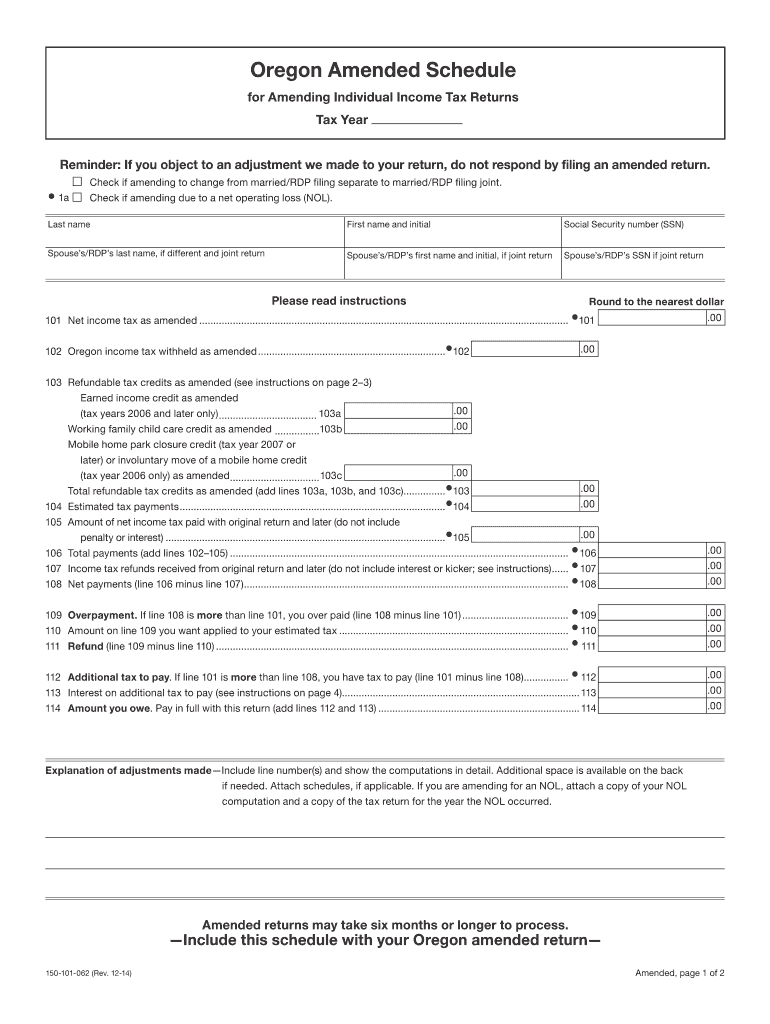

When Scott amends his 2012 tax return he will enter 5 400 on line 107 of his Oregon Amended Schedule. January 16 2009 to January 15 2010 Example 6 Sally filed her 2011 Oregon amended return and schedule on March 12 2014. Later Amy amends her 2011 return and she enters 350 on line 105 of her Oregon Amended Schedule. She will only include the tax payments. Oregon amended return corrected Form 40S 40 40N or 40P. Schedule OR-A or Schedule OR-A-N/P for tax year 2007 and Schedule OR-ASC or Schedule...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR 150-101-062

Edit your OR 150-101-062 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR 150-101-062 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR 150-101-062 online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OR 150-101-062. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR 150-101-062 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR 150-101-062

How to fill out OR 150-101-062

01

Obtain the OR 150-101-062 form from the official website or local office.

02

Carefully read the instructions provided on the form to understand what information is required.

03

Fill in your personal details such as name, address, and contact information in the designated fields.

04

Provide any necessary identification numbers or references as requested.

05

Complete the sections that apply to your specific situation, ensuring accuracy and completeness.

06

Review the filled form for any mistakes or missing information.

07

Sign and date the form at the bottom as required.

08

Submit the completed form to the appropriate office or online portal as directed.

Who needs OR 150-101-062?

01

Individuals applying for a specific license or permit.

02

Businesses seeking compliance with local regulations.

03

Anyone needing to report certain information to authorities.

Fill

form

: Try Risk Free

People Also Ask about

What forms do I send with my 1040X?

What to include in your amended return A copy of the federal refund deposit slip. Any previously unsubmitted W-2 or 1099 forms. Any other substantiating forms, schedules, or documentation supporting the amended return.

What form do I use for amended refund?

File an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return as soon as possible. Include any forms and/or schedules that you're changing and/or didn't include with the original return. Return the refund check with a letter of explanation.

How do I get my amended refund?

Taxpayers can also call the IRS' toll-free amended return hotline at 866-464-2050 to check on the status of an amended return three weeks post-filing.

What is form 40p Oregon?

2022 Form OR-40-P, Oregon Individual Income Tax Return for Full-year Residents, 150-101-055.

How do I file an amended Schedule C?

Amending Schedule C First, make the change to Schedule C, and prepare a corrected copy. The amount of the change should affect the Net Profit or Loss line. If your business had a change in profit, you must also complete a new Schedule SE for the change in self-employment tax.

How do I file an amended tax return in Oregon?

If you need to change or amend an accepted Oregon State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents), Form 40-N (nonresidents), or Form 40-P (part-year residents). Forms 40, 40-N, and 40-P are Forms used for the Tax Amendment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OR 150-101-062 to be eSigned by others?

When you're ready to share your OR 150-101-062, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the OR 150-101-062 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your OR 150-101-062 in seconds.

How can I edit OR 150-101-062 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing OR 150-101-062, you can start right away.

What is OR 150-101-062?

OR 150-101-062 is a form used for reporting specific tax information to the Oregon Department of Revenue.

Who is required to file OR 150-101-062?

Individuals and businesses that meet certain tax criteria set by the Oregon Department of Revenue are required to file OR 150-101-062.

How to fill out OR 150-101-062?

To fill out OR 150-101-062, you need to provide personal or business information, detail your income, and report any deductions applicable, following the instructions provided on the form.

What is the purpose of OR 150-101-062?

The purpose of OR 150-101-062 is to ensure that taxpayers report their income accurately and comply with state tax laws in Oregon.

What information must be reported on OR 150-101-062?

The information that must be reported on OR 150-101-062 includes your identification details, income sources, applicable deductions, and tax liability calculations.

Fill out your OR 150-101-062 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR 150-101-062 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.