OR 150-101-062 2012 free printable template

Show details

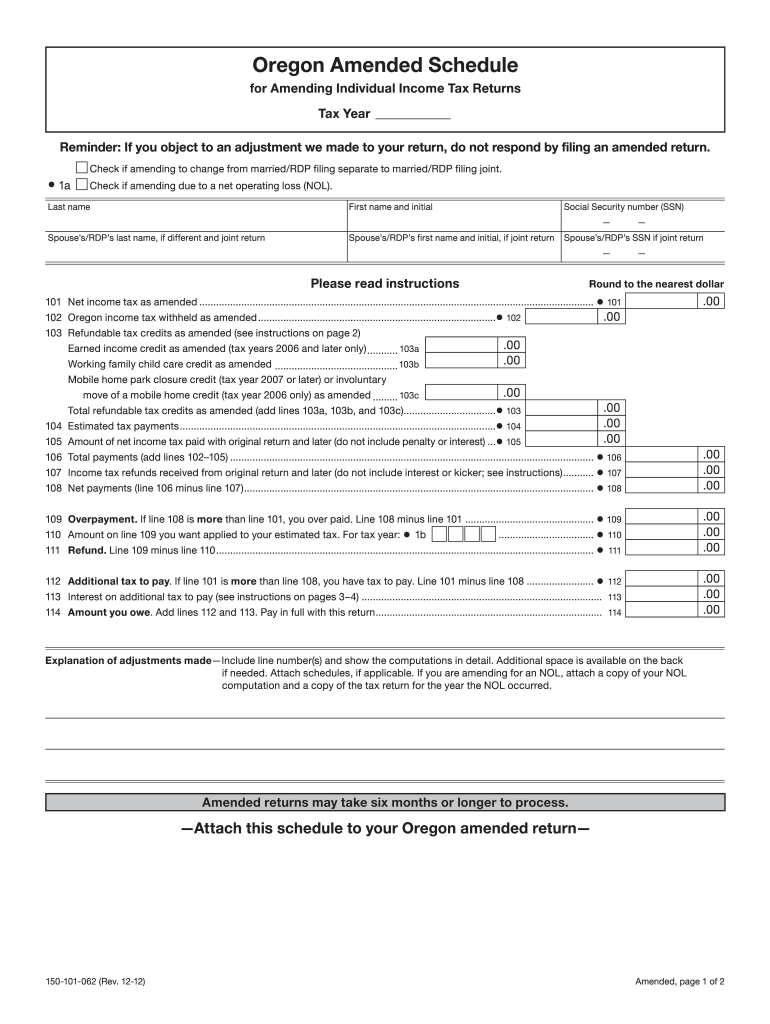

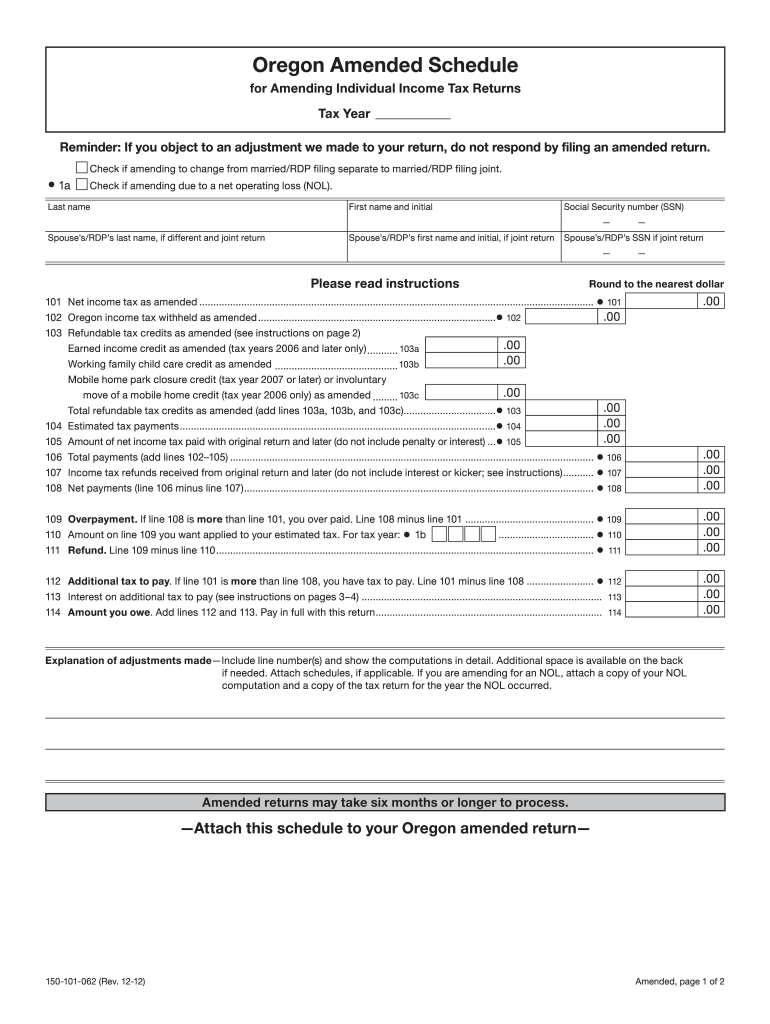

Clear This Page Oregon Amended Schedule for Amending Individual Income Tax Returns Tax Year Reminder: If you object to an adjustment we made to your return, do not respond by filing an amended return.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR 150-101-062

Edit your OR 150-101-062 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR 150-101-062 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR 150-101-062 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OR 150-101-062. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR 150-101-062 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR 150-101-062

How to fill out OR 150-101-062

01

Obtain the OR 150-101-062 form from the official website or local tax office.

02

Fill in your personal information, including name, address, and social security number in the designated fields.

03

Provide details about your income for the specified period.

04

Include any deductions or credits that you are eligible for.

05

Double-check all entries for accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate tax authority either by mail or electronically.

Who needs OR 150-101-062?

01

Individuals who are required to report their income to the tax authorities.

02

Taxpayers seeking to claim specific deductions or credits.

03

Residents of the jurisdiction that mandates the use of OR 150-101-062 for tax reporting.

04

Businesses or self-employed individuals reporting certain types of income.

Fill

form

: Try Risk Free

People Also Ask about

What forms do I send with my 1040X?

What to include in your amended return A copy of the federal refund deposit slip. Any previously unsubmitted W-2 or 1099 forms. Any other substantiating forms, schedules, or documentation supporting the amended return.

What form do I use for amended refund?

File an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return as soon as possible. Include any forms and/or schedules that you're changing and/or didn't include with the original return. Return the refund check with a letter of explanation.

How do I get my amended refund?

Taxpayers can also call the IRS' toll-free amended return hotline at 866-464-2050 to check on the status of an amended return three weeks post-filing.

What is form 40p Oregon?

2022 Form OR-40-P, Oregon Individual Income Tax Return for Full-year Residents, 150-101-055.

How do I file an amended Schedule C?

Amending Schedule C First, make the change to Schedule C, and prepare a corrected copy. The amount of the change should affect the Net Profit or Loss line. If your business had a change in profit, you must also complete a new Schedule SE for the change in self-employment tax.

How do I file an amended tax return in Oregon?

If you need to change or amend an accepted Oregon State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents), Form 40-N (nonresidents), or Form 40-P (part-year residents). Forms 40, 40-N, and 40-P are Forms used for the Tax Amendment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OR 150-101-062 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including OR 150-101-062, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the OR 150-101-062 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your OR 150-101-062 in seconds.

How do I edit OR 150-101-062 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share OR 150-101-062 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is OR 150-101-062?

OR 150-101-062 is a form used by taxpayers in Oregon to report certain financial information for tax purposes.

Who is required to file OR 150-101-062?

Individuals and businesses who have specific tax reporting obligations in Oregon are required to file OR 150-101-062.

How to fill out OR 150-101-062?

To fill out OR 150-101-062, provide accurate financial information as specified in the form's instructions, ensuring all required fields are completed.

What is the purpose of OR 150-101-062?

The purpose of OR 150-101-062 is to assist the Oregon Department of Revenue in assessing and collecting taxes by providing necessary financial data from taxpayers.

What information must be reported on OR 150-101-062?

The information that must be reported on OR 150-101-062 includes income, deductions, credits, and other relevant financial details as required by the form.

Fill out your OR 150-101-062 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR 150-101-062 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.