Get the free Form 1023-EZ First Year Report

Show details

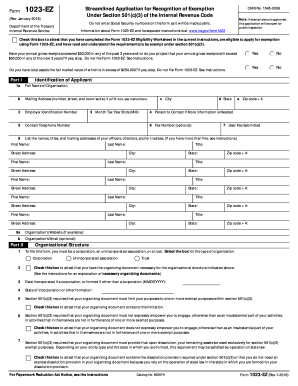

Form 1023EZ First Year Report

Executive Summary

On July 1, 2014, IRS developed and released Form 1023EZ, a simplified electronic application form

for smaller organizations to request and obtain exemption

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1023-ez first year

Edit your form 1023-ez first year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1023-ez first year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1023-ez first year online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1023-ez first year. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1023-ez first year

How to Fill Out Form 1023-EZ First Year:

01

Gather necessary information: Before starting to fill out Form 1023-EZ, gather all the necessary information, including the organization's legal name, mailing address, employer identification number (EIN), and contact information.

02

Review the eligibility requirements: Ensure that your organization meets the eligibility criteria for filing Form 1023-EZ. These criteria include having a projected gross receipts of $50,000 or less in each of the first three years and being organized and operated exclusively for tax-exempt purposes.

03

Download and complete the form: Visit the IRS website or use a reputable tax software to download Form 1023-EZ. Carefully read through the instructions and fill out the form according to the specific requirements. Provide accurate information and double-check all entries before submitting.

04

Prepare your narrative description: Along with Form 1023-EZ, you will need to provide a narrative description of your organization's activities, including its mission, programs, and how it operates. Be concise and clear in explaining your organization's purpose and ensure it aligns with the IRS regulations for tax-exempt status.

05

Pay the required user fee: As of 2021, the user fee for filing Form 1023-EZ is $275. Ensure you enclose the correct payment, either by check or money order, payable to the "United States Treasury."

06

Review and submit the form: Carefully review all the information you have entered on Form 1023-EZ and check for any errors or omissions. Once you are confident in the accuracy of the form, sign and date it before submitting it to the IRS for processing.

Who needs Form 1023-EZ first year?:

01

Small nonprofit organizations: Form 1023-EZ is specifically designed for small nonprofit organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. If your organization expects to have annual gross receipts of $50,000 or less in each of the first three years, you may be eligible to file Form 1023-EZ.

02

Organizations with tax-exempt purposes: To be eligible for Form 1023-EZ, your organization must have tax-exempt purposes, such as charitable, educational, religious, scientific, or literary activities. Ensure your activities align with the IRS regulations for tax-exempt status before considering filing this form.

03

Organizations willing to complete the simplified form: Form 1023-EZ is designed to streamline the application process for small nonprofits. If you believe your organization meets the eligibility criteria and can provide all the necessary information in the simplified format, you may choose to use Form 1023-EZ instead of the longer and more comprehensive Form 1023.

Fill

form

: Try Risk Free

People Also Ask about

Do I qualify for 1023 EZ?

Basic Eligibility Requirements for the 1023-EZ gross income under $50,000 in the past 3 years. estimated gross income less than $50,00 for the next 3 years. fair market assets under $250,000. formed in the United States.

What happens if I use Form 1023 EZ and bring in more than $50 000?

The IRS has also said that a recognition letter may not be relied on by donors if it is based on “any inaccurate material information.” If you get more than $50,000 in a year, you will have to file at least a Form 990-EZ and bring yourself to the attention of the IRS.

What happens if I use Form 1023-EZ and bring in more than $50 000?

The IRS has also said that a recognition letter may not be relied on by donors if it is based on “any inaccurate material information.” If you get more than $50,000 in a year, you will have to file at least a Form 990-EZ and bring yourself to the attention of the IRS.

How long do I have to file 1023-EZ filing?

Generally, if you file Form 1023-EZ within 27 months after the end of the month in which you were legally formed, and we approve the application, the legal date of formation will be the effective date of your exempt status.

What is the highest compensated employee on Form 1023?

Part V of Form 1023 asks questions about compensation and other financial arrangements with officers, directors, trustees, highest compensated employees (receiving more than $100,000 annually) and highest compensated independent contractors (receiving more than $100,000 annually), along with certain other related

How do I fill out a 1023 form?

0:28 2:38 Learn How to Fill the Form 1023 Application for Recognition of YouTube Start of suggested clip End of suggested clip In lines 2 through 9 answering. Yes or no to each question. For part 7 & 8.MoreIn lines 2 through 9 answering. Yes or no to each question. For part 7 & 8.

Who can help me fill out 1023 form?

The IRS. To get help with your 1023, you can also go straight to the source. The Internal Revenue Service has a guide with instructions dedicated to filing their forms. You can find the publication specific to the 1023 here.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 1023-ez first year?

With pdfFiller, the editing process is straightforward. Open your form 1023-ez first year in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I fill out form 1023-ez first year on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your form 1023-ez first year. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit form 1023-ez first year on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form 1023-ez first year from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is form 1023-ez first year?

Form 1023-EZ is a simplified version of Form 1023 used by some small nonprofits to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

Who is required to file form 1023-ez first year?

Nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to file Form 1023-EZ.

How to fill out form 1023-ez first year?

Form 1023-EZ can be filed online through the IRS website by providing information about the organization's activities, governance, finances, and more.

What is the purpose of form 1023-ez first year?

The purpose of Form 1023-EZ is to streamline the application process for small nonprofits seeking tax-exempt status, making it easier and quicker to obtain recognition from the IRS.

What information must be reported on form 1023-ez first year?

Information about the organization's purpose, activities, finances, governance structure, and more must be reported on Form 1023-EZ.

Fill out your form 1023-ez first year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1023-Ez First Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.