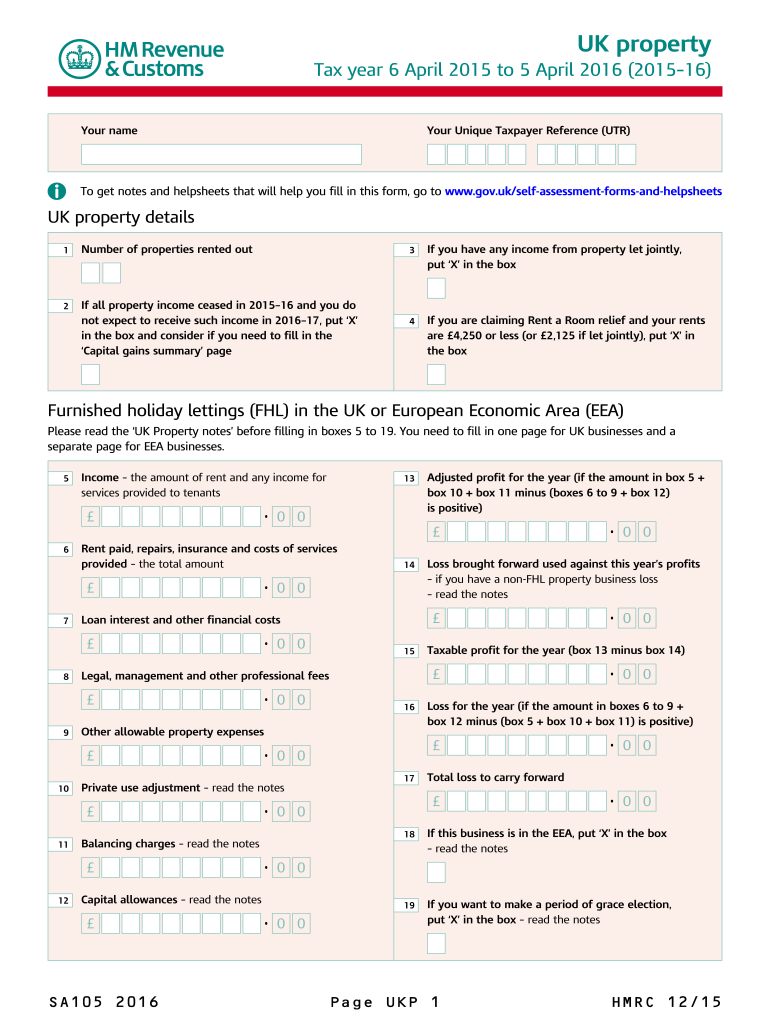

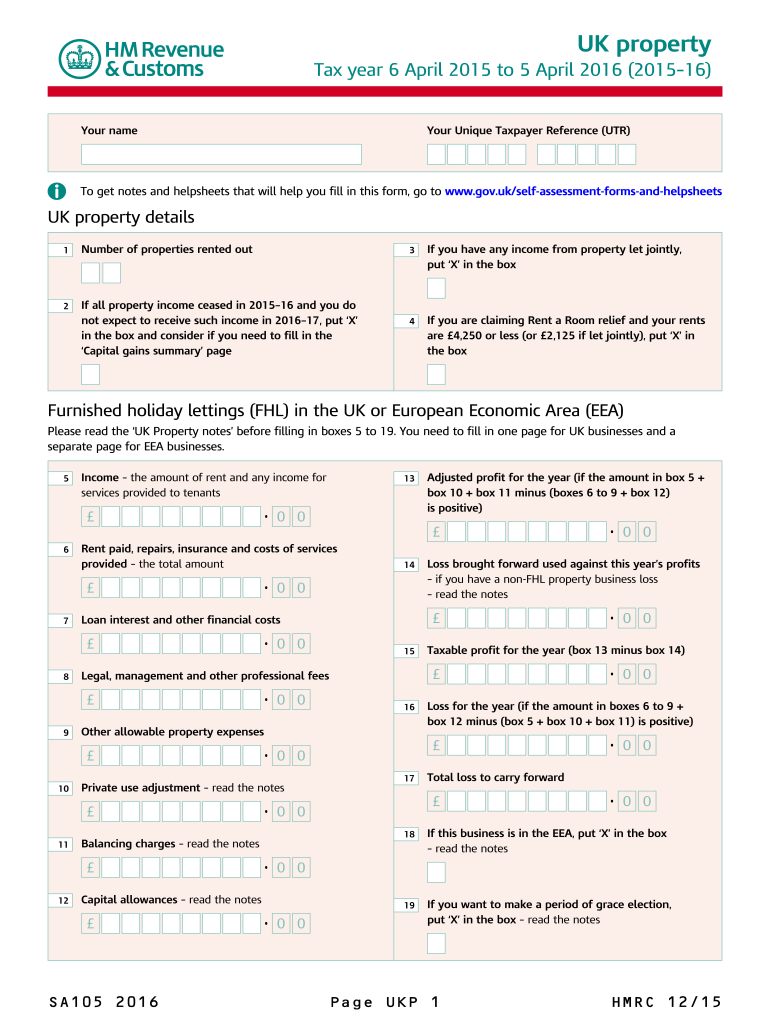

UK HMRC SA105 2016 free printable template

Show details

UK property Tax year 6 April 2015 to 5 April 2016 2015 16 Your name Your Unique Taxpayer Reference UTR To get notes and helpsheets that will help you fill in this form go to www. gov.uk/self-assessment-forms-and-helpsheets UK property details Number of properties rented out all property income ceased in 2015 16 and you do If not expect to receive such income in 2016 17 put X in the box and consider if you need to fill in the Capital gains summary page you have any income from property let...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK HMRC SA105

Edit your UK HMRC SA105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC SA105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC SA105 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK HMRC SA105. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC SA105

How to fill out UK HMRC SA105

01

Obtain the SA105 form from the HMRC website or your tax return package.

02

Fill in your personal details, including your name, address, and National Insurance number at the top of the form.

03

Provide your unique taxpayer reference (UTR).

04

Indicate the total income from your property, including rental income.

05

Complete the expenses section by detailing allowable expenses such as repairs, insurance, and management fees.

06

Calculate your taxable profit by subtracting your total expenses from your total income.

07

If applicable, include any adjustments for losses brought forward from previous years.

08

Review all information for accuracy before submitting.

09

Submit the completed SA105 form with your Self Assessment tax return by the deadline.

Who needs UK HMRC SA105?

01

Any individual who earns income from property, including rental income, in the UK must complete the SA105.

02

Landlords who let residential or commercial properties.

03

Individuals who are part of a partnership that earns property income.

Fill

form

: Try Risk Free

People Also Ask about

Am I required to file a UK tax return?

HM Revenue and Customs sends Tax Returns – or a notice to file on-line – to everyone in the Self-Assessment system in April / May every year. If you receive a tax return, or a notice to file on-line, you must complete a return and submit it to HMRC.

Do UK non-residents have to file a tax return?

Non-residents have to pay tax on income, but usually only pay Capital Gains Tax either: on UK property or land. if they return to the UK.

Do I need to file a UK tax return?

Most employees working in the UK pay all their tax through the PAYE system and are not required to submit a tax return. You may, however, need to complete a tax return because your tax affairs are complicated in some way, for example by having a source of untaxed income, in addition to your employment income.

Do you need to fill in the UK property pages?

You need to fill in the Foreign pages if you receive income from land and property overseas, but income from a furnished holiday letting in the EEA must go in the UK property pages. However, if your income from a furnished holiday letting is taxable on the remittance basis, fill in the Foreign pages.

Do I need to do a tax return if I earn under 10 000 UK?

Do I do a tax return if my income is less than the personal allowance? In short, yes. You still do.

What is self assessment tax?

The self assessment tax mechanism is most commonly how self-employed tax payers to ensure they pay their due tax prior to completion of the financial year and before filing their tax returns. Note that the Income Tax Return (ITR) filing is not considered complete unless the full tax amount is paid under these heads.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK HMRC SA105 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your UK HMRC SA105, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the UK HMRC SA105 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your UK HMRC SA105 in seconds.

How can I edit UK HMRC SA105 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing UK HMRC SA105, you can start right away.

What is UK HMRC SA105?

UK HMRC SA105 is a supplementary form used for reporting income and expenses from self-employment as part of the Self Assessment tax return in the UK.

Who is required to file UK HMRC SA105?

Individuals who are self-employed or have income from a partnership are required to file UK HMRC SA105 when completing their Self Assessment tax return.

How to fill out UK HMRC SA105?

To fill out UK HMRC SA105, you need to provide your income details, expenses, and any allowances or reliefs you are claiming related to your self-employment.

What is the purpose of UK HMRC SA105?

The purpose of UK HMRC SA105 is to report earnings and deductions from self-employment, which are then used to calculate the taxable profit and the amount of tax due.

What information must be reported on UK HMRC SA105?

The information that must be reported on UK HMRC SA105 includes total income from self-employment, business expenses, capital allowances, and any other relevant financial details pertaining to the business.

Fill out your UK HMRC SA105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC sa105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.