UK HMRC SA105 2019 free printable template

Show details

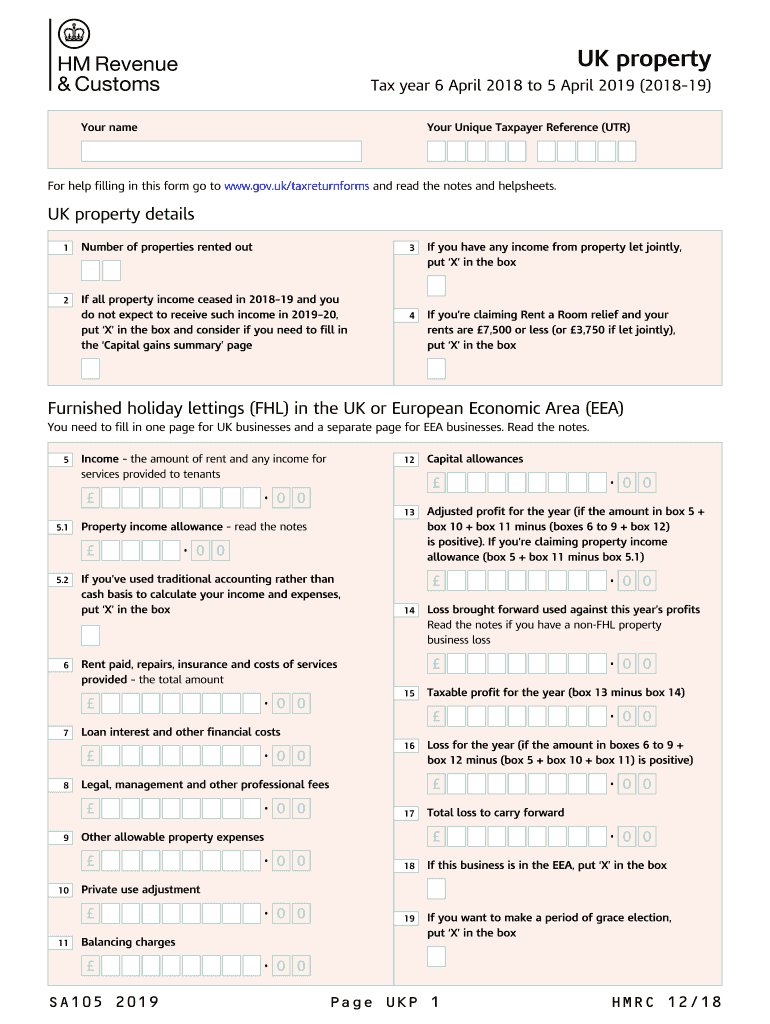

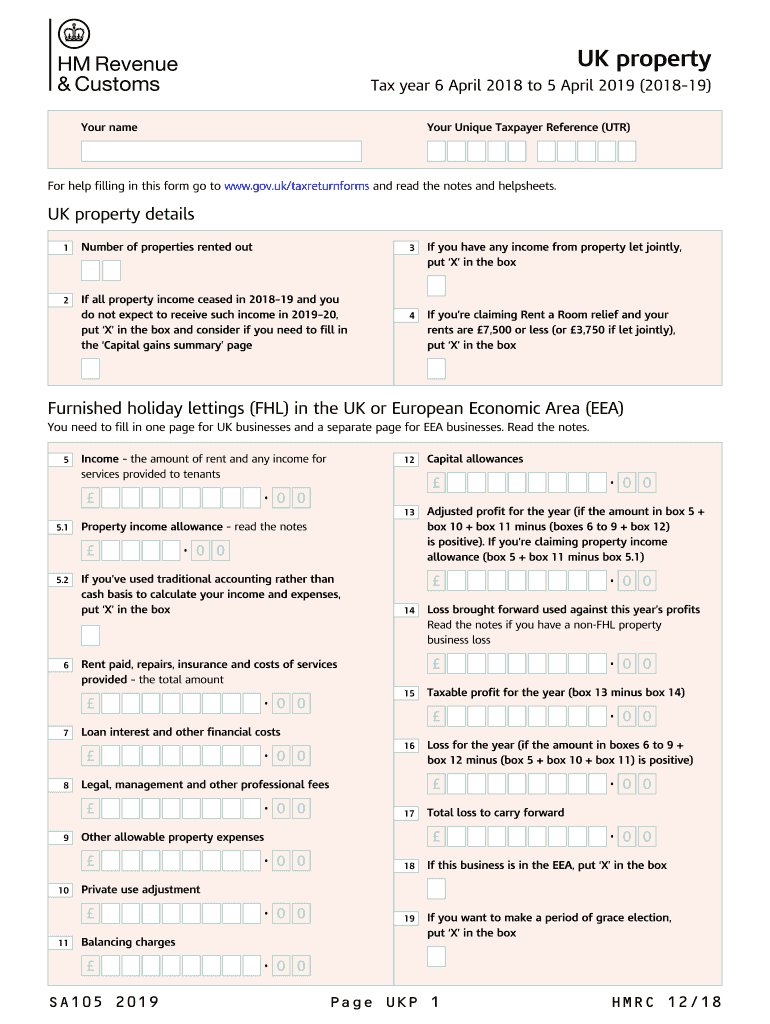

UK property

Tax year 6 April 2018 to 5 April 2019 (201819)Your numerous Unique Taxpayer Reference (UTC)For help to fill in this form go to www.gov.uk/taxreturnforms and read the notes and help sheets.UK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK HMRC SA105

Edit your UK HMRC SA105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC SA105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC SA105 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK HMRC SA105. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC SA105

How to fill out UK HMRC SA105

01

Download the SA105 form from the HMRC website or obtain a paper version.

02

Fill in your personal details including your name, address, and National Insurance number.

03

Indicate the type of income you are reporting, such as rental income or partnership profits.

04

Complete the income section by providing the total income earned during the tax year.

05

Record any allowable expenses related to your income on the relevant section.

06

Calculate your total profit or loss by deducting expenses from your income.

07

If applicable, fill in any capital allowances or reliefs you are claiming.

08

Complete the declaration section at the end of the form, confirming the accuracy of your entries.

09

Review your entries and ensure all sections are complete before submitting the form.

10

Submit the form electronically via HMRC online services or by post to the HMRC address provided.

Who needs UK HMRC SA105?

01

Individuals who receive income from self-employment, rental properties, or partnerships.

02

Self-employed individuals needing to report their business income and expenses.

03

Landlords who need to declare their rental income and associated costs.

04

Partners in a partnership who must report their share of partnership profits.

Fill

form

: Try Risk Free

People Also Ask about

How do I download SA105 form?

You can find the SA105 form on this HMRC page: select the year that you need the form for. download the SA105 form. print it and fill it in.

How to download SA100?

You can download the SA100 form via HMRC's website, but remember to apply for your UTR at least 6 weeks before the tax deadline; without a UTR you will not be able to submit a tax return, and this will result in a penalty. But don't worry, you can apply for your UTR via the SimpleTax Wizard, in minutes.

Can I complete SA100 online?

The main tax return (SA100) You can: file your Self Assessment tax return online.

Can I submit SA106 online?

No, you will only need to fill out the SA106 if you submit your tax return on paper. We highly recommend filing online–the deadline for filing online is 3 months later than the deadline for paper returns. It is much more straightforward online, and the sections you need to fill out will automatically be supplied.

What form do you use to file a tax return with the IRS?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Do I need to complete SA105?

The SA105 should be filled out if you receive: rental income and other receipts from UK land or property. income from letting furnished rooms in your own home. income from Furnished Holiday Lettings (FHL) in the UK or European Economic Area (EEA)

How to complete SA100?

How do I fill the SA100 form? You'll find all the documents you'll need to print and fill out on HMRC's website. There, you'll be able to pick the year you want to file for. Once you choose what year you need, you can download the SA100 tax return form to your computer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UK HMRC SA105?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific UK HMRC SA105 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete UK HMRC SA105 online?

pdfFiller makes it easy to finish and sign UK HMRC SA105 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit UK HMRC SA105 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your UK HMRC SA105 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is UK HMRC SA105?

The UK HMRC SA105 is a supplementary form used to report income from self-employment on the Self Assessment tax return. It is specifically designed for self-employed individuals to declare profits and losses from their business activities.

Who is required to file UK HMRC SA105?

Individuals who are self-employed or who have income from a partnership are required to file the UK HMRC SA105 as part of their annual Self Assessment tax return.

How to fill out UK HMRC SA105?

To fill out the UK HMRC SA105, individuals should gather their financial records, including income and expenses. The form requires details such as the business name, financial year, and a breakdown of all income and spending. It's essential to accurately report net profit or loss from the business.

What is the purpose of UK HMRC SA105?

The purpose of the UK HMRC SA105 is to allow self-employed individuals to report their business income and associated expenses, enabling HMRC to calculate the correct amount of tax owed based on the profits earned.

What information must be reported on UK HMRC SA105?

UK HMRC SA105 requires reporting of several key pieces of information including the individual's name and address, the business name, the accounting period, total income from self-employment, allowable business expenses, and the resulting profit or loss.

Fill out your UK HMRC SA105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC sa105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.