Get the free IFRS 9 Financial Instruments - ifrs

Show details

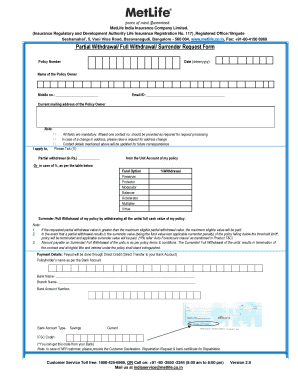

2012 Technical Summary IFRS 9 Financial Instruments as issued at 1 January 2012. Includes IFRS with an effective date after 1 January 2012 but not the IFRS they will replace. This extract has been

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifrs 9 financial instruments

Edit your ifrs 9 financial instruments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifrs 9 financial instruments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ifrs 9 financial instruments online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ifrs 9 financial instruments. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifrs 9 financial instruments

How to fill out IFRS 9 financial instruments:

01

Start by gathering all relevant financial data, including balance sheets, income statements, and cash flow statements. This information will be crucial in determining the fair value of financial assets and assessing impairment.

02

Identify the financial instruments within your organization's portfolio that fall under the scope of IFRS 9. This includes assets such as financial assets at fair value through profit or loss (FVTPL), financial assets measured at amortized cost, and financial assets measured at fair value through other comprehensive income (FVOCI).

03

Determine the classification and measurement category for each financial instrument. This involves evaluating the business model in which the asset is held and the contractual cash flow characteristics of the asset. Apply the appropriate classification (FVTPL, amortized cost, or FVOCI) based on these factors.

04

Assess impairment for financial assets. Use a forward-looking approach, considering expected credit losses over the life of the instrument. This requires evaluating the credit risk associated with each financial asset and forecasting potential losses. Apply the appropriate impairment model, such as the general approach or the simplified approach for trade receivables and lease receivables.

05

Record any necessary adjustments to the carrying amount of financial assets in the financial statements. Ensure that the financial statements reflect the accurate valuations based on the classification and impairment assessments.

06

Disclose the relevant information in the financial statements and accompanying notes. This should include details about the classification and measurement of financial instruments, impairment methodology, and any significant judgments or estimates made in applying IFRS 9.

Who needs IFRS 9 financial instruments:

01

Companies listed on a stock exchange: Publicly traded companies are often required to comply with international financial reporting standards, including IFRS 9. This ensures consistency and comparability in financial statements, allowing investors to make informed decisions.

02

Financial institutions: Banks, insurance companies, and other financial institutions that engage in lending or investment activities need to understand and apply IFRS 9. It provides guidance on how to measure and recognize financial assets and liabilities, as well as how to assess impairment, which is essential for managing risks within their portfolios.

03

Multinational corporations: Companies operating across borders often need to prepare financial statements in accordance with the relevant international accounting standards. IFRS 9 is an integral part of these standards and is used to ensure consistency in reporting financial instruments across different jurisdictions.

04

Audit and accounting firms: Professionals working in audit and accounting firms need to have a thorough understanding of IFRS 9 to provide accurate and reliable financial reporting services to their clients. Compliance with IFRS 9 may require extensive knowledge and expertise in the area of financial instruments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ifrs 9 financial instruments in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing ifrs 9 financial instruments and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my ifrs 9 financial instruments in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ifrs 9 financial instruments and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit ifrs 9 financial instruments on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ifrs 9 financial instruments.

What is ifrs 9 financial instruments?

IFRS 9 Financial Instruments is an international accounting standard that addresses the classification and measurement of financial assets and liabilities.

Who is required to file ifrs 9 financial instruments?

Companies that are required to comply with IFRS reporting standards are required to file IFRS 9 Financial Instruments.

How to fill out ifrs 9 financial instruments?

To fill out IFRS 9 Financial Instruments, companies need to classify their financial assets and liabilities, measure them at fair value, and recognize any impairment losses.

What is the purpose of ifrs 9 financial instruments?

The purpose of IFRS 9 Financial Instruments is to provide more relevant and useful information about an entity's financial position and performance.

What information must be reported on ifrs 9 financial instruments?

Companies must report the classification and measurement of their financial assets and liabilities, any impairment losses recognized, and any hedge accounting activities.

Fill out your ifrs 9 financial instruments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifrs 9 Financial Instruments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.