OH IT 1040 2016 free printable template

Show details

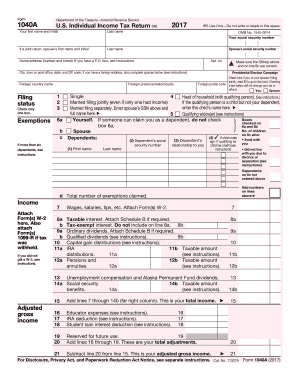

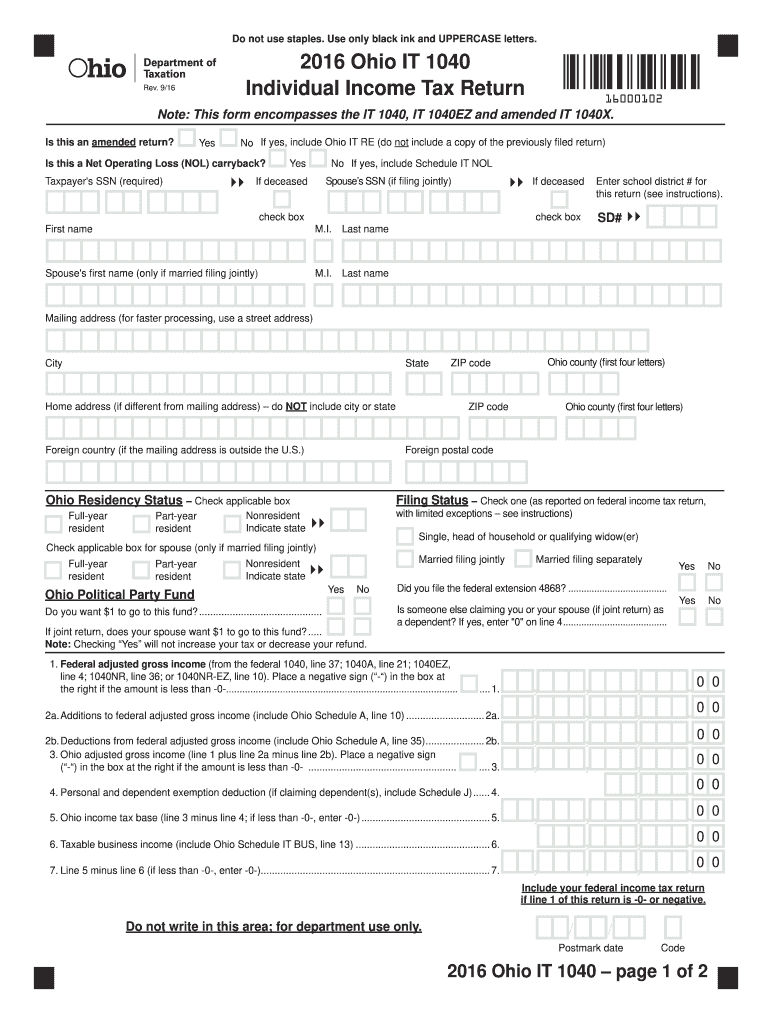

Do not use staples. Use only black ink and UPPERCASE letters. 2016 Ohio IT 1040 Individual Income Tax Return Rev. 9/16 16000102 Note This form encompasses the IT 1040 IT 1040EZ and amended IT 1040X. O. Box 182131 Columbus OH 43218-2131. IT RE 2016 Ohio IT RE Reason and Explanation of Corrections Note For amended individual return only Complete the Ohio IT 1040 checking the amended return box and include this form with documentation to support any adjustments to line items on the return. Reason...s Net operating loss carryback IMPORTANT Be sure to complete and include Ohio IT NOL Net Operating Loss Carryback Schedule available at tax. Is this an amended return Yes No If yes include Ohio IT RE do not include a copy of the previously filed return Is this a Net Operating Loss NOL carryback Taxpayer s SSN required Spouse s SSN if filing jointly If deceased check box Enter school district for this return see instructions. SD First name M. I. Last name Spouse s first name only if married...filing jointly M. I. Last name Mailing address for faster processing use a street address City State Home address if different from mailing address do NOT include city or state Foreign country if the mailing address is outside the U*S* Part-year resident ZIP code Ohio county first four letters Foreign postal code Ohio Residency Status Check applicable box Full-year Filing Status Check one as reported on federal income tax return with limited exceptions see instructions Indicate state Single...head of household or qualifying widow er Check applicable box for spouse only if married filing jointly Married filing jointly Ohio Political Party Fund No Do you want 1 to go to this fund. Did you file the federal extension 4868. Is someone else claiming you or your spouse if joint return as a dependent If yes enter 0 on line 4. If joint return does your spouse want 1 to go to this fund. Note Checking Yes will not increase your tax or decrease your refund. 1. Federal adjusted gross income from...the federal 1040 line 37 1040A line 21 1040EZ line 4 1040NR line 36 or 1040NR-EZ line 10. Place a negative sign - in the box at the right if the amount is less than -0-. 1. 2a* Additions to federal adjusted gross income include Ohio Schedule A line 10. 2a* 2b. Deductions from federal adjusted gross income include Ohio Schedule A line 35. 2b. 3. Ohio adjusted gross income line 1 plus line 2a minus line 2b. Place a negative sign - in the box at the right if the amount is less than -0-. 4....Personal and dependent exemption deduction if claiming dependent s include Schedule J. 4. 5. Ohio income tax base line 3 minus line 4 if less than -0- enter -0-. 5. 6. Taxable business income include Ohio Schedule IT BUS line 13. 6. 7. Line 5 minus line 6 if less than -0- enter -0-. 7. Include your federal income tax return if line 1 of this return is -0- or negative. Do not write in this area for department use only. / Postmark date Code SSN 7a* Amount from line 7 on page 1. 7a* 8a* Nonbusiness...income tax liability on line 7a see instructions for tax tables. 8a* 8b. Business income tax liability include Ohio Schedule IT BUS line 14.

pdfFiller is not affiliated with any government organization

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

Instructions and Help about OH IT 1040

How to edit OH IT 1040

To edit the OH IT 1040 tax form, first, download the form in PDF format. Use a PDF editor like pdfFiller to access its editing features. With pdfFiller, you can fill in the necessary fields, correct any errors, and even add your digital signature if required. Ensure that all information is accurate and reflects your tax situation correctly before submitting.

How to fill out OH IT 1040

Filling out the OH IT 1040 requires detailed information regarding your personal and financial details. Gather the necessary documents such as W-2s or 1099s, and follow these steps:

01

Begin with your personal identification information, including name, address, and Social Security number.

02

Report your income in the designated sections according to the type of income received.

03

Include any applicable deductions and credits as specified by the Ohio Department of Taxation.

04

Calculate your total tax liability and any payments already made.

05

Sign and date the form before submission.

About OH IT previous version

What is OH IT 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH IT previous version

What is OH IT 1040?

OH IT 1040 is the Ohio Individual Income Tax Return form used by residents to report personal income and calculate tax obligations to the state of Ohio. This form captures income from various sources and serves as a basis for determining any tax due or refund owed. Although this version was primarily used for past tax years, it can be informative for understanding past tax requirements.

What is the purpose of this form?

The primary purpose of the OH IT 1040 form is to facilitate the accurate reporting of taxable income by individuals in Ohio. By submitting this form, taxpayers declare their earnings and demonstrate their compliance with state tax laws. It also ensures that taxpayers pay the correct amount of state taxes owed based on their reported income.

Who needs the form?

Anyone who is a resident of Ohio and has income to report must fill out the OH IT 1040 form. This includes full-time residents, part-time residents with income earned in Ohio, and individuals who may have earned income from other states while living in Ohio. Self-employed individuals are also required to file this form to report their business income.

When am I exempt from filling out this form?

Some exemptions exist where you may not need to file the OH IT 1040. Generally, if your total income for the year was below the minimum filing requirement set by the Ohio Department of Taxation, you may be exempt. Additionally, certain non-residents earning income not sourced in Ohio might not need to file this form.

Components of the form

The OH IT 1040 form consists of several key components that must be completed accurately, including:

01

Your personal identification information.

02

Income section detailing all sources of income.

03

Deductions and tax credits applicable to your situation.

04

Calculation of total tax owed or refund due.

What are the penalties for not issuing the form?

Failing to file the OH IT 1040 can lead to various penalties imposed by the Ohio Department of Taxation. These may include late filing penalties, interest on unpaid taxes, and potential legal action for non-compliance. It is crucial to file on time to avoid these outcomes.

What information do you need when you file the form?

When preparing to file the OH IT 1040, gather essential information including but not limited to your Social Security number, income statements (W-2s, 1099s), details of any tax deductions or credits you plan to claim, and banking information if you expect a refund via direct deposit. Having all necessary documentation ready will streamline the filing process and help prevent errors.

Is the form accompanied by other forms?

Yes, the OH IT 1040 may require accompanying forms depending on your financial situation. Commonly, additional schedules for various income types, deductions, or credits may be necessary. It's critical to review the instructions accompanying the OH IT 1040 to determine which additional forms are applicable to your tax situation.

Where do I send the form?

Once completed, the OH IT 1040 form should be sent to the specified address listed in the instructions for the tax year you are filing. This address may vary depending on whether you are filing for a refund or sending a payment. Ensure that you verify the correct mailing address according to the most recent guidelines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

love learning everything. Problem with sending multiple pages in one email to have signed. Problems with getting the signature from the recepient because the codes don't work consistently.

I am selling my own piece of real estate and this has been awesome for the necessary forms.

See what our users say