IN DoR ST-200 2013 free printable template

Show details

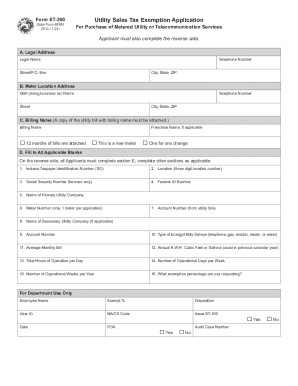

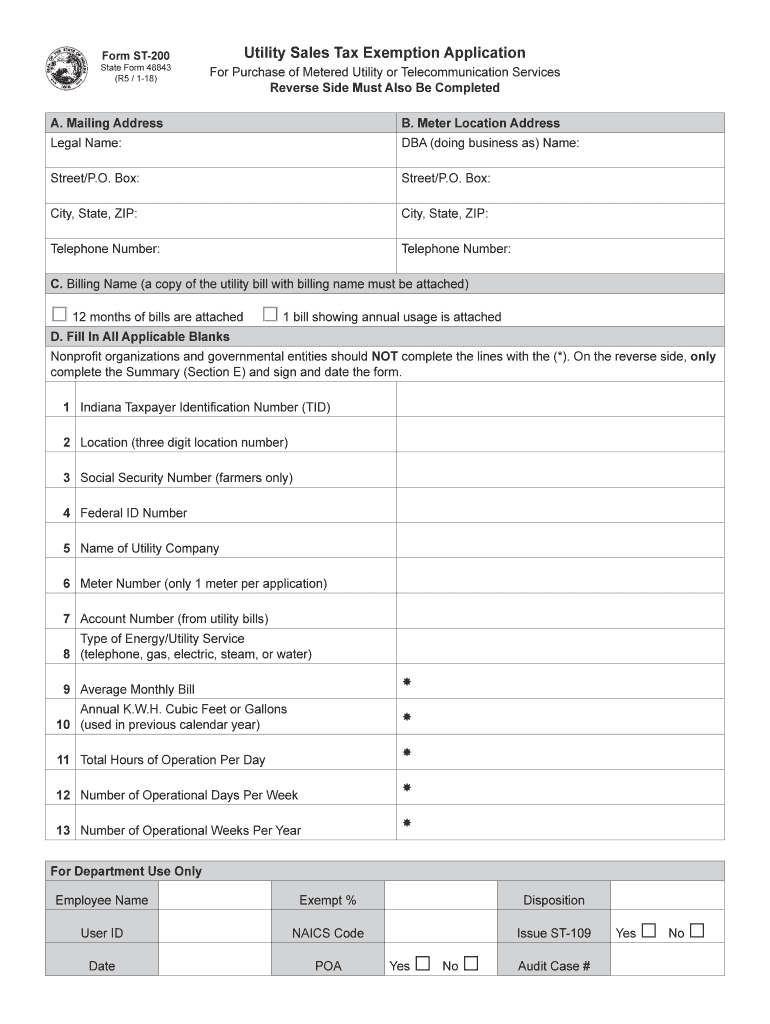

Form ST200State Form 48843

(R5 / 118)Utility Sales Tax Exemption ApplicationFor Purchase of Metered Utility or Telecommunication Services

Reverse Side Must Also Be CompletedA. Mailing AddressB. Meter

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DoR ST-200

Edit your IN DoR ST-200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DoR ST-200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR ST-200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DoR ST-200

How to fill out IN DoR ST-200

01

Obtain the IN DoR ST-200 form from the Indiana Department of Revenue website or your local tax office.

02

Fill in your name and the business name as applicable at the top of the form.

03

Enter your Social Security number or Federal Employer Identification Number (FEIN).

04

Provide your mailing address, ensuring it is complete and accurate.

05

Indicate the applicable tax periods for which you are filing.

06

Complete the necessary fields based on your specific tax situation, following the instructions provided.

07

Sign and date the form at the bottom to certify that the information is accurate.

08

Submit the completed form to the Indiana Department of Revenue via the method specified in the instructions.

Who needs IN DoR ST-200?

01

Individuals or businesses that are required to report certain tax information to the Indiana Department of Revenue.

02

Entities seeking a tax exemption or refund related to sales and use tax.

03

Taxpayers who are involved in activities that fall under Indiana tax law requiring the use of the ST-200 form.

Fill

form

: Try Risk Free

People Also Ask about

Can I get certificate of tax exemption online?

TIEZA provides a simple and contactless way to apply for your Travel Tax Exemption Certificate (TEC) through the official TIEZA website.

What is an st105 form?

Form ST-105 General Sales Tax Exemption Certificate.

Do South Carolina sales tax exemption certificates expire?

How long is my South Carolina sales tax exemption certificate good for? There is no explicitly stated expiration period for these exemption certificate, the business the apply to must simply still be in operation.

What is a ST-105 form Indiana?

ST-105. 49065. Indiana General Sales Tax Exemption Certificate.

What qualifies for Oklahoma farm tax exemption?

Nearly all items used in production agriculture are exempt from sales tax in the state including seed, feed, fertilizer, livestock pharmaceuticals and farm machinery.

How do I get a tax-exempt certificate in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying.

How do I verify my Indiana resale certificate?

Indiana – Online verification is not available. Purchaser will provide you with form ST-105 for your records. Contact the Indiana Department of Revenue at (317) 233-4015 with specific tax exemption questions.

Does an Indiana sales tax exemption certificate expire?

How do I get authorization for Indiana sales tax exemption? File form NP-20A with the Indiana Department of Revenue. They can also issue you your Indiana Taxpayer Identification Number.

Does Oklahoma have a sales tax exemption certificate?

Oklahoma has a comprehensive sales tax exemption for manufacturers who obtain a Manufacturer's Sales Tax Exemption Permit from the Oklahoma Tax Commission. The permit must be renewed every three years.

How do I apply for sales tax exemption in Indiana?

Qualifying for sales tax exemption requires the completion and filing of an application form prescribed by the Indiana Department of Revenue. The taxpayer Identification Number (TID) above must be provided to the retailer if purchases are to be exempt from sales tax.

How do I apply for tax exemption?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

What items are tax-exempt in Oklahoma?

What purchases are exempt from the Oklahoma sales tax? Clothing. 4.5% Groceries. 4.5% Prepared Food. 4.5% Prescription Drugs. 4.5% OTC Drugs. 4.5%

How do I file a sales tax exemption in Indiana?

If you are gifting a vehicle to a relative, the transaction could be exempt from sales tax and requires filling out Indiana BMV form 48841. A bill of sale cannot be used to transfer vehicle ownership for a vehicle that requires a certificate of title by law.

What qualifies a person as tax-exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

Does Indiana Form ST-105 expire?

Does an Indiana sales tax exemption certificate expire? Indiana sales tax exemption certificates do not expire.

How do I get a sales tax license in South Carolina?

You can easily acquire your South Carolina Sales Tax License online using the South Carolina Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (803) 896-1350 or by checking the permit info website .

How do I file for sales tax exemption in Indiana?

How do I get authorization for Indiana sales tax exemption? File form NP-20A with the Indiana Department of Revenue. They can also issue you your Indiana Taxpayer Identification Number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IN DoR ST-200?

IN DoR ST-200 is a form used for reporting various financial activities and obligations in accordance with the Department of Revenue guidelines in India.

Who is required to file IN DoR ST-200?

Entities engaged in certain business activities or individuals designated by the Department of Revenue are required to file IN DoR ST-200.

How to fill out IN DoR ST-200?

To fill out IN DoR ST-200, you must provide accurate information regarding your financial activities, income details, and any other relevant data as specified in the form instructions.

What is the purpose of IN DoR ST-200?

The purpose of IN DoR ST-200 is to ensure compliance with tax regulations and to facilitate transparent reporting of financial information to the authorities.

What information must be reported on IN DoR ST-200?

IN DoR ST-200 must report information such as total income earned, applicable deductions, tax obligations, and other financial details as required by the Department of Revenue.

Fill out your IN DoR ST-200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DoR ST-200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.