IN DoR ST-200 2023-2025 free printable template

Show details

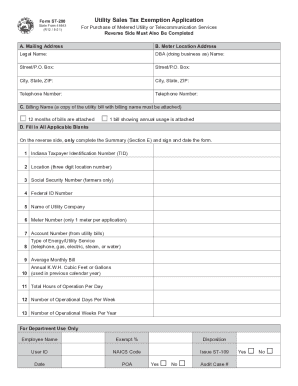

Form ST200

State Form 48843

(R13 / 123)Utility Sales Tax Exemption ApplicationFor Purchase of Metered Utility or Telecommunication Services

Applicant must also complete the reverse side.A. Legal Address

Legal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana st sales tax exemption form

Edit your indiana st exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana form tax exemption application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana st state form 48843 sales exemption online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indiana st state form sales tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR ST-200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out indiana st sales exemption pdf form

How to fill out IN DoR ST-200

01

Begin by obtaining the IN DoR ST-200 form from the Indiana Department of Revenue website or your local revenue office.

02

Write your full name in the designated name field on the form.

03

Provide your Social Security Number (SSN) or Taxpayer Identification Number (TIN) as required.

04

Fill in your current address, including city, state, and ZIP code.

05

Indicate the tax year for which you are submitting the form.

06

Carefully read the instructions provided on the form to ensure accurate completion.

07

Complete any additional sections required, such as income details or tax credits, based on your individual situation.

08

Review the entire form for any errors or missed information.

09

Sign and date the form at the bottom.

10

Submit the completed form according to the instructions provided, whether by mail or electronically.

Who needs IN DoR ST-200?

01

Individuals or businesses in Indiana who need to report tax liabilities or claim refunds.

02

Taxpayers seeking to correct their tax records or report changes.

03

Anyone filing for a specific tax credit or exemption that requires the use of the form.

Fill

indiana st state exemption get

: Try Risk Free

People Also Ask about indiana form sales tax exemption application

Can I get certificate of tax exemption online?

TIEZA provides a simple and contactless way to apply for your Travel Tax Exemption Certificate (TEC) through the official TIEZA website.

What is an st105 form?

Form ST-105 General Sales Tax Exemption Certificate.

Do South Carolina sales tax exemption certificates expire?

How long is my South Carolina sales tax exemption certificate good for? There is no explicitly stated expiration period for these exemption certificate, the business the apply to must simply still be in operation.

What is a ST-105 form Indiana?

ST-105. 49065. Indiana General Sales Tax Exemption Certificate.

What qualifies for Oklahoma farm tax exemption?

Nearly all items used in production agriculture are exempt from sales tax in the state including seed, feed, fertilizer, livestock pharmaceuticals and farm machinery.

How do I get a tax-exempt certificate in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying.

How do I verify my Indiana resale certificate?

Indiana – Online verification is not available. Purchaser will provide you with form ST-105 for your records. Contact the Indiana Department of Revenue at (317) 233-4015 with specific tax exemption questions.

Does an Indiana sales tax exemption certificate expire?

How do I get authorization for Indiana sales tax exemption? File form NP-20A with the Indiana Department of Revenue. They can also issue you your Indiana Taxpayer Identification Number.

Does Oklahoma have a sales tax exemption certificate?

Oklahoma has a comprehensive sales tax exemption for manufacturers who obtain a Manufacturer's Sales Tax Exemption Permit from the Oklahoma Tax Commission. The permit must be renewed every three years.

How do I apply for sales tax exemption in Indiana?

Qualifying for sales tax exemption requires the completion and filing of an application form prescribed by the Indiana Department of Revenue. The taxpayer Identification Number (TID) above must be provided to the retailer if purchases are to be exempt from sales tax.

How do I apply for tax exemption?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

What items are tax-exempt in Oklahoma?

What purchases are exempt from the Oklahoma sales tax? Clothing. 4.5% Groceries. 4.5% Prepared Food. 4.5% Prescription Drugs. 4.5% OTC Drugs. 4.5%

How do I file a sales tax exemption in Indiana?

If you are gifting a vehicle to a relative, the transaction could be exempt from sales tax and requires filling out Indiana BMV form 48841. A bill of sale cannot be used to transfer vehicle ownership for a vehicle that requires a certificate of title by law.

What qualifies a person as tax-exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

Does Indiana Form ST-105 expire?

Does an Indiana sales tax exemption certificate expire? Indiana sales tax exemption certificates do not expire.

How do I get a sales tax license in South Carolina?

You can easily acquire your South Carolina Sales Tax License online using the South Carolina Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (803) 896-1350 or by checking the permit info website .

How do I file for sales tax exemption in Indiana?

How do I get authorization for Indiana sales tax exemption? File form NP-20A with the Indiana Department of Revenue. They can also issue you your Indiana Taxpayer Identification Number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my st 200 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your indiana st sales exemption and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out indiana st200 state printable using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign indiana sales tax exemption application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out indiana st exemption form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your indiana st state form tax exemption. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is IN DoR ST-200?

IN DoR ST-200 is a form used for reporting state taxes in Indiana, specifically related to the Department of Revenue.

Who is required to file IN DoR ST-200?

Businesses and individuals who are subject to Indiana state taxes are required to file IN DoR ST-200.

How to fill out IN DoR ST-200?

To fill out IN DoR ST-200, follow the instructions provided in the form, ensuring that all relevant financial information and tax liabilities are accurately reported.

What is the purpose of IN DoR ST-200?

The purpose of IN DoR ST-200 is to facilitate the reporting and payment of state taxes owed by individuals or businesses in Indiana.

What information must be reported on IN DoR ST-200?

The information that must be reported on IN DoR ST-200 includes income details, deductions, credits, and any other relevant tax liability information.

Fill out your indiana state form sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Exemption Application is not the form you're looking for?Search for another form here.

Keywords relevant to indiana state form exemption application

Related to indiana state utility tax exemption

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.