Get the free Macroeconomic Analysis and Tax Analysis Divisions

Show details

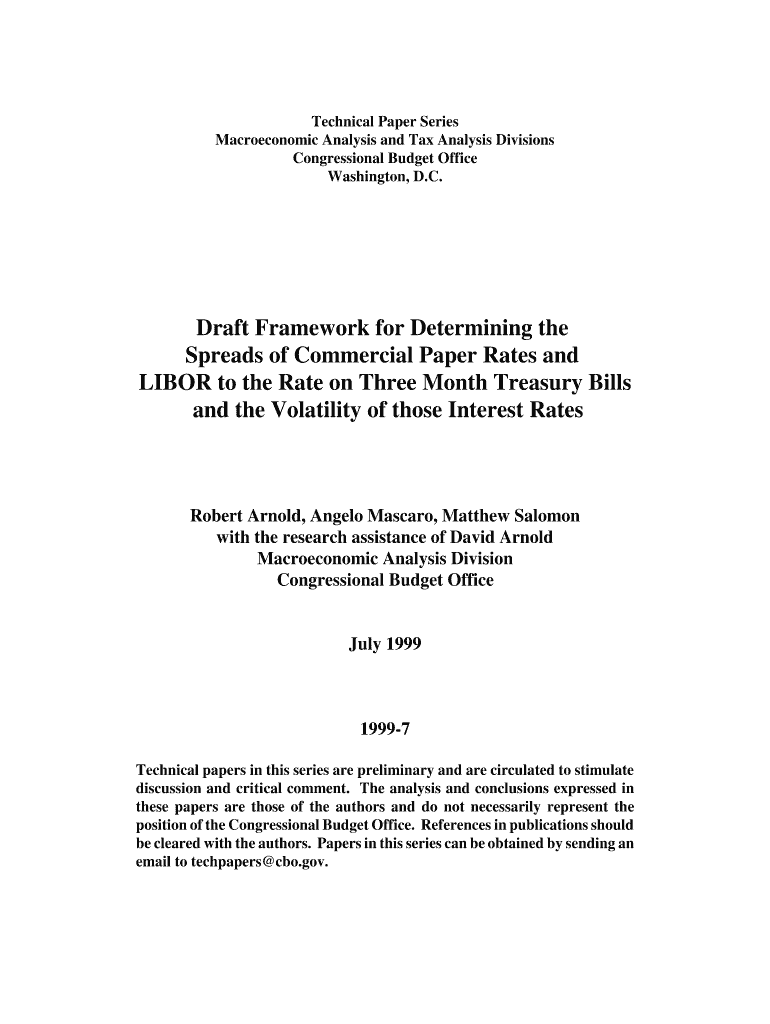

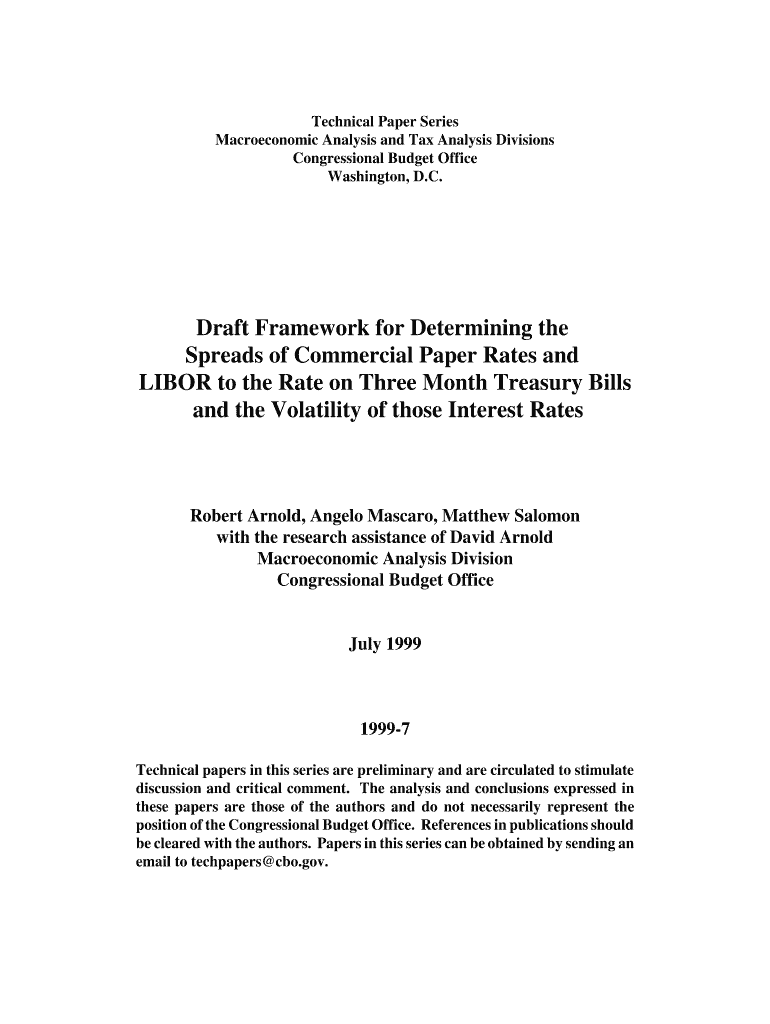

Technical Paper Series

Macroeconomic Analysis and Tax Analysis Divisions

Congressional Budget Office

Washington, D.C. Draft Framework for Determining the

Spreads of Commercial Paper Rates and

LIBOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign macroeconomic analysis and tax

Edit your macroeconomic analysis and tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your macroeconomic analysis and tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit macroeconomic analysis and tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit macroeconomic analysis and tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out macroeconomic analysis and tax

How to fill out macroeconomic analysis and tax:

01

Start by gathering all relevant financial data, including income statements, balance sheets, and cash flow statements.

02

Analyze the data to identify key trends and patterns, such as revenue growth, cost structure, and profitability.

03

Conduct a comprehensive economic analysis, considering factors such as GDP growth, inflation rates, and exchange rates, to assess the overall macroeconomic environment.

04

Evaluate the impact of tax policies on the business, including corporate taxes, sales taxes, and payroll taxes.

05

Calculate tax liabilities based on applicable tax rates and regulations, considering deductions, credits, and exemptions.

06

Prepare financial statements and reports that reflect the results of the macroeconomic analysis and tax calculations.

Who needs macroeconomic analysis and tax:

01

Businesses of all sizes can benefit from macroeconomic analysis and tax planning. It helps them understand the current economic conditions, anticipate future trends, and make informed business decisions.

02

Investors and financial institutions use macroeconomic analysis to assess the attractiveness of investment opportunities and manage risks in their portfolios.

03

Governments and policymakers rely on macroeconomic analysis to make informed decisions on fiscal and monetary policies, tax reforms, and economic development strategies.

04

Economic researchers and analysts use macroeconomic analysis to study and forecast the overall health and performance of the economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the macroeconomic analysis and tax in Gmail?

Create your eSignature using pdfFiller and then eSign your macroeconomic analysis and tax immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit macroeconomic analysis and tax on an iOS device?

Create, modify, and share macroeconomic analysis and tax using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out macroeconomic analysis and tax on an Android device?

On Android, use the pdfFiller mobile app to finish your macroeconomic analysis and tax. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is macroeconomic analysis and tax?

Macroeconomic analysis is the study and assessment of the overall economy, including factors such as GDP, inflation, employment, and government policies. Tax refers to the mandatory financial contribution levied by the government on individuals and entities based on their income, profits, or transactions.

Who is required to file macroeconomic analysis and tax?

The requirement to file macroeconomic analysis and tax typically falls on businesses, organizations, and individuals with significant economic activities or taxable income. The exact criteria may vary depending on the country and its tax regulations.

How to fill out macroeconomic analysis and tax?

The process of filling out macroeconomic analysis and tax forms involves gathering relevant financial information, such as income, expenses, assets, and liabilities, and reporting them accurately on the designated tax forms. It is important to consult the specific tax regulations and guidelines provided by the relevant tax authority for detailed instructions.

What is the purpose of macroeconomic analysis and tax?

The purpose of macroeconomic analysis is to analyze and understand the overall health and performance of the economy, while the purpose of tax is to fund government operations and public services. Through macroeconomic analysis, policymakers can make informed decisions to promote economic growth and stability. Taxation ensures a sustainable revenue source for the government.

What information must be reported on macroeconomic analysis and tax?

The information that must be reported on macroeconomic analysis and tax forms may include income from various sources, deductions, credits, expenses, investments, assets, liabilities, and other relevant financial data. The specific requirements may vary depending on the country and its tax regulations.

Fill out your macroeconomic analysis and tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Macroeconomic Analysis And Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.