DC D-40EZ & D-40 2015 free printable template

Show details

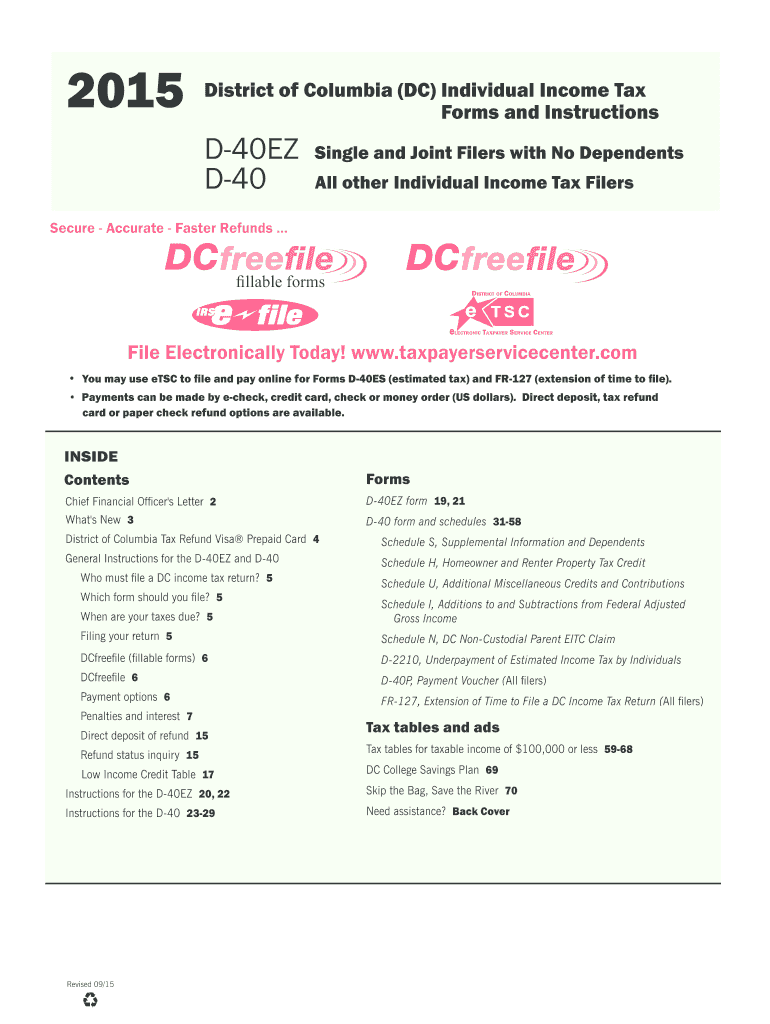

Assembling your D-40EZ or D-40 return Staple all supporting forms and schedules behind the D-40. Staple Forms W-2 and 1099 to the front of Form D-40. Staple your payment to the D-40P voucher. Do not attach your payment to your D-40 or D-40EZ return. Mail the D-40P with but not attached to your D-40 or D-40EZ tax return in the envelope provided in this tax book96169 Washington DC 20090-6169. Attach all copies of your Forms W-2 and 1099 that show DC tax withheld to the Forms D-40 or D-40EZ....Include the D-40P with your D-40 or D-40EZ in the return envelope provided. Use the PO Box 96169 mail label from the back flap of the return envelope. I. Last number SSN Homesocial City address number street and suite/apartment number if applicable 00/00 D-40PD-40P Use the D-40P Payment Voucher to make any payment due on your D-40/D-40EZ return. Do not use this voucher to make estimated tax payments. D-40EZ or Lines 36 43a and/or 43b of the D-40. For Estimated Tax The form can also be located...at www. Over 10 000 but not over 40 000 Over 350 000. New option to file the D-40 and D-40EZ on a fiscal year basis. 13 Total subtractions from DC income Lines 7-12. 2015 D-40 P1 File order 1 D-40 PAGE 2 Enter your last name. fillable forms electronic Taxpayer Service Center File Electronically Today www. taxpayerservicecenter. com You may use eTSC to file and pay online for Forms D-40ES estimated tax and FR-127 extension of time to file. Payments can be made by e-check credit card check or...money order US dollars. Direct deposit tax refund card or paper check refund options are available. The District of Columbia observes Emancipation Day on Friday April 15 when April 16 is a Saturday. This makes Monday April 18 2016 the deadline for filing income tax returns for Tax Year 2015. All new direct deposit requests taxpayers requesting a direct deposit for the first time will receive a paper check. Refer to Paper Check section on page 15 for additional information* Phase out of the...Personal Exemption Amount The amount of the personal exemption otherwise allowable for the taxable year in the case of an individual whose adjusted gross income exceeds 150 000 shall be reduced by 2 for every 2 500 or fraction thereof by which the taxpayer s adjusted gross income for the taxable year exceeds 150 000. No amount of the personal exemption shall be available for an adjusted gross income in excess of 275 000. New tax rates. The tax rates for individuals for tax years beginning after...12/31/2014 are If the taxable income is Not over 10 000. The credit is not allowable if your net federal adjusted gross income exceeds the federal minimum filing requirements. Schedule H Section A Line 2 has been changed to allow taxpayers to list the source and amount of other money not included in federal adjusted gross income of the tax filing unit that is used to pay rent. Money reported on this line is not used to calculate the amount of the credit but to assist OTR in determining the...reasonableness of the claim* Line 6 Calculation B has changed* The DC income exclusion for long-term care insurance premiums is no longer a subtraction from federal adjusted gross income.

pdfFiller is not affiliated with any government organization

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

How to fill out DC D-40EZ D-40

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

To edit the DC D-40EZ D-40 tax form, users can utilize features that allow for easy document modification, such as adding or removing information and correcting errors. Tools available through platforms like pdfFiller enable users to input correct data directly onto the form and save changes efficiently. Utilize editing options to ensure all information is accurate before submission.

How to fill out DC D-40EZ D-40

Filling out the DC D-40EZ D-40 requires providing specific details pertaining to your income and deductions. Follow these steps to complete the form:

01

Start with personal identification information including your name and address.

02

Report your total income on the designated lines, ensuring accuracy in all figures.

03

Calculate your deductions and credits based on eligibility, and input those amounts.

04

Lastly, determine the total tax liability or refund and sign the form to validate submission.

About DC D-40EZ D-40 2015 previous version

What is DC D-40EZ D-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About DC D-40EZ D-40 2015 previous version

What is DC D-40EZ D-40?

The DC D-40EZ D-40 is a simplified tax form specific to Washington D.C. that allows residents with straightforward tax situations to file their income tax returns with ease. This form is designed for individuals whose income falls within specific thresholds and who do not have complex financial circumstances.

What is the purpose of this form?

The main purpose of the DC D-40EZ D-40 is to streamline the filing process for eligible residents, facilitating a simpler submission that captures essential tax information without excessive detail. It helps taxpayers meet compliance requirements with the D.C. Office of Tax and Revenue efficiently.

Who needs the form?

The DC D-40EZ D-40 is intended for individuals whose taxable income does not exceed the limits established by the D.C. tax code. Typically, this includes taxpayers with simple tax situations, such as those who do not itemize deductions or have multiple sources of taxable income.

When am I exempt from filling out this form?

Filers may be exempt from using the DC D-40EZ D-40 if they have complex tax situations, such as self-employment income, business losses, or if their tax returns exceed certain income thresholds. Additionally, those claiming specific tax credits or filing status variations may need to utilize a different form.

Components of the form

The DC D-40EZ D-40 consists of various sections including personal identification details, income reporting fields, and deductions or credits. Each of these components is critical for accurately establishing the taxpayer's financial position and tax liability.

What are the penalties for not issuing the form?

Failure to file the DC D-40EZ D-40 by its deadline can result in penalties imposed by the D.C. Office of Tax and Revenue. These penalties may include late filing fees, interest on any taxes owed, and potential legal ramifications for persistent non-compliance. Timely submission is crucial to avoid such penalties.

What information do you need when you file the form?

When filing the DC D-40EZ D-40, individuals should gather their personal identification information, total income amount, details on any applicable deductions or credits, and bank information for potential refunds. Ensuring all documentation is accurate and accessible is essential for a smooth filing process.

Is the form accompanied by other forms?

The DC D-40EZ D-40 may need to be submitted alongside other relevant tax forms, depending on the individual taxpayer's financial circumstances. It is important to check the D.C. Office of Tax and Revenue guidelines for any supplementary forms that may be required to complete the filing process.

Where do I send the form?

Once completed, the DC D-40EZ D-40 form should be mailed to the D.C. Office of Tax and Revenue at the address specified in the instructions section of the form. Make sure to double-check the mailing address and any required postage to ensure proper delivery.

See what our users say