Get the free The following information reflects your final 2016 pay stub plus any adjustments sub...

Show details

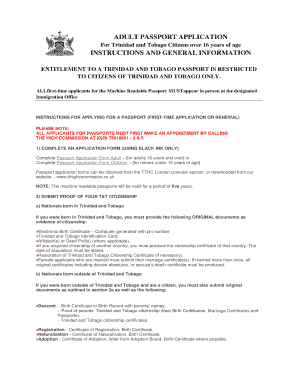

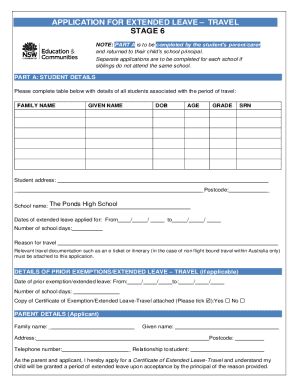

2016 W2 and EARNINGS SUMMARY Employee Reference Wage and Tax Statement Copy W2 2016 Dept. Control number 803233 1. The following information reflects your final 2016 pay stub plus any adjustments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form following information reflects

Edit your form following information reflects form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form following information reflects form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form following information reflects online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form following information reflects. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form following information reflects

Point by point, here is how to fill out the form following the information reflects:

01

Start by entering your personal information, such as your name, address, and contact details. Make sure to provide accurate and up-to-date information.

02

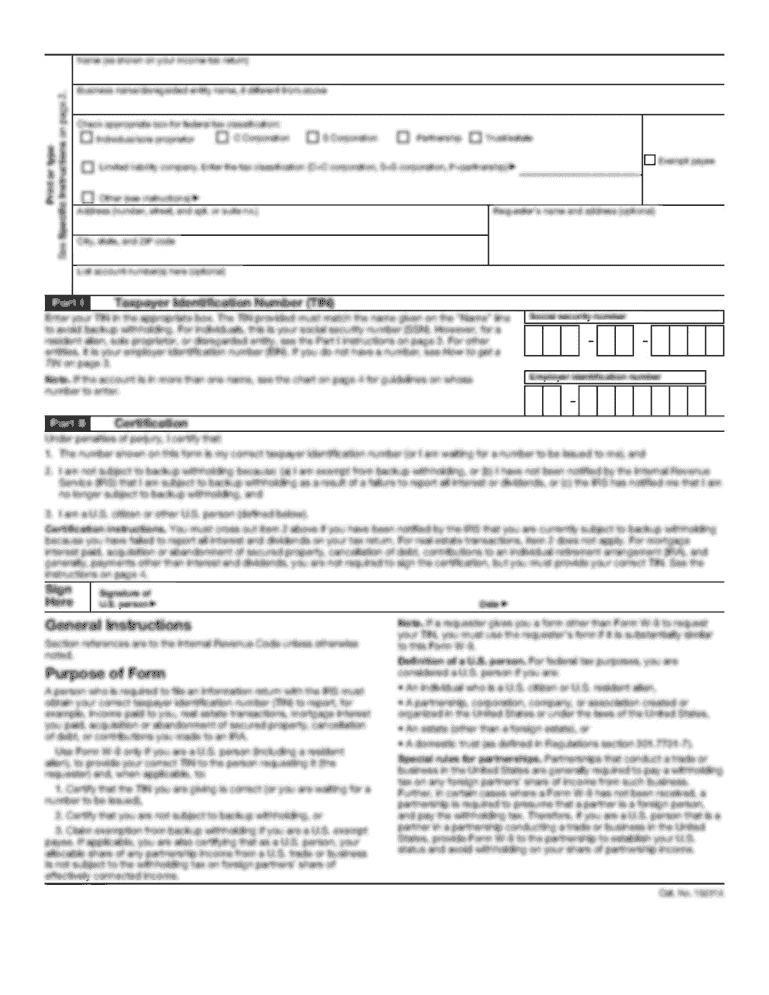

Next, indicate any relevant identification or account numbers, if required. This could include your social security number, customer ID, or membership number, depending on the purpose of the form.

03

Provide the necessary details specific to the information reflecting. For example, if the form is related to a financial transaction, you might need to include bank account details or payment information. If it pertains to a job application, you may be asked to provide your work history and qualifications.

04

Review the form carefully to ensure completeness and accuracy. Double-check all the information you have provided to avoid any mistakes or omissions.

05

If the form requires any additional documentation or attachments, make sure to include them before submitting it. This could be copies of identification documents, proof of address, or any supporting material relevant to the information reflects.

06

Once you are satisfied with the form and have verified its accuracy, sign and date it as required. This signifies your agreement to the information you have provided.

Who needs the form following the information reflects? Anyone who requires or is involved in the process related to the information reflects may need to fill out this form. This could include individuals applying for a service, submitting an application, providing updates or changes, or anyone else who needs to communicate or provide information in the context of the information reflects.

Fill

form

: Try Risk Free

People Also Ask about

Can I use last pay stub instead of w2?

Can You File Taxes Without a W-2? No, you cannot file a return using your last pay stub. Your last paycheck stub is not guaranteed to be an accurate statement of your annual earnings, and it could be missing some information that you need to file a full tax return.

What important information is available on a pay stub?

A paycheck stub summarizes how your total earnings were distributed. The information on a paystub includes how much was paid on your behalf in taxes, how much was deducted for benefits, and the total amount that was paid to you after taxes and deductions were taken.

Do you get Social Security tax back?

You may then end up with total Social Security taxes withheld that exceed the maximum. When you file your tax return the following year, you can claim a refund from the Internal Revenue Service for Social Security taxes withheld that exceeded the maximum amount.

Why is my w2 less than my last pay stub?

Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. That's why your W-2 doesn't match your last pay stub.

Why do I have Social Security tax withheld?

The federal government uses Social Security taxes to fund Social Security benefits. The Social Security Administration (SSA) administers the program and uses the tax funds to support: Retired individuals. Widows and widowers.

What is the Social Security tax withheld on a paystub?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form following information reflects in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form following information reflects and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an eSignature for the form following information reflects in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form following information reflects and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out form following information reflects on an Android device?

Complete form following information reflects and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is form following information reflects?

Form following information reflects the essential details and data required for compliance with regulatory or reporting obligations in a specific context, often related to financial, legal, or operational requirements.

Who is required to file form following information reflects?

Entities or individuals subject to specific regulations, laws, or requirements associated with the information outlined in the form are typically required to file it.

How to fill out form following information reflects?

To fill out the form, carefully read the instructions provided, gather the necessary information, complete each section accurately, and review the form for any errors before submission.

What is the purpose of form following information reflects?

The purpose of the form is to ensure compliance, maintain transparency, and facilitate the reporting of critical information to relevant authorities or stakeholders.

What information must be reported on form following information reflects?

The information required typically includes personal or organizational identification details, financial data, compliance-related information, and any other specifics mandated by the relevant authority.

Fill out your form following information reflects online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Following Information Reflects is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.