UK HMRC CH2 (CS) 2017 free printable template

Show details

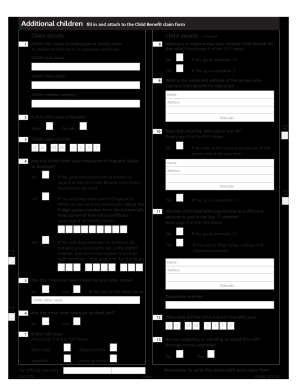

Additional children fill in and attach to the Child Benefit claim form Child details 1 Child details Child's last name or family name As shown on the birth or adoption certificate. 9 office use continued

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC CH2 CS

Edit your UK HMRC CH2 CS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC CH2 CS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC CH2 CS online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK HMRC CH2 CS. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC CH2 (CS) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC CH2 CS

How to fill out UK HMRC CH2 (CS)

01

Start by downloading the UK HMRC CH2 (CS) form from the HMRC website.

02

Fill in your personal details at the top of the form, including your name, address, and National Insurance number.

03

Provide details of your employment or self-employment history as required.

04

Complete the section regarding your income, ensuring you include all relevant information.

05

Check the eligibility criteria listed in the form to ensure you qualify.

06

Sign and date the declaration at the end of the form.

07

Submit the completed form to HMRC either online or via post, following the instructions provided.

Who needs UK HMRC CH2 (CS)?

01

Individuals who are claiming tax credits in the UK.

02

People who need to confirm their income and personal circumstances to HMRC.

03

Taxpayers who have been instructed to complete the CH2 (CS) form as part of the tax credit process.

Fill

form

: Try Risk Free

People Also Ask about

What day is Child Benefit paid in Ireland?

The child benefit is paid on the first Tuesday of every month and parents usually get the first payment the month after the child is born.

How long does it take to get Child Benefit Ireland?

Children's Allowance or Child Benefit in Ireland is currently €140 per month for each child. Child Benefit is paid out on the first Tuesday of every month. The annual amount of Child Benefit per child is €1680.

How do I contact child benefit Ireland?

How can I get help and further information? If you need any help to complete this form, please contact the Child Benefit section by email on child.benefit@welfare.ie or by calling 0818 300 600 or 074 916 4496. Your local Intreo Centre, Social Welfare Office or any Citizens Information Centre can also help.

Do you get back pay for Child Benefit Ireland?

This will include Child Benefit for July and August. If your child turns 18 in July or August and returns to full-time education in September, you will get any arrears of Child Benefit, up until the month they turn 18.

How do I cancel my child benefit UK?

You can opt out of child benefit payments in two ways - either by filling in an online form on the government's website or contacting the Child Benefit Office by phone or post. The number to call is 0300 200 3100.

Is child benefit backdated Ireland?

Child Benefit must be claimed within 12 months of the date: in which the child was born.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UK HMRC CH2 CS without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your UK HMRC CH2 CS into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send UK HMRC CH2 CS for eSignature?

When you're ready to share your UK HMRC CH2 CS, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute UK HMRC CH2 CS online?

Easy online UK HMRC CH2 CS completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is UK HMRC CH2 (CS)?

UK HMRC CH2 (CS) is a form used by contractors and sub-contractors in the construction industry to report their financial dealings and tax obligations to Her Majesty's Revenue and Customs (HMRC).

Who is required to file UK HMRC CH2 (CS)?

Contractors and sub-contractors that are registered under the Construction Industry Scheme (CIS) and are making payments to subcontractors must file the UK HMRC CH2 (CS).

How to fill out UK HMRC CH2 (CS)?

To fill out the UK HMRC CH2 (CS), users must provide details such as their own details, subcontractor information, payment amounts, and any deductions made. It is important to follow the instructions provided by HMRC to ensure accuracy.

What is the purpose of UK HMRC CH2 (CS)?

The purpose of the UK HMRC CH2 (CS) is to ensure that tax is collected at the source from payments made in the construction industry, helping to prevent tax evasion and ensuring compliance with tax regulations.

What information must be reported on UK HMRC CH2 (CS)?

The information that must be reported on UK HMRC CH2 (CS) includes the contractor's name and details, subcontractor's name and details, total amount paid, any tax deducted, and the period of the payments.

Fill out your UK HMRC CH2 CS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC ch2 CS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.