SSA-L725-F3 2012 free printable template

Show details

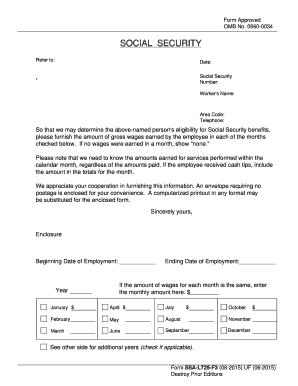

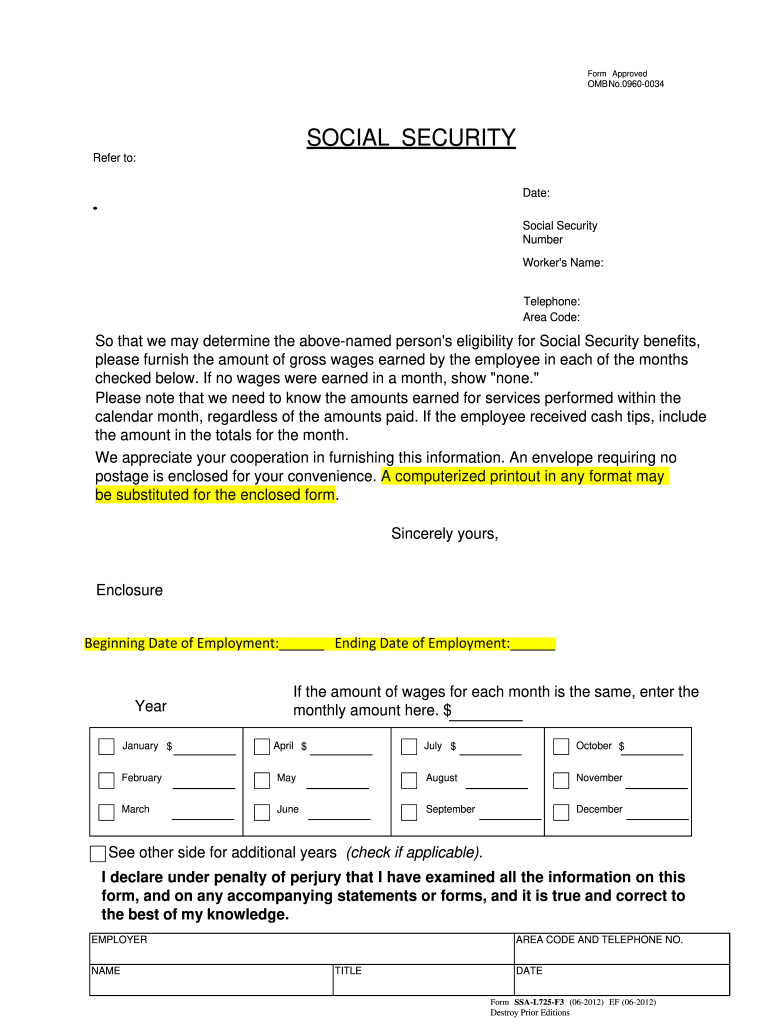

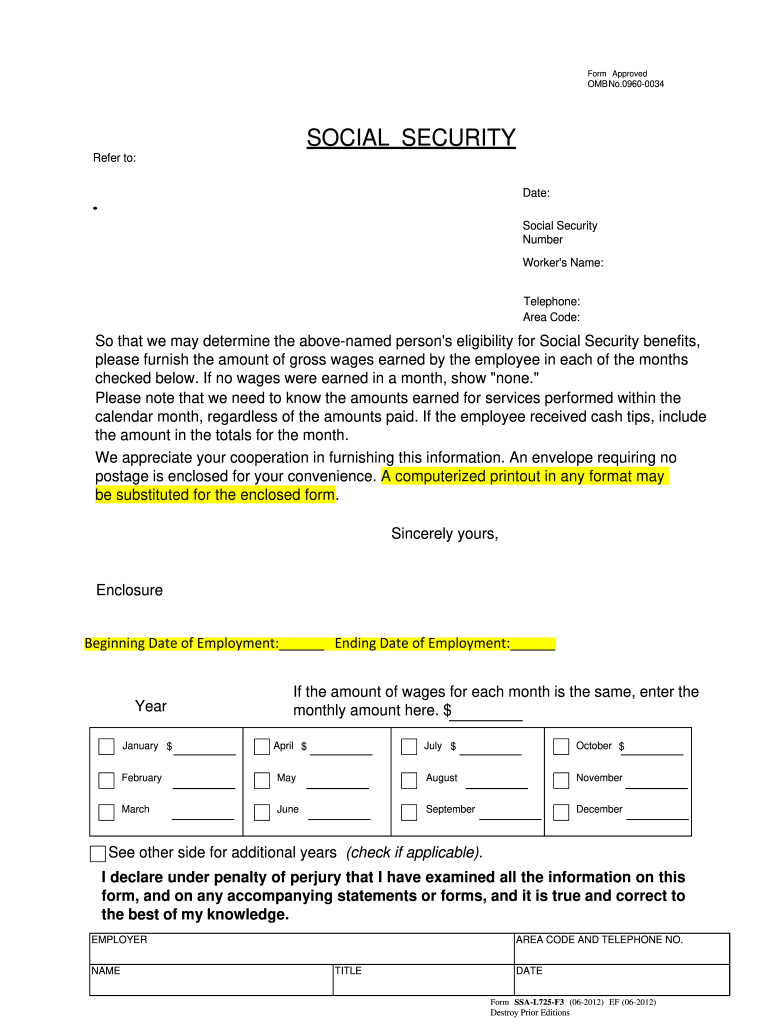

Form Approved OMB No.09600034 SOCIAL SECURITY Refer to: Date: Social Security Number Worker's Name: Telephone: Area Code: So that we may determine the above named person's eligibility for Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-L725-F3

Edit your SSA-L725-F3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-L725-F3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-L725-F3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SSA-L725-F3. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-L725-F3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-L725-F3

How to fill out SSA-L725-F3

01

Obtain a blank SSA-L725-F3 form from the Social Security Administration's website or local office.

02

Begin by entering your personal information at the top of the form, including your full name, Social Security number, and date of birth.

03

Provide details of your work history, including employers' names, addresses, and the dates you worked there.

04

Record any other relevant information such as disability status or reasons for filing.

05

Make sure to answer all questions clearly and provide any necessary documentation if required.

06

Review the completed form for accuracy and completeness before submission.

07

Submit the form as instructed, either by mail or online, depending on SSA guidelines.

Who needs SSA-L725-F3?

01

Individuals applying for Social Security benefits, such as retirement or disability.

02

People who need to report work history for SSA-related claims or inquiries.

03

Anyone seeking to update their personal information with the Social Security Administration.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a Social Security cost of living statement?

If you would like to receive your Social Security Statement by mail, please print and complete a "Request For Social Security Statement" (Form SSA-7004) and mail it to the address provided on the form. You should receive your paper Social Security Statement in the mail in four to six weeks.

What is the beneficiary form for Social Security?

The IRS Form SSA-1724-F4 is used by the relatives of the deceased social security recipient or the legal representative of the estate. Among the immediate relatives allowed to receive these payments are the spouse, children, and parents of the deceased.

Can I get a copy of my W 2 from Social Security online?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

What is not included in Social Security wages?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

How do I get my W 2 from Social Security?

Send your request with a check or money order payable to the Social Security Administration. Please include your SSN on the check or money order. You also can pay with a credit card by completing Form-714. Regular credit card rules apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SSA-L725-F3 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your SSA-L725-F3 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send SSA-L725-F3 to be eSigned by others?

When you're ready to share your SSA-L725-F3, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit SSA-L725-F3 on an iOS device?

Create, modify, and share SSA-L725-F3 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is SSA-L725-F3?

SSA-L725-F3 is a form used by the Social Security Administration (SSA) to collect information regarding a deceased person's benefits and to determine whether any benefits are payable to surviving family members.

Who is required to file SSA-L725-F3?

The person responsible for the deceased individual's financial matters, often a family member or executor of the estate, is required to file SSA-L725-F3.

How to fill out SSA-L725-F3?

To fill out SSA-L725-F3, provide accurate details about the deceased individual, including their Social Security number, date of death, and any relevant survivor information, and follow the instructions provided with the form.

What is the purpose of SSA-L725-F3?

The purpose of SSA-L725-F3 is to report the death of a Social Security beneficiary and to initiate the process for determining any death benefits or survivor benefits that may be available.

What information must be reported on SSA-L725-F3?

The information that must be reported on SSA-L725-F3 includes the deceased's name, Social Security number, date of death, place of death, and details about any surviving dependents or beneficiaries.

Fill out your SSA-L725-F3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-l725-f3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.