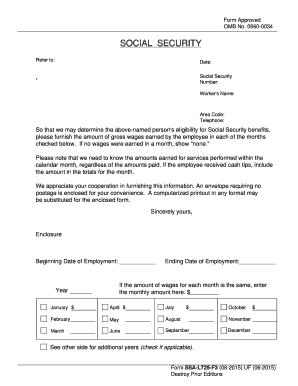

SSA-L725-F3 2009 free printable template

Show details

Telephone directory, or you may call Social Security at 1-800-772-1213 (TTY 1- 800-325-0778). You may send ... Form SSA L725-F3 (08-2009) EF08 20092009).

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-L725-F3

Edit your SSA-L725-F3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-L725-F3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-L725-F3 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SSA-L725-F3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-L725-F3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-L725-F3

How to fill out SSA-L725-F3

01

Obtain the SSA-L725-F3 form from the Social Security Administration's website or office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

04

Provide any required details about your employment history or disability status, as directed by the form.

05

Review your entries for accuracy and completeness to ensure all necessary information is included.

06

Sign and date the form at the designated area to validate your submission.

07

Submit the completed form to the appropriate Social Security Administration office, either by mail or in person.

Who needs SSA-L725-F3?

01

Individuals applying for Social Security disability benefits.

02

People seeking to request a reconsideration of a previous decision regarding their disability claim.

03

Anyone needing to report a change in their medical condition related to a disability application.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a Social Security benefits statement?

If you would like to receive your Social Security Statement by mail, please print and complete a "Request For Social Security Statement" (Form SSA-7004) and mail it to the address provided on the form. You should receive your paper Social Security Statement in the mail in four to six weeks.

Does Social Security send out w2s?

An SSA-1099 is a tax form we mail each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the Internal Revenue Service on your tax return.

Can I get my W-2 from Social Security online?

You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. Refer to Transcript Types and Ways to Order Them and About Tax Transcripts for more information.

What do I do if I haven't received my Social Security W-2?

If you did not receive your SSA-1099 or have misplaced it, you can get a replacement online if you have a My Social Security account. Sign in to your account and click the link for Replacement Documents. You'll be able to access your form and save a printable copy.

What is form SSA 1695?

In addition, an attorney or other person must complete this SSA-1695, Identifying Information for Possible Direct Payment of Authorized Fees, for each claim in which a request is being made to receive direct payment of authorized fees. Instructions for Completing the Form.

What is the beneficiary form for Social Security?

The IRS Form SSA-1724-F4 is used by the relatives of the deceased social security recipient or the legal representative of the estate. Among the immediate relatives allowed to receive these payments are the spouse, children, and parents of the deceased.

Where do I send SSA form 7162?

Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401. IF YOU HAVE ANSWERED "YES" TO ANY OF THE QUESTIONS ON THE OTHER SIDE OF THIS FORM, YOU MUST COMPLETE THE CORRESPONDING BLOCK(S) BELOW.

What is not included in Social Security wages?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

What is form SSA 7162 used for?

SSA uses Forms SSA-7161-OCR-SM and SSA 7162-OCR-SM to: (1) determine continuing entitlement to Social Security benefits; (2) correct benefit amounts for beneficiaries outside the United States; and (3) monitor the performance of representative payees outside the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SSA-L725-F3 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your SSA-L725-F3 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute SSA-L725-F3 online?

Easy online SSA-L725-F3 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in SSA-L725-F3 without leaving Chrome?

SSA-L725-F3 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is SSA-L725-F3?

SSA-L725-F3 is a form used by the Social Security Administration (SSA) for individuals to report information related to their eligibility for Social Security benefits.

Who is required to file SSA-L725-F3?

Individuals who are applying for or receiving Social Security benefits and need to provide additional information as requested by the SSA are required to file SSA-L725-F3.

How to fill out SSA-L725-F3?

To fill out SSA-L725-F3, individuals should read the instructions carefully, provide accurate information related to their situation, and submit the form to the SSA by the deadline specified in the request.

What is the purpose of SSA-L725-F3?

The purpose of SSA-L725-F3 is to collect necessary information to determine an individual's eligibility for Social Security benefits, including income and resource information.

What information must be reported on SSA-L725-F3?

SSA-L725-F3 requires individuals to report personal information, income details, and any other relevant information that could affect their Social Security benefits eligibility.

Fill out your SSA-L725-F3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-l725-f3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.