SC ST-389 2017 free printable template

Show details

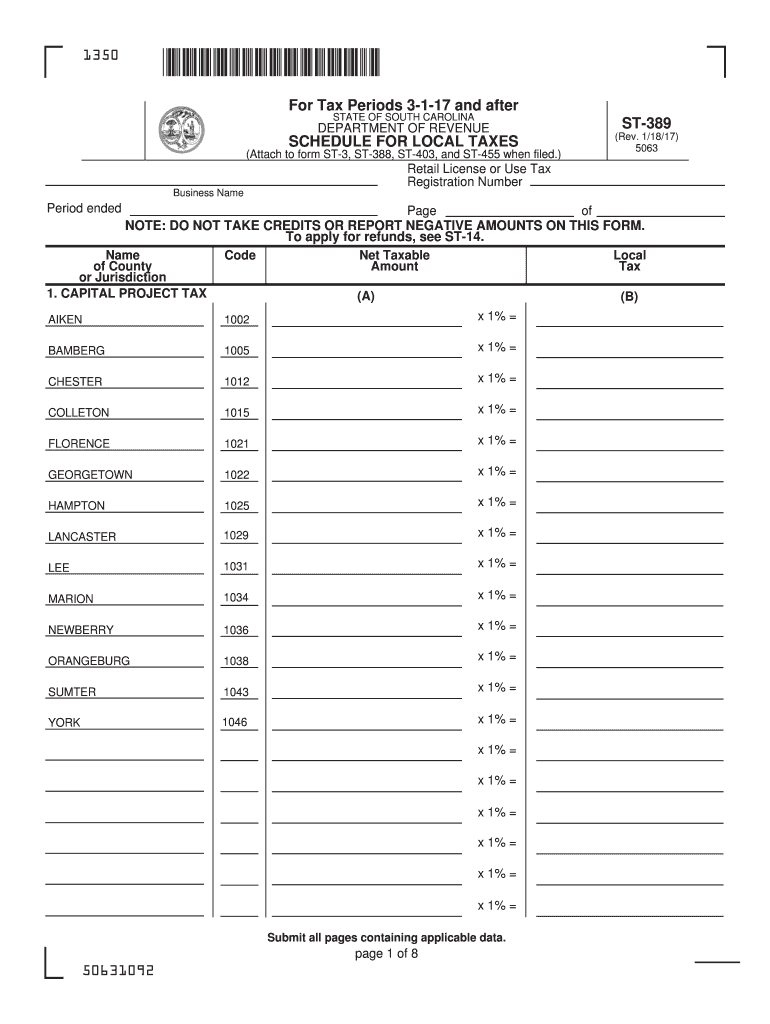

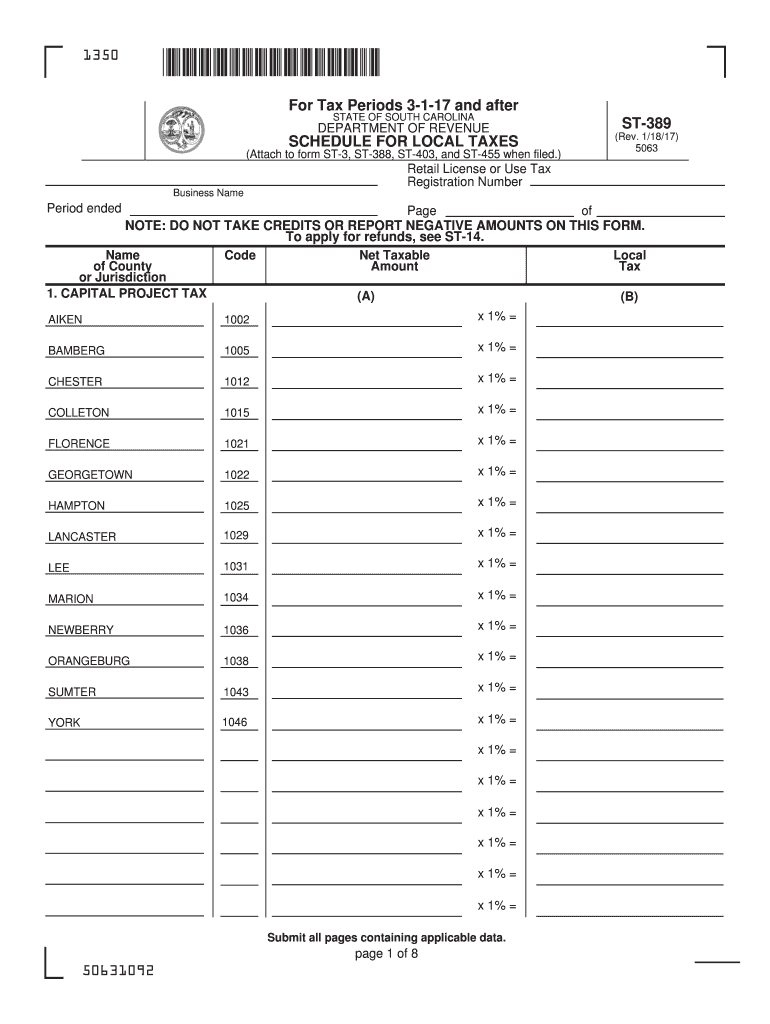

1350 For Tax Periods 3117 and after STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCHEDULE FOR LOCAL TAXES (Attach to form ST3, ST388, ST403, and ST455 when filed.) ST389 (Rev. 1/18/17) 5063 Retail

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ST-389

Edit your SC ST-389 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ST-389 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC ST-389 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SC ST-389. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ST-389 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ST-389

How to fill out SC ST-389

01

Obtain the SC ST-389 form from the relevant authority or website.

02

Fill in your personal details, including your name, contact information, and address.

03

Provide information about your caste or tribe, along with relevant documentation to support your claim.

04

Include any additional details as required, such as the purpose for which the certificate is needed.

05

Review the form for accuracy and completeness before submitting.

06

Submit the completed form to the designated authority along with any required documents.

Who needs SC ST-389?

01

Individuals belonging to Scheduled Castes (SC) or Scheduled Tribes (ST) who require a certificate for educational or employment opportunities.

02

Applicants seeking government benefits or reservations in jobs and educational institutions.

03

Persons applying for scholarships or financial assistance programs aimed at SC/ST communities.

Instructions and Help about SC ST-389

Fill

form

: Try Risk Free

People Also Ask about

Does South Carolina have online sales tax?

Sales tax is imposed on the sale of goods and certain services in South Carolina. The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax. Generally, all retail sales are subject to the sales tax.

What items have sales tax in South Carolina?

Goods that are subject to sales tax in South Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription medicines, groceries, and gasoline are all tax-exempt. Some services in South Carolina are subject to sales tax.

How do I get a sales tax permit in South Carolina?

You can easily acquire your South Carolina Sales Tax License online using the South Carolina Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (803) 896-1350 or by checking the permit info website .

Is food subject to sales tax in South Carolina?

Are groceries taxable in South Carolina? Grocery items are exempt from state sales tax but still subject to local sales tax.

How do you pay taxes when you file electronically?

How to pay your taxes Electronic Funds Withdrawal. Pay using your bank account when you e-file your return. Direct Pay. Pay directly from a checking or savings account for free. Credit or debit cards. Pay your taxes by debit or credit card online, by phone, or with a mobile device. Pay with cash. Installment agreement.

What is the purpose of the ST 389?

The ST-389 is used to report different types of local Sales and Use Taxes which must be reported by county and municipality. When completing the ST-389, all entries must be typed or hand-printed clearly and legibly.

How do I pay South Carolina sales tax?

You have two options for filing and paying your South Carolina sales tax: File online File online at the South Carolina Department of Revenue. You can remit your payment through their online system. Check here for our step-by-step guide to filing your South Carolina sales tax return.

At what age do you stop paying state taxes in South Carolina?

If you have resided in South Carolina as your permanent home and legal residence for a full calendar year (January 1-December 31) and you are 65 years or older, legally blind, or permanently and totally disabled, you are eligible for a Homestead Exemption of $50,000 from the value of your home for tax purposes.

Are groceries tax free in SC?

Most groceries are not taxable, and this encompasses any food meant to be taken home and consumed. Items like beverages, snacks, and seasonings are included here, but hot, ready-to-eat foods are not. Other excluded items are: Foods meant to be heated in the store.

What is SC sales and use tax?

The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax.

How do I register for sales and use tax in South Carolina?

How do you register for a sales tax permit in South Carolina? A retail license can be obtained online, through the mail, or in person. Online: Visit the South Carolina's My DORWAY Service.

What is sales tax exempt in South Carolina?

South Carolina exempts sales tax on the gross proceeds of the sales of tangible personal property where the seller, by contract of sale, is obligated to deliver to the buyer, an agent of the buyer or a donee of the buyer, at a point outside of South Carolina or to deliver it to a carrier or to the mails for

What is subject to sales tax in South Carolina?

Sales tax is imposed on the sale of goods and certain services in South Carolina. The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax. Generally, all retail sales are subject to the sales tax.

What items are tax exempt in SC?

Other tax-exempt items in South Carolina CategoryExemption StatusFood and MealsRaw MaterialsEXEMPTUtilities & FuelEXEMPTMedical Goods and Services21 more rows

What are the requirements for tax exemption?

If your annual income does not exceed Rs 5 lakh, you are eligible for a tax rebate of up to Rs 12,500. Surcharge is applicable on annual incomes of Rs 50 lakh and above. The rates are: 10% on income between Rs 50 lakh and Rs 1 crore.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SC ST-389 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your SC ST-389 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit SC ST-389 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign SC ST-389. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out SC ST-389 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your SC ST-389. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is SC ST-389?

SC ST-389 is a tax form used in certain jurisdictions for the reporting of sales and use tax transactions related to specific purchases.

Who is required to file SC ST-389?

Businesses and individuals who make taxable sales or purchases that require reporting under sales tax laws are required to file SC ST-389.

How to fill out SC ST-389?

To fill out SC ST-389, one must provide details such as the seller's information, the type of transaction, and the amount of sales or use tax being reported. Instructions typically accompany the form to guide users.

What is the purpose of SC ST-389?

The purpose of SC ST-389 is to ensure accurate reporting of sales tax transactions to the tax authorities, facilitating compliance with tax laws.

What information must be reported on SC ST-389?

Information that must be reported on SC ST-389 includes the dates of transactions, descriptions of items sold or purchased, total sales amount, applicable tax rates, and total tax collected or owed.

Fill out your SC ST-389 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ST-389 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.