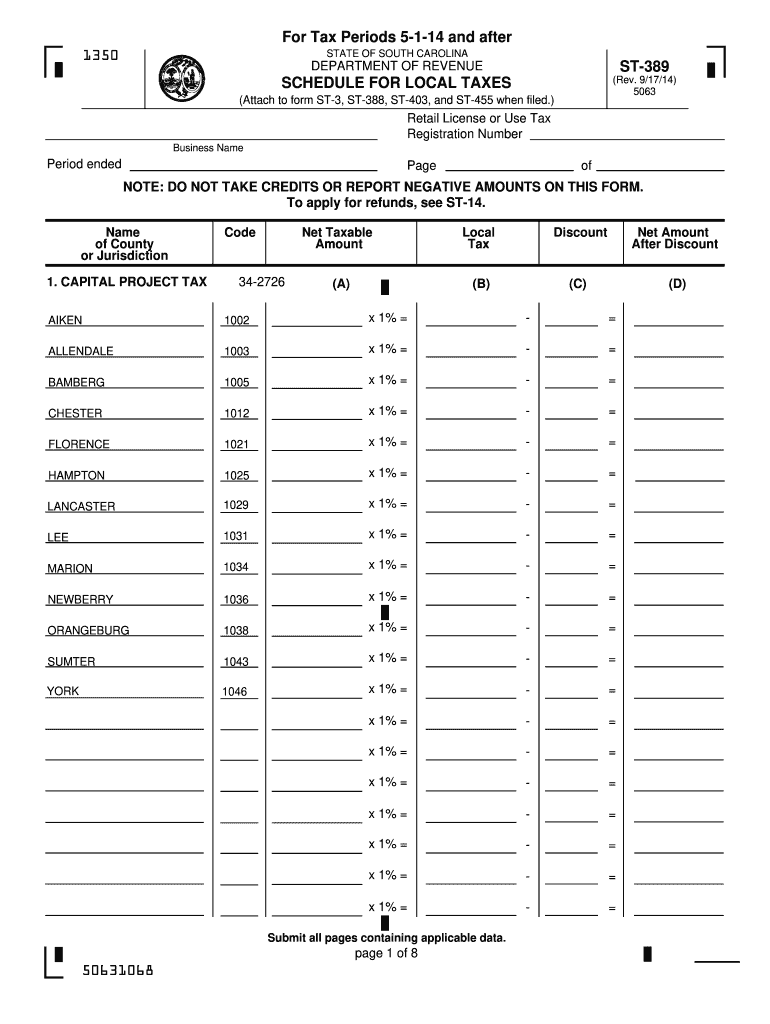

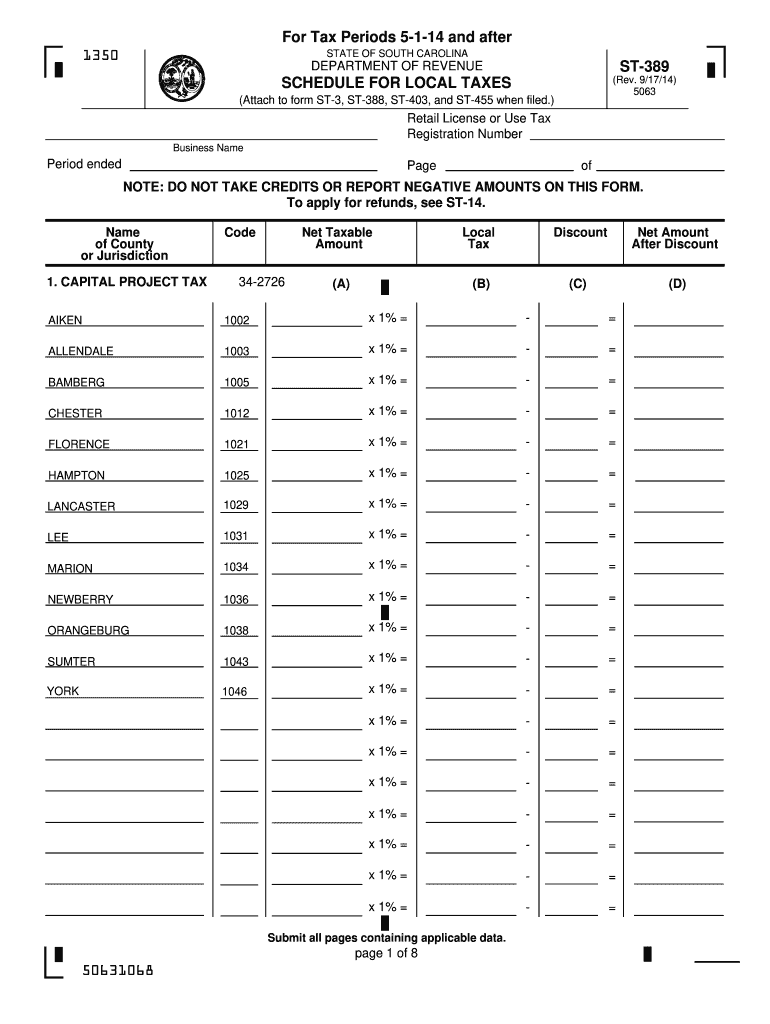

SC ST-389 2014 free printable template

Show details

To obtain information about local tax exemptions visit our website www. dor. sc.gov to obtain a current copy of the Department s Policy Document which discusses the types of local taxes imposed and exemptions allowed under each local tax. Note When your sales purchases and withdrawals are made or delivered into a locality with more than one local tax type the total net taxable amount on line 1 page 7 of 8 of form ST-389 will not agree with Item 4 of ST-389 worksheet. For Tax Periods 5-1-14...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ST-389

Edit your SC ST-389 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ST-389 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC ST-389 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC ST-389. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ST-389 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ST-389

How to fill out SC ST-389

01

Obtain the SC ST-389 form from the relevant authority or website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Indicate your caste status by checking the appropriate box for SC (Scheduled Caste) or ST (Scheduled Tribe).

04

Provide any necessary documentation that proves your caste status, such as certificates from authorized bodies.

05

Review the filled form for any errors or missing information.

06

Sign and date the form at the designated place.

07

Submit the completed form to the appropriate department or authority.

Who needs SC ST-389?

01

Individuals belonging to Scheduled Castes (SC) or Scheduled Tribes (ST) who need to apply for government schemes, educational benefits, or other affirmative action programs.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to keep 941 returns?

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review.

What is Schedule 1 Form 1040 Line 5?

Line 5 is for income you made from rental property, royalties, partnerships, S corporations, or trusts.

What is tax Schedule A Line 5?

Enter on line 5c the state and local personal property taxes you paid, but only if the taxes were based on value alone and were imposed on a yearly basis. Example. You paid a yearly fee for the registration of your car. Part of the fee was based on the car's value and part was based on its weight.

What do I put for tax period?

There are two kinds of tax years: Calendar Tax Year: This is a period of 12 consecutive months beginning January 1 and ending December 31; or. Fiscal Tax Year: This is a period of 12 consecutive months ending on the last day of any month except December.

What period is the 2023 tax year?

Tax Year 2023 is from January 1 until December 31, 2023. Prepare and e-File 2023 Tax Returns starting in January 2024.

What is Schedule 1 on the 1040 form?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SC ST-389 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your SC ST-389 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete SC ST-389 online?

pdfFiller has made filling out and eSigning SC ST-389 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit SC ST-389 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute SC ST-389 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is SC ST-389?

SC ST-389 is a form used for reporting sales and use tax information in certain jurisdictions, particularly relevant for businesses operating in those areas.

Who is required to file SC ST-389?

Individuals and businesses that are registered for sales and use tax in the jurisdiction where SC ST-389 is applicable are required to file this form.

How to fill out SC ST-389?

To fill out SC ST-389, individuals must provide their business information, sales figures, tax calculations, and any relevant details regarding exemptions or deductions.

What is the purpose of SC ST-389?

The purpose of SC ST-389 is to ensure compliance with sales and use tax regulations and to provide accurate reporting of transactions to the tax authorities.

What information must be reported on SC ST-389?

SC ST-389 must typically report information such as total sales, taxable sales, sales tax collected, exemptions claimed, and any other pertinent details related to sales tax compliance.

Fill out your SC ST-389 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ST-389 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.