Get the free Fidelity Fund Portfolios - Fidelity Investments

Show details

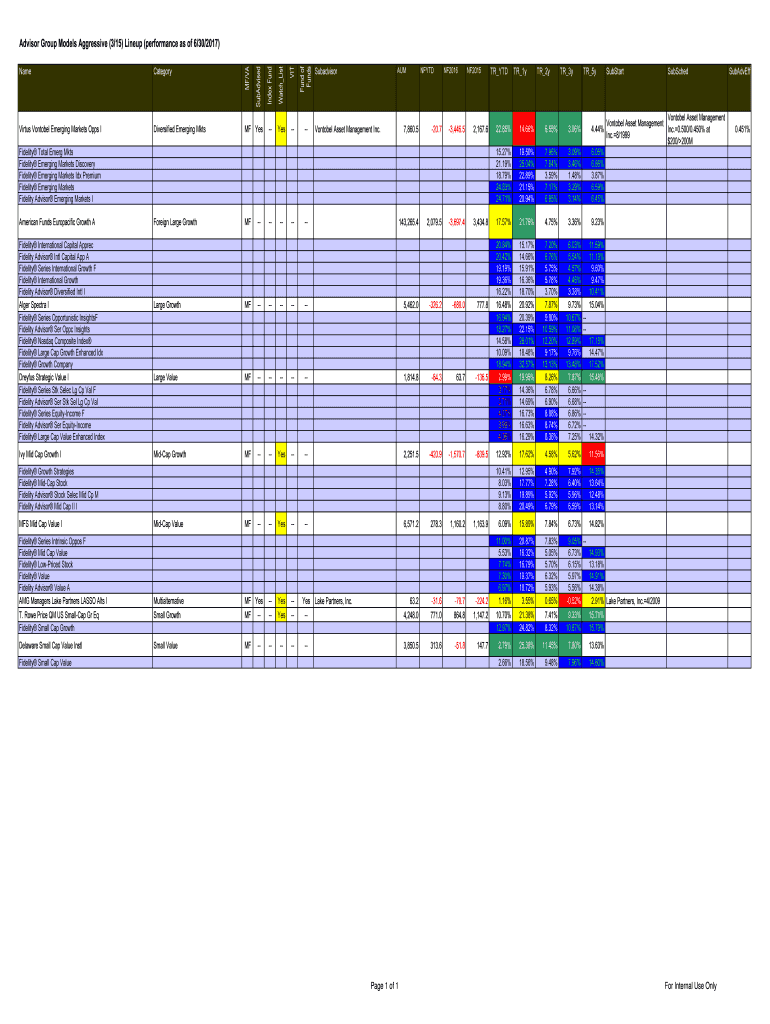

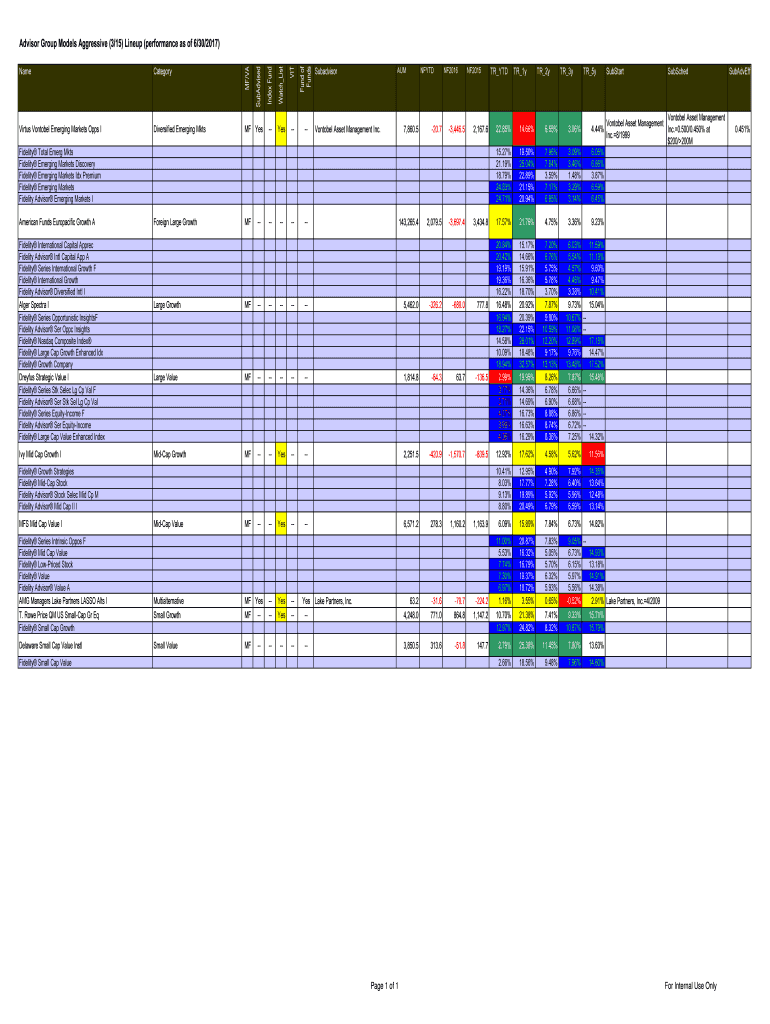

9 15. 89 14. 82 Fidelity Low-Priced Stock Fidelity Value AMG Managers Lake Partners LASSO Alts I Multialternative MF -MF -MF -MF -MF -MF Yes -31. 8029 -8179. 6867 6568. 0078 TRYTD TR1y TR2y TR3y TR5y SubStart AUM NFYTD 1 NF2016 1 NF2015 1 TRYTD 2 TR1y 2 TR2y 2 TR3y 2 TR5y 2 SubStart NFYTD NF2016 TRYTD TR1y TR2y TR3y TR5y SubStart WatchList VIT Fund of Funds Virtus Vontobel Emerging Markets Opps I Diversified Emerging Mkts MF Yes -- Yes Vontobel Asset Management Inc. 7 860. 5 313. 6 -51. 8...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity fund portfolios

Edit your fidelity fund portfolios form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity fund portfolios form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity fund portfolios online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fidelity fund portfolios. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity fund portfolios

01

Determine your investment goals: Before filling out a fidelity fund portfolio, it is important to identify your investment objectives. Are you looking for long-term growth, income generation, or a combination of both? Clarifying your goals will help guide your investment decisions.

02

Assess your risk tolerance: Understanding your risk tolerance is crucial when filling out fidelity fund portfolios. Are you comfortable with higher levels of volatility to potentially achieve higher returns, or do you prefer a more conservative approach? Evaluating your risk tolerance will help you determine the appropriate mix of investments for your portfolio.

03

Research fidelity funds: Fidelity offers a wide range of funds that cater to different investment objectives and risk appetites. Take the time to research and analyze the performance, fees, and strategies of various fidelity funds. This will help you identify funds that align with your investment goals and risk tolerance.

04

Diversify your holdings: Diversification is a fundamental principle of investing. It involves spreading your investments across different asset classes, sectors, and regions to reduce risk. Determine the optimal asset allocation for your portfolio based on your risk tolerance and allocate your investments accordingly.

05

Consider your time horizon: Your investment time horizon is an important factor when filling out fidelity fund portfolios. If you are investing for the long term, you may have a higher percentage of equity funds in your portfolio. On the other hand, if you have a shorter time horizon, you may opt for a more conservative approach with a higher allocation to fixed-income funds.

06

Review and rebalance regularly: It is essential to regularly review your fidelity fund portfolio to ensure it remains aligned with your investment goals. Monitor the performance of your funds and rebalance if necessary to maintain your desired asset allocation. This may involve selling outperforming funds and reallocating the proceeds to underperforming funds.

Who needs fidelity fund portfolios?

01

Individual investors: Individual investors who want to grow their wealth, generate income, or achieve specific financial goals can benefit from using fidelity fund portfolios. Fidelity offers a wide range of funds suitable for different investment objectives and risk profiles.

02

Retirement savers: Individuals planning for their retirement can use fidelity fund portfolios to build a diversified investment strategy that aligns with their retirement goals. Fidelity offers target-date funds designed specifically for retirement savings, making it easier for investors to choose a portfolio based on their retirement timeline.

03

Institutional investors: Institutional investors such as pension funds, endowments, and foundations can utilize fidelity fund portfolios to manage their investments. Fidelity offers a variety of institutional funds that cater to the unique needs and objectives of these organizations.

In conclusion, filling out fidelity fund portfolios involves determining investment goals, assessing risk tolerance, researching funds, diversifying holdings, considering the time horizon, and regularly reviewing and rebalancing. Fidelity fund portfolios are suitable for individual investors, retirement savers, and institutional investors alike.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fidelity fund portfolios directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your fidelity fund portfolios and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out fidelity fund portfolios using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign fidelity fund portfolios and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out fidelity fund portfolios on an Android device?

Use the pdfFiller mobile app to complete your fidelity fund portfolios on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is fidelity fund portfolios?

Fidelity fund portfolios are a collection of investments managed by Fidelity Investments.

Who is required to file fidelity fund portfolios?

Investment managers or entities managing fidelity fund portfolios are required to file.

How to fill out fidelity fund portfolios?

Fidelity fund portfolios can be filled out by providing detailed information about the investments in the portfolio.

What is the purpose of fidelity fund portfolios?

The purpose of fidelity fund portfolios is to track and manage investments to achieve financial goals.

What information must be reported on fidelity fund portfolios?

Information such as investment types, values, returns, and risks must be reported on fidelity fund portfolios.

Fill out your fidelity fund portfolios online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Fund Portfolios is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.