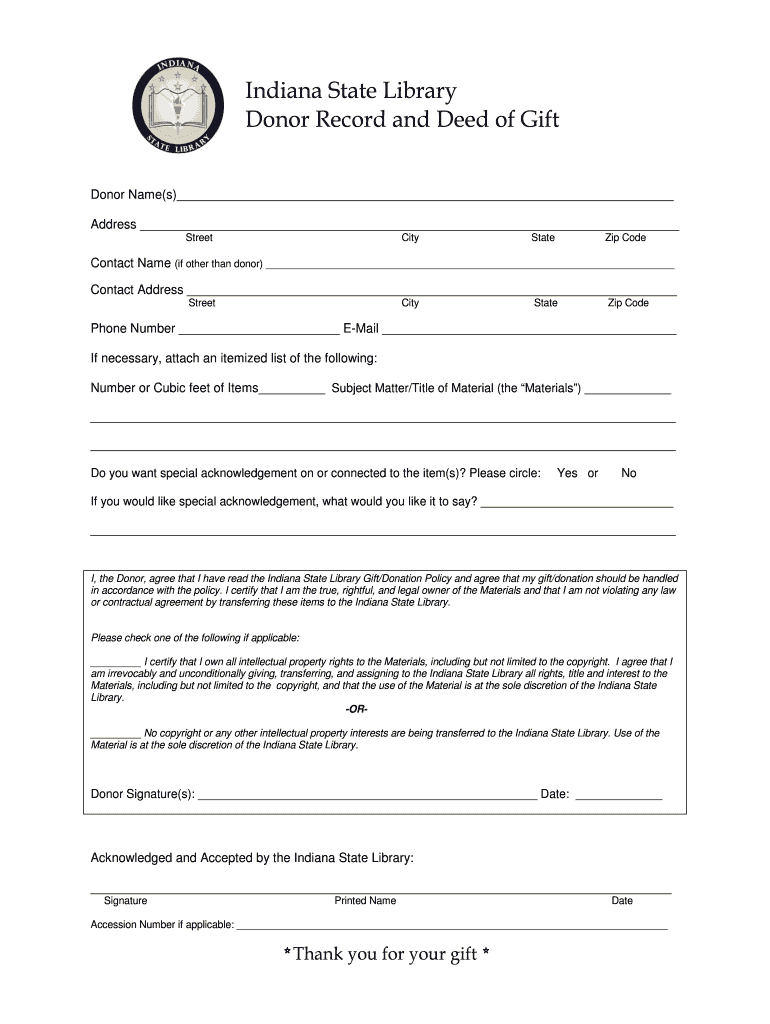

Get the free Donor Record and Deed of Gift

Show details

Modest gifts are much appreciated as are larger contributions bequests and endowments. The Library encourages donors to make monetary donations bequests and endowments to the Indiana state Library Foundation. Donations made to the Library may be transferred to the Indiana State Library Foundation at the discretion of the Indiana Library and Historical Board. Prior to making any donation please contact 140 N. Senate Avenue Indianapolis IN 46204 Attn Gift/Donation Coordinator Attn Foundation Ph...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor record and deed

Edit your donor record and deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor record and deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donor record and deed online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donor record and deed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor record and deed

How to fill out donor record and deed:

01

Begin by gathering all necessary information, such as the donor's full name, contact information, and any special instructions or preferences they may have.

02

Next, clearly identify the property or asset being donated and provide a thorough description. Include details such as the location, size, and any unique features or qualities.

03

Specify the purpose of the donation and any conditions or restrictions that may apply. This could include limitations on how the property can be used or requirements for ongoing maintenance.

04

Determine the type of deed that will be used for transferring ownership. Consult with a legal professional to ensure the correct deed is selected based on the specific circumstances and legal requirements.

05

Complete all necessary sections of the donor record and deed forms. This may include providing additional documentation, such as a survey or appraisal report, to support the donation.

06

Review all information for accuracy and completeness. Double-check spellings, addresses, and any financial or legal terms that are included.

07

Sign and date the donor record and deed forms, ensuring that all required parties have done so as well.

Who needs donor record and deed:

01

Individual donors who wish to make a gift of property or assets to a nonprofit organization or other beneficiary may need to fill out a donor record and deed.

02

Nonprofit organizations or other entities that receive donated property or assets also need to maintain donor records and have appropriate deeds in place to document the transfer of ownership.

03

Legal professionals, such as estate planning attorneys or real estate attorneys, may be involved in assisting with the preparation and review of donor records and deeds.

Remember, it is always advisable to consult with an attorney or legal professional for specific guidance on filling out donor record and deed forms, as requirements may vary based on the jurisdiction and nature of the donation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donor record and deed to be eSigned by others?

When you're ready to share your donor record and deed, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit donor record and deed online?

The editing procedure is simple with pdfFiller. Open your donor record and deed in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the donor record and deed form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign donor record and deed. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is donor record and deed?

Donor record and deed is a legal document that records the transfer of ownership of a property as a gift from one individual to another.

Who is required to file donor record and deed?

The donor, or the person giving the gift, is required to file the donor record and deed.

How to fill out donor record and deed?

To fill out the donor record and deed, the donor must provide information about the property being gifted, the value of the gift, and the names of the donor and recipient.

What is the purpose of donor record and deed?

The purpose of donor record and deed is to legally document the transfer of ownership of a property as a gift.

What information must be reported on donor record and deed?

The donor must report information about the property being gifted, the value of the gift, and the names of the donor and recipient on the donor record and deed.

Fill out your donor record and deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Record And Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.