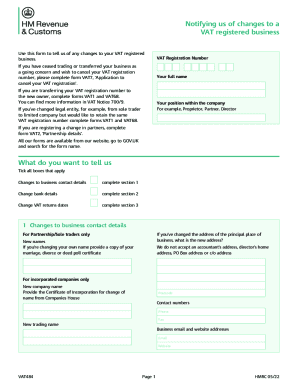

UK HMRC VAT484 2017 free printable template

Show details

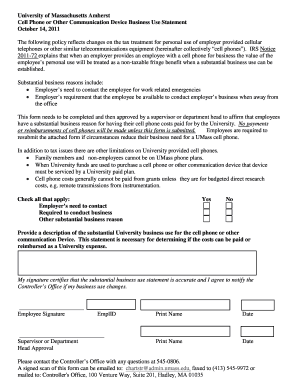

Notifyingusofchangestoa

VATregisteredbusiness

Youmayusethisformtotellusofanychangestoyour

VATregisteredbusiness.VATRegistrationNumberIfyouhaveceasedtradingortransferredthebusiness

toanewowner,completeformVAT7Applicationtocancel

yourVATRegistration.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC VAT484

Edit your UK HMRC VAT484 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC VAT484 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC VAT484 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK HMRC VAT484. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT484 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC VAT484

How to fill out UK HMRC VAT484

01

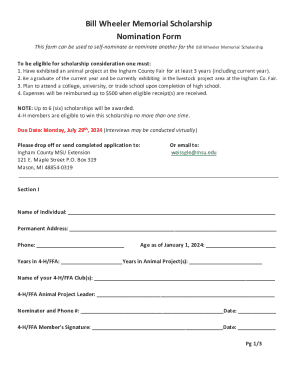

Gather necessary information: Ensure you have your VAT registration number and relevant business details ready.

02

Download the VAT484 form from the HMRC website or obtain a paper copy.

03

Fill out your business name, address, and contact details in the appropriate sections of the form.

04

Enter the details of the taxable supplies you have made during the reporting period.

05

Provide information on any imports or exports and the VAT accounted for on these transactions.

06

Complete the sections regarding any adjustments or corrections that need to be made.

07

Review the completed form for accuracy and sign it if required.

08

Submit the VAT484 form using the preferred submission method, either online or by post.

Who needs UK HMRC VAT484?

01

Any business that is registered for VAT in the UK and needs to report changes or updates related to their VAT records.

02

Businesses that have made significant adjustments to their VAT liability or corrections to previous submissions.

Fill

form

: Try Risk Free

What is vat 484 form?

Get Form. Show details. Hide details. Notifying us of changes to a VAT registered business You may use this form to tell us of any changes to your VAT registered business. VAT Registration Number If you have ceased trading or transferred.

People Also Ask about

How do I get a VAT number?

You must get help to apply for a VAT number. An application must be submitted to the local tax authorities using the right registration forms. This application should include documentation about your business, evidence of the authority of the legal representative, and detailed information about your planned activities.

Can you change VAT quarters?

You can change a VAT quarter date by logging into your government gateway account, selecting “Your Business Details” from the dashboard and then the option to “Change” VAT return dates.

What is HMRC VAT?

VAT (Value Added Tax) is a tax added to most products and services sold by VAT -registered businesses. Businesses have to register for VAT if their VAT taxable turnover is more than £85,000. They can also choose to register if their turnover is less than £85,000. This guide is also available in Welsh (Cymraeg).

Can I send an email to HMRC?

If you would like to use email as one of the ways HMRC will contact you, we'll need you to confirm in writing by post or email: that you understand and accept the risks of using email. that you're content for financial information to be sent by email. that attachments can be used.

Can I have a VAT number without a business?

A person carrying out only exempt activities or non taxable activities may not register for VAT. However, a person carrying on exempt activities or non taxable activities may have to register for VAT in certain situations, for example: acquiring goods from other Member States.

Can you operate without a VAT number?

Traders whose sales are below the VAT threshold do not need to register for VAT (but can do so voluntarily) so not all traders are required to be VAT-registered.

How do I communicate with HMRC?

The 'Income Tax: general enquiries' helpline is 0300 200 3300. Dial 18001 0300 200 3300 to contact the 'Income Tax: general enquiries' helpline by text relay. HMRC also offers a textphone service for some of its helplines.

What is an example of a VAT number?

'BE' + 8 digits + 2 check digits – e.g. BE09999999XX.

How do I change my address with VAT?

Tell HM Revenue and Customs ( HMRC ) within 30 days of any changes to the: name, trading name or main address of your business. accountant or agent who deals with your VAT.You can change your details: online - through your VAT online account. by post - using form VAT484. by webchat or phone.

How do I find a VAT code?

A VAT number – or VAT registration number – is a unique code issued to companies which are registered to pay VAT. Businesses can find their own number on the VAT registration certificate issued by HMRC, while the numbers for other businesses should be stated on any invoice they issue.

What is VAT484?

Use form VAT484 to tell HMRC if any of the business details on your VAT registration application have changed.

What is the correct format for UK VAT number?

VAT number format In England, Scotland, and Wales, a VAT number consists of the letters 'GB' followed by nine numbers. An example of a VRN that follows the UK VAT number format could be 'GB123456789'. If your business is located in Northern Ireland and you trade to the EU, you will use the prefix “XI” instead of GB.

Do I need a VAT number in the UK?

You must register if: your total VAT taxable turnover for the last 12 months was over £85,000 (the VAT threshold) you expect your turnover to go over £85,000 in the next 30 days.

How do I get a VAT number in USA?

You must get help to apply for a VAT number. An application must be submitted to the local tax authorities using the right registration forms. This application should include documentation about your business, evidence of the authority of the legal representative, and detailed information about your planned activities.

How do I contact HMRC VAT?

Phone Telephone: 0300 200 3701. Textphone: 0300 200 3719. Outside UK: +44 2920 501 261.

How do I get a VAT number UK?

You can usually register for VAT online. You need a Government Gateway user ID and password to register for VAT . If you do not already have a user ID you can create one when you sign in for the first time. Registering for VAT also creates a VAT online account.

How do I get my VAT number?

Your unique VAT number is shown on the registration certificate which HMRC issue when your business becomes VAT registered. Once you receive your VAT registration certificate, you (or your agent) can create an online VAT account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK HMRC VAT484 in Chrome?

Install the pdfFiller Google Chrome Extension to edit UK HMRC VAT484 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the UK HMRC VAT484 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your UK HMRC VAT484 in minutes.

Can I edit UK HMRC VAT484 on an iOS device?

Create, edit, and share UK HMRC VAT484 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is UK HMRC VAT484?

UK HMRC VAT484 is a form used by businesses to report specific activities related to VAT, usually concerning the sale of goods to other countries.

Who is required to file UK HMRC VAT484?

Businesses that are registered for VAT in the UK and make supplies of goods or services that fall within certain criteria are required to file UK HMRC VAT484.

How to fill out UK HMRC VAT484?

To fill out UK HMRC VAT484, businesses need to provide information regarding their VAT registration, the details of the transactions, and any other requested information specific to their sales activities.

What is the purpose of UK HMRC VAT484?

The purpose of UK HMRC VAT484 is to ensure compliance with VAT regulations by reporting specific transactions and to help the HMRC monitor VAT obligations.

What information must be reported on UK HMRC VAT484?

UK HMRC VAT484 requires businesses to report details such as VAT registration number, the nature of supplied goods or services, dates of transactions, values of sales, and any applicable VAT amounts.

Fill out your UK HMRC VAT484 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC vat484 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.