UK HMRC VAT484 2009 free printable template

Show details

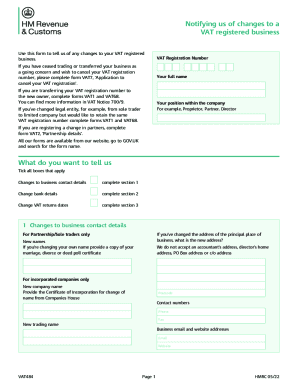

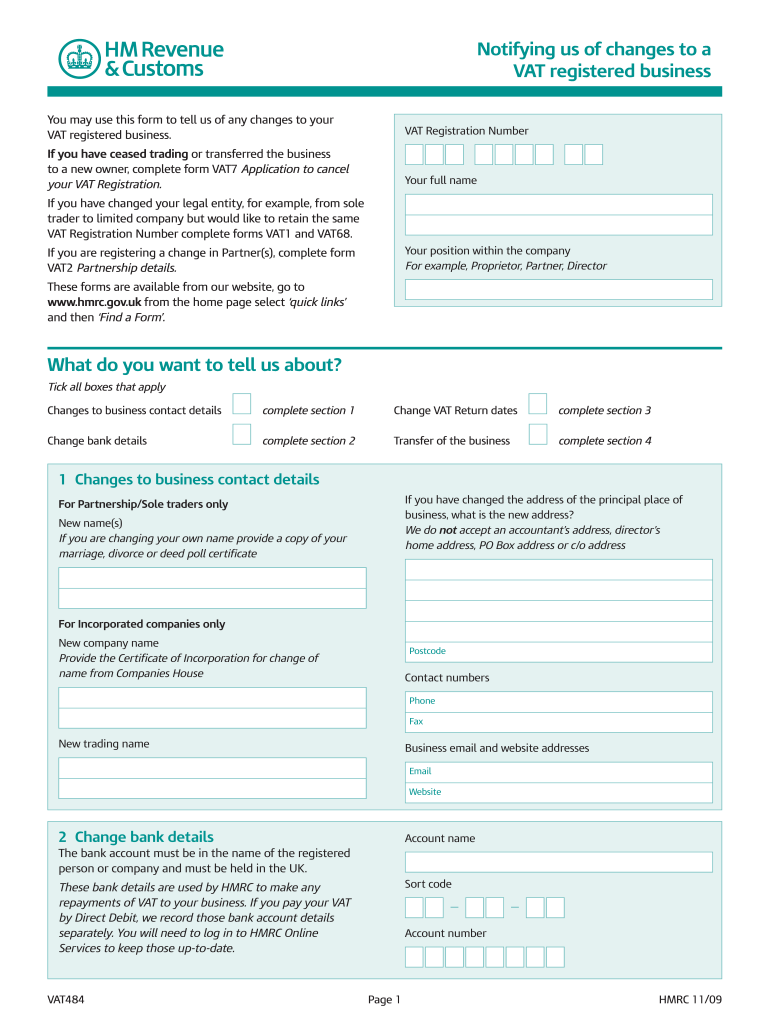

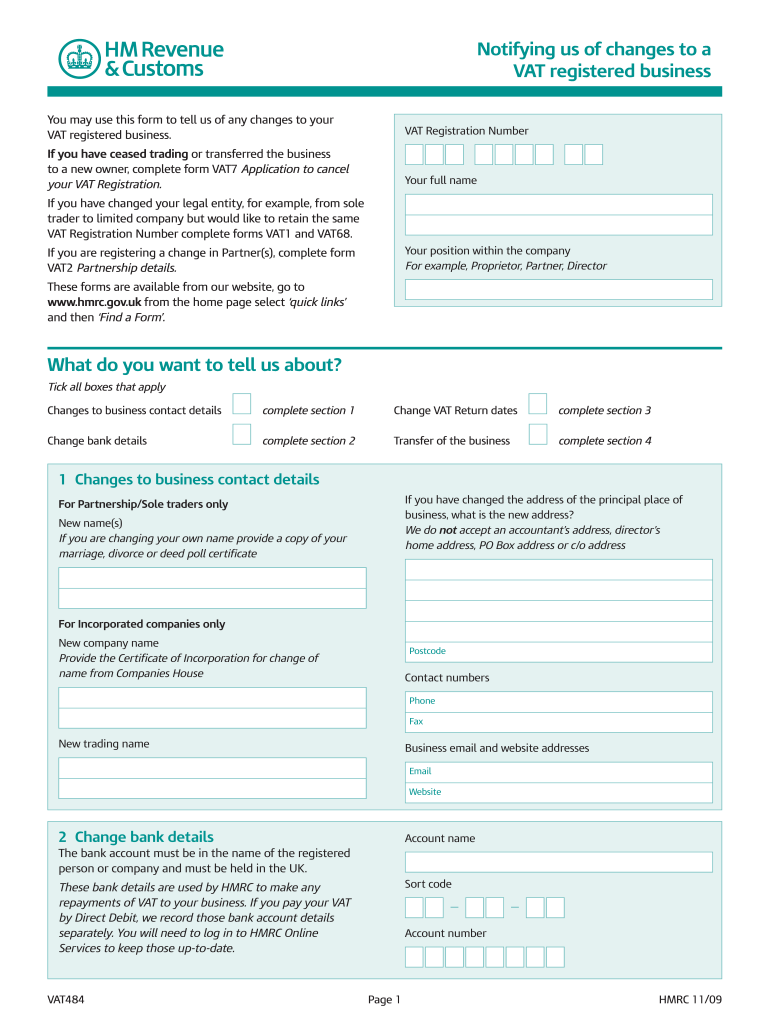

Notifying us of changes to a VAT registered business You may use this form to tell us of any changes to your VAT registered business. VAT Registration Number If you have ceased trading or transferred

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC VAT484

Edit your UK HMRC VAT484 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC VAT484 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC VAT484 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK HMRC VAT484. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT484 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC VAT484

How to fill out UK HMRC VAT484

01

Gather necessary information including your VAT registration number, and details of the transactions for the quarter.

02

Start by completing the basic details section at the top of the form, including your trading name and address.

03

Enter the total sales made during the period in the respective box.

04

Fill in the total VAT due on sales in the appropriate section.

05

Include the total amount of purchases for the period.

06

Record the total VAT reclaimable on purchases.

07

Calculate the net VAT due or reclaimable by subtracting the VAT on purchases from the VAT on sales.

08

Review all entries for accuracy.

09

Submit the completed VAT484 form to HMRC by the deadline.

Who needs UK HMRC VAT484?

01

Businesses registered for VAT in the UK that need to report their VAT transactions to HMRC for a specific period.

Fill

form

: Try Risk Free

What is vat 484 form?

Get Form. Show details. Hide details. Notifying us of changes to a VAT registered business You may use this form to tell us of any changes to your VAT registered business. VAT Registration Number If you have ceased trading or transferred.

People Also Ask about

How do I change my VAT registration?

You need to: Download and save the Changes to VAT registration details (VAT484) ( PDF , 215 KB, 2 pages) form on your computer. Print and complete the form. Send the form to the HMRC address on the form.

Why would you change your VAT number?

You can transfer a VAT registration if there's a change of business ownership or legal status. For example, if: you take over a company and want to keep using its VAT number. your business changes from a partnership to a sole trader.

Can I change my VAT quarters?

You log in to your VAT online account (your Government Gateway account) and request the change online. You can do this yourself, or your accountant can do it on your behalf as your tax agent.

Is it mandatory to have a VAT number?

You can choose to register for VAT if your turnover is less than £85,000 ('voluntary registration'). You must pay HM Revenue and Customs ( HMRC ) any VAT you owe from the date they register you. If everything you sell is exempt from VAT, you do not have to register for VAT.

What is a VAT 484 form?

Form VAT484 is a document provided by HMRC that allows businesses to notify the tax authority of any changes to their VAT registration details. The form can be used to update various details, including: Business name or trading name. Business address or contact details. VAT registration number.

What is the purpose of a VAT number?

What is a VAT identification number? Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UK HMRC VAT484 for eSignature?

Once you are ready to share your UK HMRC VAT484, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get UK HMRC VAT484?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific UK HMRC VAT484 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my UK HMRC VAT484 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UK HMRC VAT484 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is UK HMRC VAT484?

UK HMRC VAT484 is a form used by businesses to report VAT (Value Added Tax) related information, specifically around transactions involving the buying and selling of goods and services.

Who is required to file UK HMRC VAT484?

Businesses that are registered for VAT in the UK and are involved in transactions that require reporting under VAT laws are required to file the UK HMRC VAT484.

How to fill out UK HMRC VAT484?

To fill out the UK HMRC VAT484, businesses need to gather relevant financial data, accurately enter transaction details including VAT amounts, and follow the instructions provided by HMRC for submission.

What is the purpose of UK HMRC VAT484?

The purpose of UK HMRC VAT484 is to provide HMRC with necessary information regarding VAT transactions to ensure compliance with VAT regulations and accurate tax assessment.

What information must be reported on UK HMRC VAT484?

The UK HMRC VAT484 must report information such as VAT amounts charged or reclaimed, details of goods and services sold and purchased, and any relevant adjustments for the reporting period.

Fill out your UK HMRC VAT484 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC vat484 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.