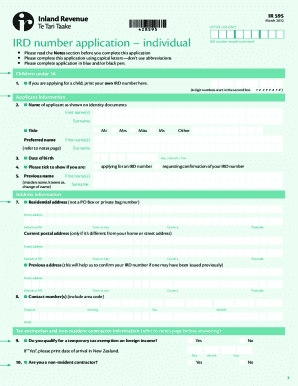

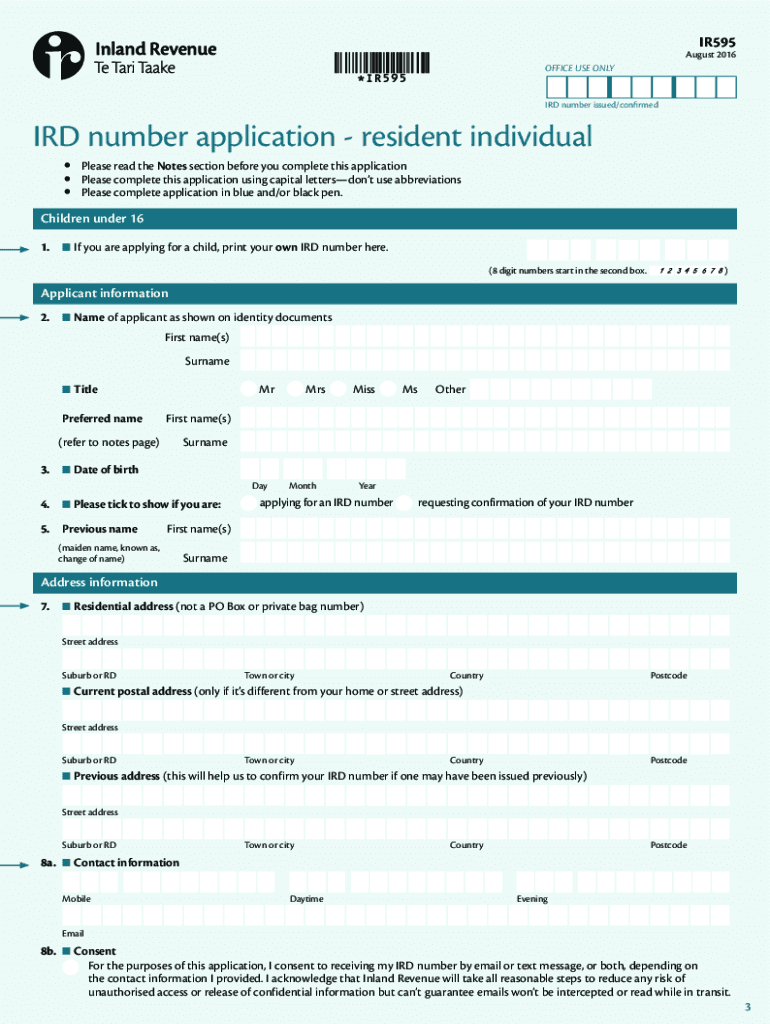

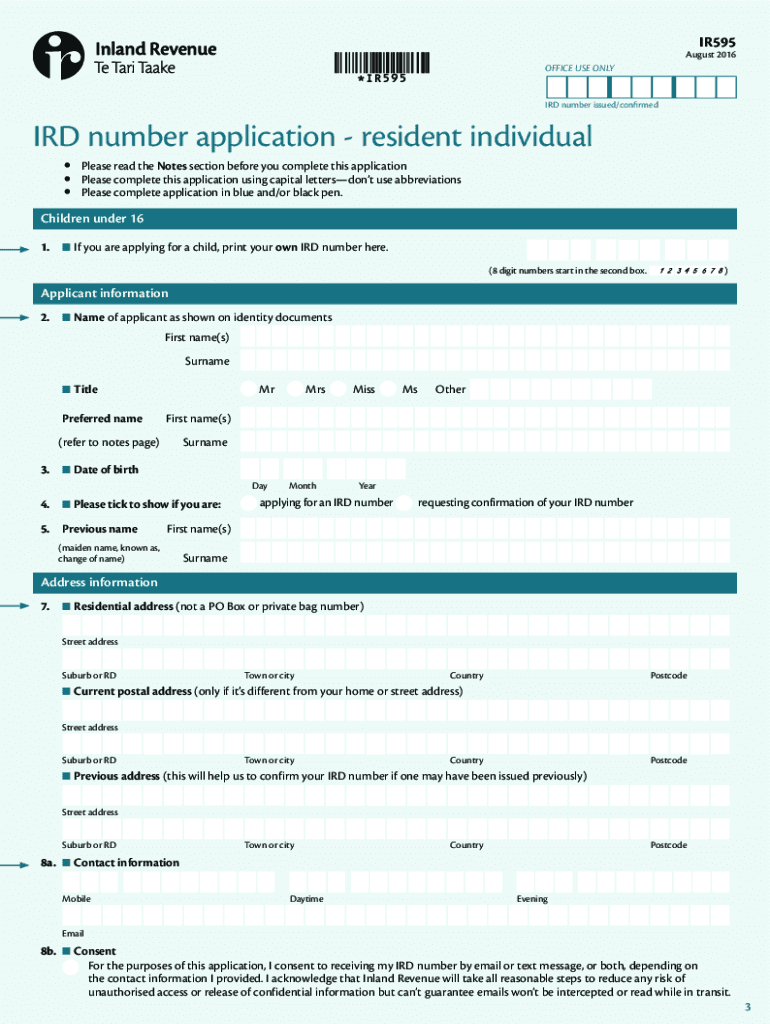

NZ IR595 2017-2025 free printable template

Show details

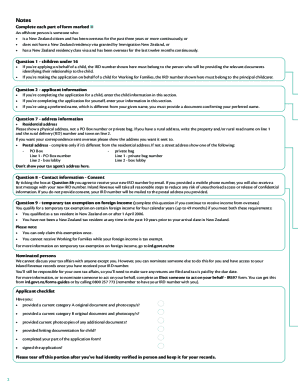

This document is an application form for obtaining an IRD number for resident individuals or children in their care, detailing the required documents and procedures for submission to Inland Revenue.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ird number application form

Edit your apply for ird number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ir595 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ir595 form ird online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ir595d form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR595 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ir595 application download form

How to fill out NZ IR595

01

Start by downloading the NZ IR595 form from the official New Zealand Inland Revenue website.

02

Read the instructions carefully provided with the form.

03

Fill in your personal details, such as your name, address, and IRD number.

04

Specify the type of income you are declaring – this could be wages, salary, business income, etc.

05

Enter the total amounts for each income type as required by the form.

06

Complete any additional sections related to deductions or tax credits that apply to you.

07

Double-check all the information for accuracy before submission.

08

Sign and date the form to certify that the information provided is correct.

09

Submit the form to the New Zealand Inland Revenue either by mail or through their online portal.

Who needs NZ IR595?

01

Individuals or businesses that earn income in New Zealand.

02

Those who have tax obligations and need to report their income to the New Zealand Inland Revenue.

03

Individuals applying for certain tax credits or deductions related to their income.

Fill

form ir595

: Try Risk Free

People Also Ask about ird application

How do I get my first IRD number?

Applying for your child's IRD number You can get an IRD number for your baby when you register their birth. Your child will need an IRD number if they: earn income from any source. get interest from a bank account or investment.

Can I apply for IRD number online?

Apply online You'll need to apply for an IRD number as 'living in New Zealand and not a new arrival' if: you're applying in New Zealand after your visa travel date. you're a New Zealand citizen applying for your child's IRD number. you prefer using the paper forms, which are an option for that process.

Can I file I online?

File online File your California tax return electronically (e-file) Filing online (e-file) is a secure, accurate, fast, and easy option to file your tax return.

What do I need to apply for IRD number?

Gather your identification documents your passport details. your Immigration New Zealand Application Number. your most recent overseas tax number (if you have one) an NZ bank account, showing your name and account number, or customer due diligence (CDD), if you have one.

Can you get an IRD number without a bank account?

You need a current New Zealand bank account before you apply for an IRD number.

How can I directly speak to someone at the IRS?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

How long does it take for IRD to reply?

If you do not have your refund yet You can check your details in myIR or call us. We'll process your assessment within 10 weeks of receiving it. If you do not have yours by then, let us know.

Do you need an IRD number to open a bank account in New Zealand?

The only way that a person with a current IRD number can be required to provide a bank account is if they are a non-individual and become an offshore person on or after 1 October (for example, if New Zealand shareholders of a New Zealand-registered company sell their shares to offshore individuals).

How long does it take to get an IRD number in NZ?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

How do I apply for an IRD?

You can apply online or complete a paper application if you have a NZ resident, student or work visa or an Australian passport.

How long does it take to apply for IRD?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

How do I set up an IRD number?

Apply for an IRD number If you're an NZ citizen. You can apply online or complete a paper application. If you have a resident visa or a student or work visa. You can apply online or complete a paper application if you have a NZ resident, student or work visa or an Australian passport. If you live outside NZ.

Can you fill out IRD forms online?

You can submit information to us using our online forms. If you're providing information on an online form, you must complete all required details, and confirm the information is true and correct before submitting it to us.

Where can I get my IRD?

You can also find your IRD number: in myIR. on payslips. on letters or statements we've sent you. on your KiwiSaver statement. on income details from your employer. by calling us.

How long does it take to get an IRD number?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nz ird number application individual for eSignature?

When you're ready to share your form ird application resident, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the ir595 form nz electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your nz form ir595 ird in minutes.

How do I edit ird application resident individual on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ir595 online on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

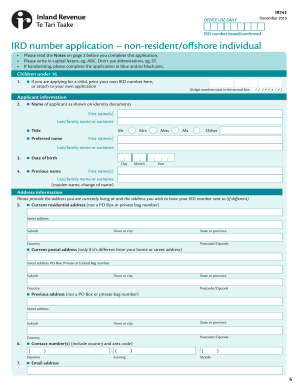

What is NZ IR595?

NZ IR595 is a tax form used in New Zealand for reporting income earned by non-residents.

Who is required to file NZ IR595?

Non-residents who receive income from sources in New Zealand may be required to file NZ IR595.

How to fill out NZ IR595?

To fill out NZ IR595, you need to provide your personal details, the type of income received, and any applicable deductions.

What is the purpose of NZ IR595?

The purpose of NZ IR595 is to ensure proper income taxation of non-residents earning income in New Zealand.

What information must be reported on NZ IR595?

NZ IR595 requires reporting of personal identification details, types of income earned, and any tax withheld at source.

Fill out your NZ IR595 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form ir595 Download is not the form you're looking for?Search for another form here.

Keywords relevant to 101554032

Related to ird number application resident

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.