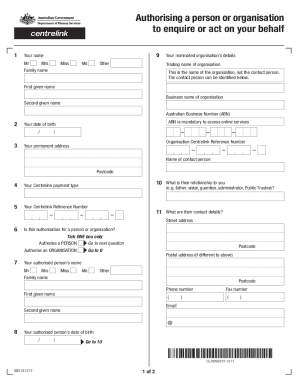

AU SA457 2017 free printable template

Show details

Permanent Residential Aged Care

Request for a Combined asset and Income Assessment

Purpose of this forth Australian Government Department of Human Services or the Department of Veterans

Affairs requires

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU SA457

Edit your AU SA457 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SA457 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SA457 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU SA457. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA457 Form Versions

Version

Form Popularity

Fillable & printabley

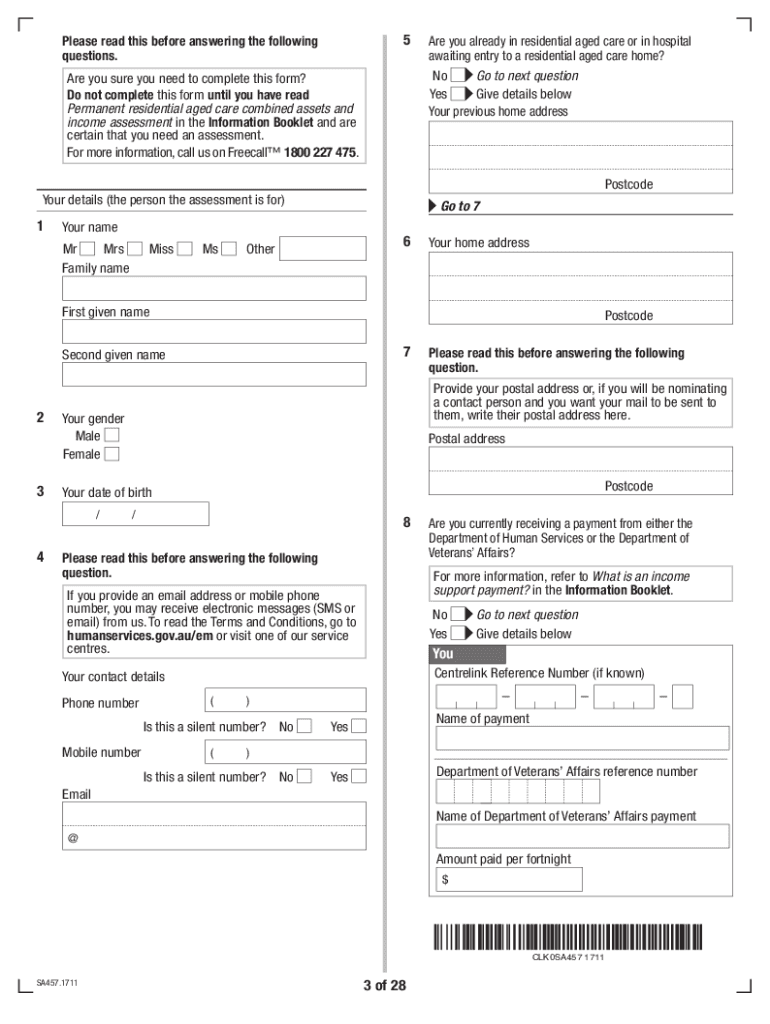

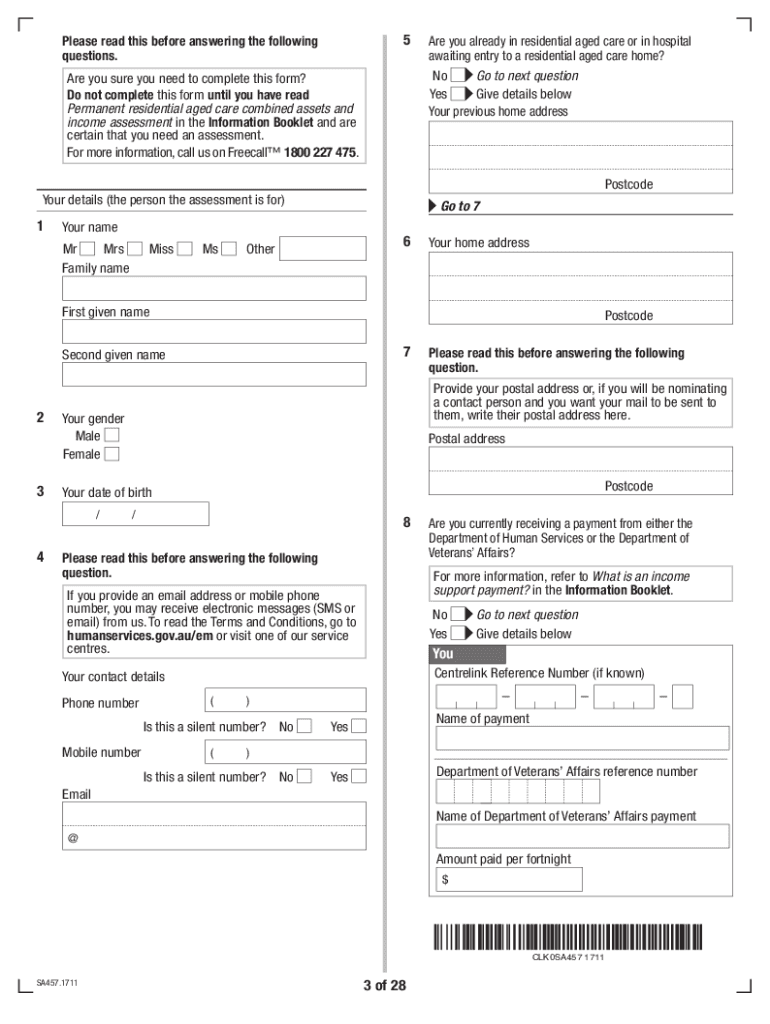

How to fill out AU SA457

How to fill out AU SA457

01

Obtain the AU SA457 form from the appropriate government website or agency.

02

Fill in your personal details including your name, address, and contact information.

03

Provide your visa details if applicable, specifying the type of visa you are applying for.

04

Describe the position you are applying for and include details about your employer.

05

Indicate your skills and qualifications relevant to the position.

06

Review the form for accuracy and completeness.

07

Submit the form as instructed, ensuring any required documents are attached.

Who needs AU SA457?

01

Individuals seeking to apply for a specific type of visa in Australia, particularly for skilled workers.

02

Employers who wish to sponsor foreign workers for employment in Australia.

Fill

form

: Try Risk Free

People Also Ask about

How to protect assets if spouse goes into nursing home Australia?

Protecting Assets From Nursing Home Costs Refundable Accommodation Deposit (RAD) This is a lump sum payment made towards the aged care facility, similar to a bond. Basic Daily Care Fee. This fee is non-negotiable and the same for every nursing home resident. Extra Services Fee. Means Tested Fee.

How do I protect my assets from nursing homes in Ohio?

Use irrevocable trust planning. Changing ownership of certain assets using an Irrevocable Trust at least five years before needing long-term nursing care, allows you to continue using your assets while also protecting them from being counted as resources when applying for Ohio Medicaid financial assistance.

How can you protect your assets from the government?

The two most common ways to protect assets are: Choosing a protective business structure: It is not easy for the IRS to obtain property from an LLC or other corporation. Establishing legal trusts: Though usually related to estate planning, trusts legally shift ownership of assets whenever you decide.

How do you avoid losing money in a nursing home?

How to protect your assets from nursing home costs Purchase long-term care insurance. Purchase a Medicaid-compliant annuity. Form a life estate. Put your assets in an irrevocable trust. Start saving statements and receipts.

What is a sa486?

Use this form to give us your financial details. We'll use these details to work out how much you'll pay towards your aged care costs.

How do I protect my assets from nursing home in Wisconsin?

What would make your assets safe is an Irrevocable Trust. The Irrevocable Trust allows you to protect your assets from Medicaid. For details on this and other Medicaid Planning Issues, contact us today. Learn more about estate planning options available from the Elder Law Center of Wisconsin.

Is ACAT asset tested?

You can have an ACAT assessment while you are waiting for your income and assets assessment to come through. This will save precious time. Your income and assets assessment is valid for 120 days. You can be reassessed if your financial situation changes significantly.

What is a sa457 form?

This form is used to calculate the amount you will pay towards your cost of care. There are annual and lifetime caps that apply to the means-tested care fee for residents who entered an aged care home after 1 July 2014.

How can we reduce assets for aged care?

How to Reduce Assets for Aged Care? Paying a higher refundable accommodation deposit. Purchasing a funeral bond. Gifting to family members as long as it is within Centrelink exemption rules. Making sure that home contents are valued at fire sale value and not replacement value. Purchase a specialised annuity.

How do I avoid paying for care to sell my house Australia?

The best way to avoid selling the home to pay for aged care is to have a carefully structured financial plan to pay for the various aged care fees. You need to consider if rental, government support, or other income, will be enough to pay the fees, or are there other financial assets to pay the RAD.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my AU SA457 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your AU SA457 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out AU SA457 using my mobile device?

Use the pdfFiller mobile app to complete and sign AU SA457 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out AU SA457 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your AU SA457 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is AU SA457?

AU SA457 is a form used in Australia for reporting certain types of transactions or information to the authorities, particularly in the context of tax obligations.

Who is required to file AU SA457?

Individuals or entities that meet specific criteria set by the Australian Taxation Office (ATO) and are involved in taxable transactions are required to file AU SA457.

How to fill out AU SA457?

To fill out AU SA457, one must provide accurate information regarding the transactions, include their personal or business details, and follow the ATO's guidelines for completing the form.

What is the purpose of AU SA457?

The purpose of AU SA457 is to ensure that the ATO receives accurate reporting of relevant transactions for compliance with tax laws and regulations.

What information must be reported on AU SA457?

AU SA457 requires reporting details such as transaction amounts, the nature of the transactions, taxpayer identification information, and any other relevant data as specified by the ATO.

Fill out your AU SA457 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU sa457 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.