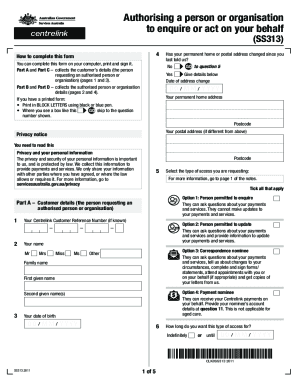

AU SA457 2019 free printable template

Show details

Residential Aged Recalculation of your cost of care (SA457)About this former Estimator more information understand that entering into aged

care can be a sensitive time. You can get an estimate of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU SA457

Edit your AU SA457 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SA457 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SA457 online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU SA457. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA457 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU SA457

How to fill out AU SA457

01

Obtain the AU SA457 form from the official website or relevant authority.

02

Fill out personal information including your name, date of birth, and contact details.

03

Provide details of your current visa status and residency information.

04

Specify the purpose of the application and include necessary supporting documents.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate department or online portal.

Who needs AU SA457?

01

Individuals seeking to apply for an Australian visa to work in a skilled occupation.

02

Employers intending to sponsor overseas workers under the Temporary Work (Skilled) visa program.

03

Anyone needing to update their visa details or change their visa circumstances in Australia.

Fill

form

: Try Risk Free

People Also Ask about

How to protect assets if spouse goes into nursing home Australia?

Protecting Assets From Nursing Home Costs Refundable Accommodation Deposit (RAD) This is a lump sum payment made towards the aged care facility, similar to a bond. Basic Daily Care Fee. This fee is non-negotiable and the same for every nursing home resident. Extra Services Fee. Means Tested Fee.

How do I protect my assets from nursing homes in Ohio?

Use irrevocable trust planning. Changing ownership of certain assets using an Irrevocable Trust at least five years before needing long-term nursing care, allows you to continue using your assets while also protecting them from being counted as resources when applying for Ohio Medicaid financial assistance.

How can you protect your assets from the government?

The two most common ways to protect assets are: Choosing a protective business structure: It is not easy for the IRS to obtain property from an LLC or other corporation. Establishing legal trusts: Though usually related to estate planning, trusts legally shift ownership of assets whenever you decide.

How do you avoid losing money in a nursing home?

How to protect your assets from nursing home costs Purchase long-term care insurance. Purchase a Medicaid-compliant annuity. Form a life estate. Put your assets in an irrevocable trust. Start saving statements and receipts.

What is a sa486?

Use this form to give us your financial details. We'll use these details to work out how much you'll pay towards your aged care costs.

How do I protect my assets from nursing home in Wisconsin?

What would make your assets safe is an Irrevocable Trust. The Irrevocable Trust allows you to protect your assets from Medicaid. For details on this and other Medicaid Planning Issues, contact us today. Learn more about estate planning options available from the Elder Law Center of Wisconsin.

Is ACAT asset tested?

You can have an ACAT assessment while you are waiting for your income and assets assessment to come through. This will save precious time. Your income and assets assessment is valid for 120 days. You can be reassessed if your financial situation changes significantly.

What is a sa457 form?

This form is used to calculate the amount you will pay towards your cost of care. There are annual and lifetime caps that apply to the means-tested care fee for residents who entered an aged care home after 1 July 2014.

How can we reduce assets for aged care?

How to Reduce Assets for Aged Care? Paying a higher refundable accommodation deposit. Purchasing a funeral bond. Gifting to family members as long as it is within Centrelink exemption rules. Making sure that home contents are valued at fire sale value and not replacement value. Purchase a specialised annuity.

How do I avoid paying for care to sell my house Australia?

The best way to avoid selling the home to pay for aged care is to have a carefully structured financial plan to pay for the various aged care fees. You need to consider if rental, government support, or other income, will be enough to pay the fees, or are there other financial assets to pay the RAD.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AU SA457 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your AU SA457 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make edits in AU SA457 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing AU SA457 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the AU SA457 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign AU SA457 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is AU SA457?

AU SA457 is a form used in Australia for reporting specific financial transactions and compliance information to the Australian Taxation Office.

Who is required to file AU SA457?

Individuals and entities that meet certain thresholds for financial transactions or income reporting are required to file AU SA457.

How to fill out AU SA457?

To fill out AU SA457, one must gather necessary financial information, complete the form as per the guidelines provided by the Australian Taxation Office, and submit it by the specified deadline.

What is the purpose of AU SA457?

The purpose of AU SA457 is to ensure compliance with Australian tax laws and to report financial activities that may affect tax liabilities.

What information must be reported on AU SA457?

The information that must be reported on AU SA457 includes details of income, deductions, and any relevant financial transactions as specified by the Australian Taxation Office.

Fill out your AU SA457 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU sa457 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.