NC AV-9 2018 free printable template

Show details

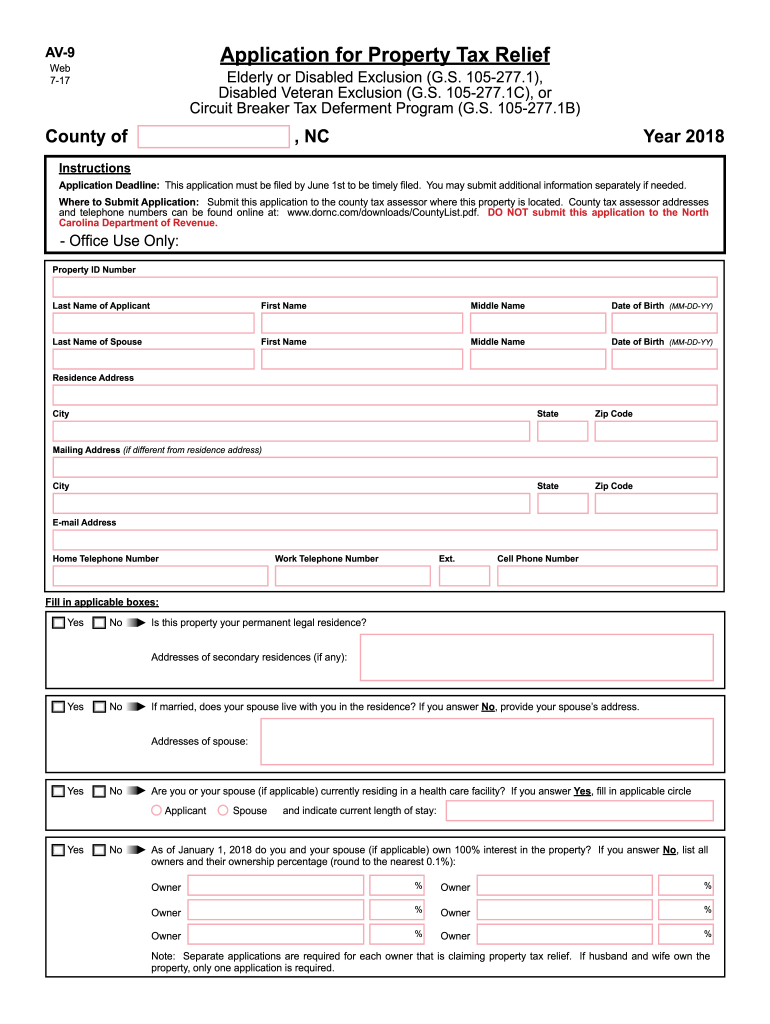

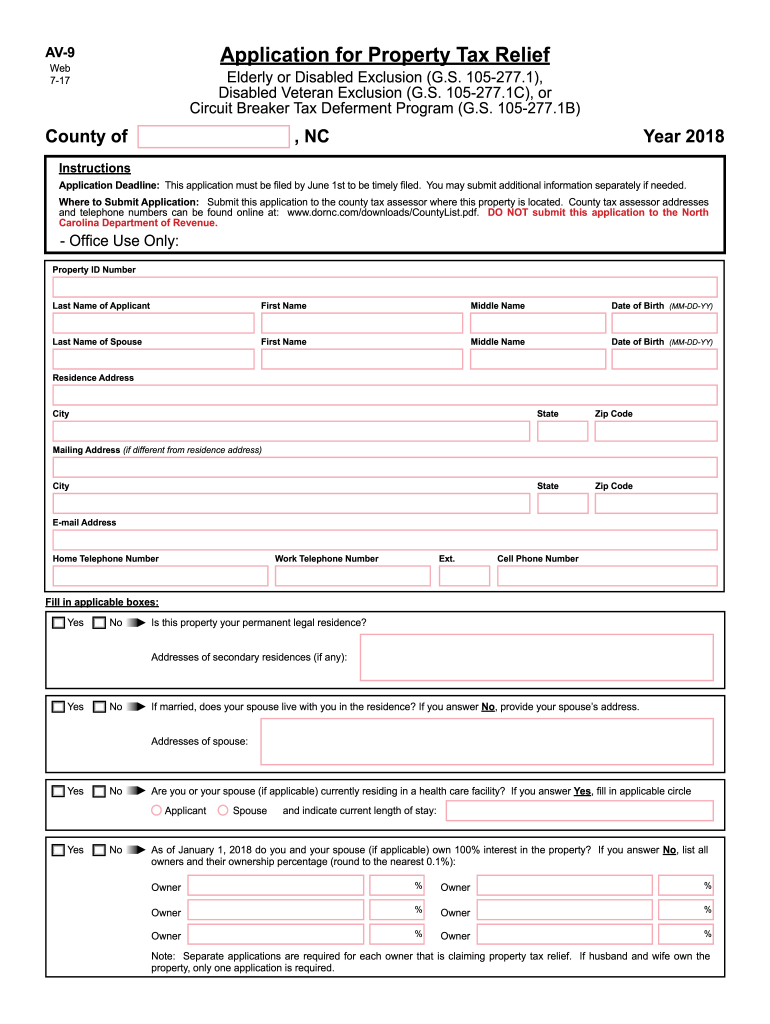

Application for Property Tax Relief. Elderly or Disabled Exclusion (G.S. 105-277.1

),. Disabled Veteran Exclusion (G.S. 105-277.1C), or. Circuit Breaker Tax

Deferment Program (G.S. 105-277.1B). County

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC AV-9

Edit your NC AV-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC AV-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC AV-9 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NC AV-9. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC AV-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC AV-9

How to fill out NC AV-9

01

Begin by downloading the NC AV-9 form from the official North Carolina DMV website.

02

Fill in your name and address in the designated fields.

03

Enter your vehicle details, including VIN (Vehicle Identification Number) and license plate number.

04

Indicate the reason for your application, such as an address change or new registration.

05

Check the appropriate box for the type of vehicle (e.g., passenger car, truck).

06

Provide any additional information required, such as previous registration details if applicable.

07

Sign and date the form at the bottom.

08

Submit the completed form to your local DMV office along with any required documentation or fees.

Who needs NC AV-9?

01

Individuals who are registering a vehicle in North Carolina for the first time.

02

Residents who need to update their vehicle registration information due to an address change.

03

Vehicle owners applying for a title in North Carolina.

04

Those who have purchased a vehicle from a dealer or privately and need to register it.

Fill

form

: Try Risk Free

People Also Ask about

How can I lower my property taxes in NC?

In North Carolina, there are three types of property tax relief that local governments can offer to property owners: elderly and disabled exclusion, disabled veteran exclusion, and circuit breaker deferment.

Who qualifies for homestead exemption in NC?

North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2022 income does not exceed $33,800 annually.

What is the NC tax Debt Relief Program?

The North Carolina Offer In Compromise program allows qualifying, financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a lump sum amount in exchange for the liability being settled in full.

What are the rules for homesteading in North Carolina?

In North Carolina, the homestead exemption applies to real and personal property, including your home, condominium, co-op, or burial plot. The property must be owned by a North Carolina resident. The resident or dependents must live in the property when filing for bankruptcy to claim the homestead exemption.

Does NC have property tax relief for seniors?

North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $50,700.

How to apply for property tax exemption in North Carolina?

North Carolina allows low-income homestead exclusions for qualifying individuals. Qualifying owners must apply with the Assessor's Office between January 1st and June 1st. If you qualify, you can receive an exclusion of the taxable value of your residence of either $25,000 or 50% (whichever is greater).

At what age do you stop paying property taxes in North Carolina?

Short Description: Under this program, taxes for each year are limited to a percentage of the qualifying owner's income. A qualifying owner must either be at least 65 years of age or be totally and permanently disabled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NC AV-9 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NC AV-9. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out NC AV-9 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NC AV-9 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out NC AV-9 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NC AV-9. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is NC AV-9?

NC AV-9 is a tax form used in North Carolina for reporting and requesting an exemption for certain property tax assessments.

Who is required to file NC AV-9?

Individuals or businesses claiming an exemption for specific property types are required to file NC AV-9, including nonprofit organizations and certain government entities.

How to fill out NC AV-9?

To fill out NC AV-9, provide the required personal or business information, describe the property being claimed for exemption, and submit any necessary supporting documentation.

What is the purpose of NC AV-9?

The purpose of NC AV-9 is to formally claim a property tax exemption in North Carolina, ensuring that eligible entities can avoid property tax liabilities.

What information must be reported on NC AV-9?

The information that must be reported on NC AV-9 includes applicant details, property description, the specific exemption being claimed, and any relevant supporting documents.

Fill out your NC AV-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC AV-9 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.