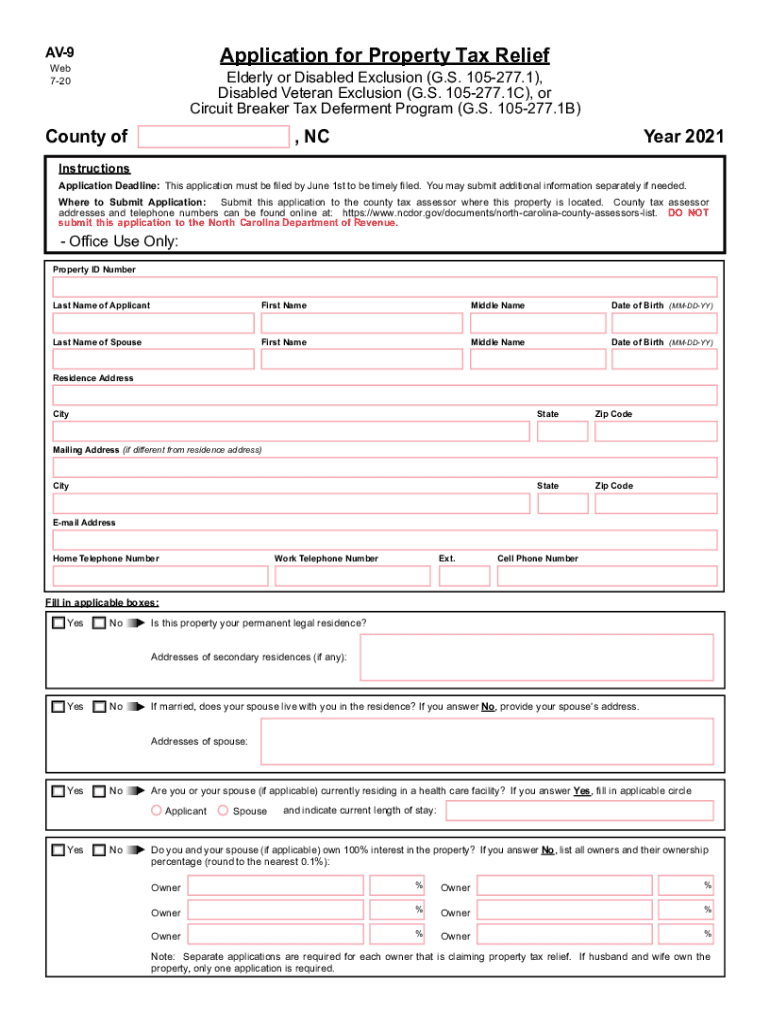

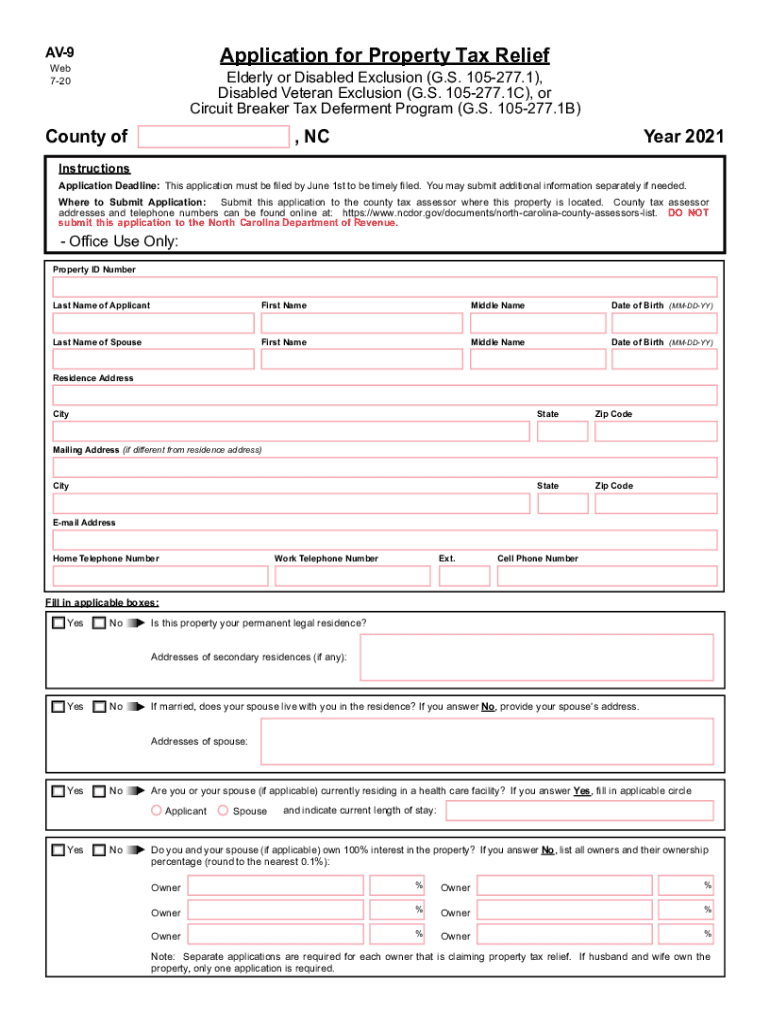

NC AV-9 2021 free printable template

Get, Create, Make and Sign NC AV-9

Editing NC AV-9 online

Uncompromising security for your PDF editing and eSignature needs

NC AV-9 Form Versions

How to fill out NC AV-9

How to fill out NC AV-9

Who needs NC AV-9?

Instructions and Help about NC AV-9

So folks what's up guys something to this is a tutorial on how to take wear it out I know I'm doing something I um am I how to apply Styron II okay, and I'm using a star relief medicine by company called TRP had 2017 won Miss Choice Award yeah I can see that keep this focused in here focus I guess, so yeah ever had a stash since 2008, and I got a key I waited contacts and back into I mean at 2000 2005 I think it was I was wearing contacts I was working in warehousing or driving a forklift and with the propane, and you know when you turn the face you're going to reverse all that propane and dust and all that blowing back in your face get all in your eyes all behind contacts all Daniel is right we're back then I'm still kind of new to wearing contacts, and I was just taking that the contact solution to clean the contacts I'm supposed to take the contacts out then I'm making a little dispenser and clear the implementing later no I'll just squirt some Charlie keep ongoing right they all kinda stuff build up down in my other hat — this be that all that is like rock hard ass — that being a bull — I want to see in this one, so I had to have surgery right I'm taking out I don't know if you could see them why they fit my obviously was rebuilt after white right there it's a lie I did with it so about together man taste of death on a pedestal I could see got almost a new idea today going close, so I don't know if I got one fingertip, but I like quick care to do it because doing on the phone I can't tell close I am to my eyeball compared to in the mirror I just got shouts on a mirror all fogged up, and I already put these on my finger when I went in the bathroom that's when I realized oh snap Mary still father, so I had to improvise and that's how I got on the phone sensual I mean you do camera on the phone, so I do like that did some time you made a tutorial oh no no I've met I was not on the stairs Music they can't feel like okay, so we do best to store it so back know that right — against a terrible is my idea, so you know I did the one compressing all that it drops learn that was work finally go see a doctor all I was doing is goes to go see that doctor show him I never know what's going on right it's so oh, oh yes I go in there you know anybody knows anything cool see the doctors my it comes in right where's the assistant came in you know she did her analysis of what's going on with the ad her notes and stuff, and she set me up to see the doctor comes in tall guy but older that right look like he bought a tea soon right he comes in, and he got the shakes in or the old folks shakes and stuff you know oh snap alright you know your doctor, and he's like you still you know doing this thing, so I was okay so assume I might imagine that my eyelids was like out the hair like broken it was bigger than this accident it was out to here looking like I had that Napoleon blue great dang massive bull massive napoleon blue massive cherry eye type stuff going on right...

People Also Ask about

How do I apply for property tax exemption in Ohio?

What is the deadline to file a homestead exemption Texas 2022?

Is Homestead automatic in Texas?

Can you file Texas homestead exemption online?

How to fill out homestead exemption form Texas 2022?

What documents are needed for homestead exemption in Texas?

How to apply for homestead exemption in Texas online?

Who is exempt from paying property taxes in Ohio?

What are valid reasons for claiming tax exemption in Ohio?

How do I qualify for homestead exemption in California?

How do I apply for property tax exemption in California?

What age do you stop paying property taxes in California?

Does California offer property tax exemption for seniors?

How do I get homestead exemption in Texas?

Do I qualify for California homeowners property tax exemption?

How to fill out Texas homestead exemption Form 2022?

How do I fill out the Texas Homestead?

Can I use Homestead immediately in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the NC AV-9 form on my smartphone?

How do I edit NC AV-9 on an Android device?

How do I fill out NC AV-9 on an Android device?

What is NC AV-9?

Who is required to file NC AV-9?

How to fill out NC AV-9?

What is the purpose of NC AV-9?

What information must be reported on NC AV-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.