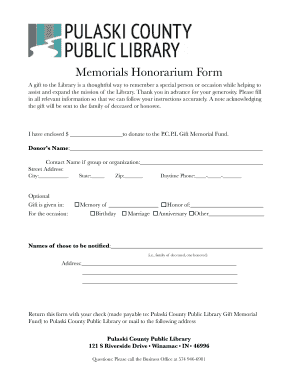

Get the free Medium Term Bank Guarantee - exim

Show details

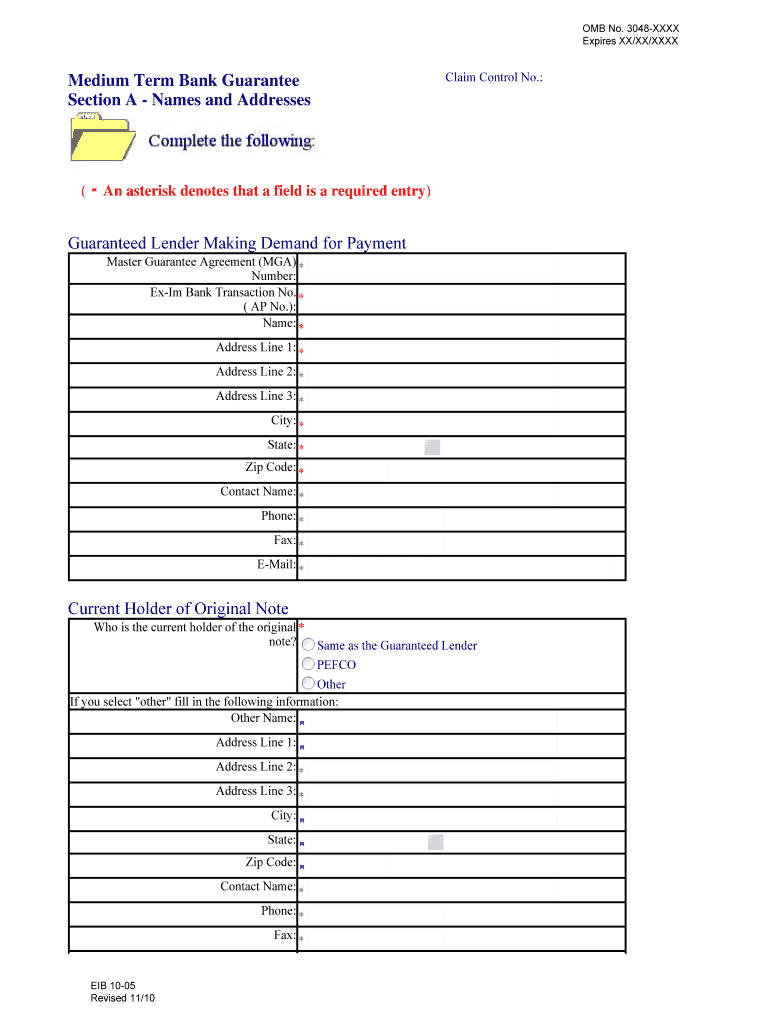

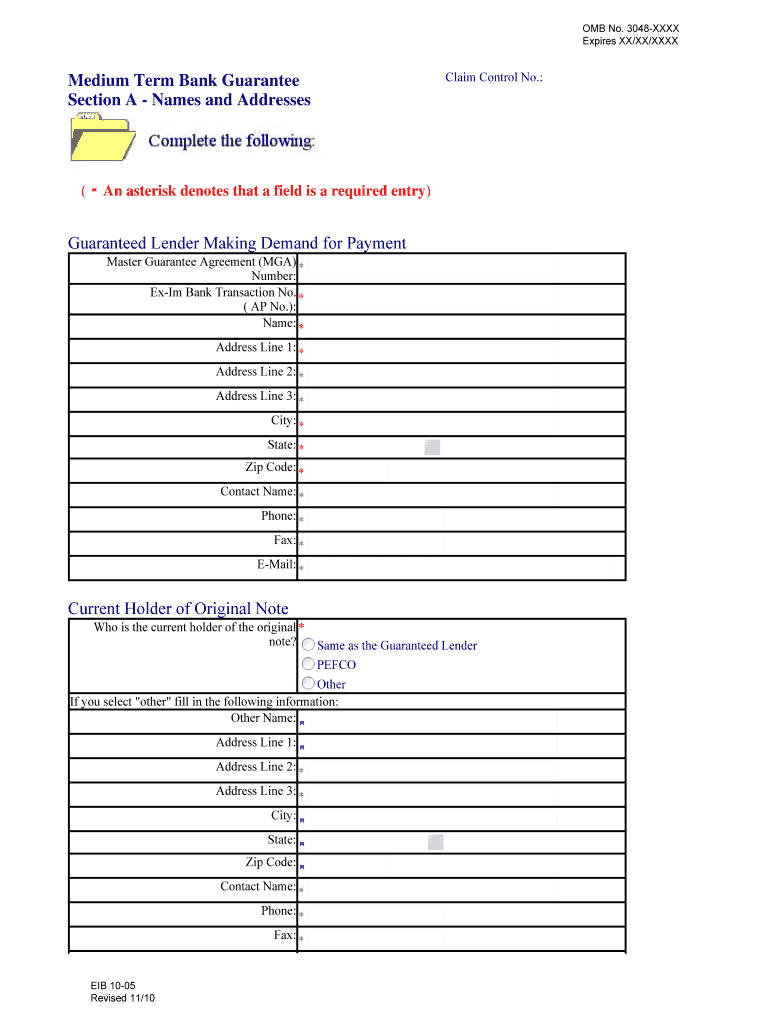

This document is used to submit a claim under a medium term bank guarantee provided by the Ex-Im Bank, detailing lender, borrower, and guarantee information along with supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medium term bank guarantee

Edit your medium term bank guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medium term bank guarantee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit medium term bank guarantee online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit medium term bank guarantee. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medium term bank guarantee

How to fill out Medium Term Bank Guarantee

01

Obtain the application form for the Medium Term Bank Guarantee from your bank.

02

Fill in your personal and business details accurately in the form.

03

Specify the purpose of the guarantee clearly.

04

Provide detailed information about the amount required and the duration of the guarantee.

05

Attach any necessary supporting documents, such as financial statements or contracts.

06

Submit the completed form and documents to the bank for review.

07

Wait for the bank to assess your application and provide feedback or approval.

Who needs Medium Term Bank Guarantee?

01

Businesses looking to secure financing for projects or contracts.

02

Companies needing to provide assurance to suppliers or clients.

03

Entrepreneurs aiming to enhance their creditworthiness with financial institutions.

Fill

form

: Try Risk Free

People Also Ask about

What is bank guarantee verbiage?

A bank guarantee is a guarantee given by the bank on behalf of the applicant to cover a payment obligation to a third party. In other words, the bank becomes a guarantor and is answerable for the person requesting the guarantee in the event that they are unable to make the payment they have agreed with a third party.

What are the terms of a bank guarantee?

It is a written promise on your behalf that a financial institution like Westpac will make a future payment to the beneficiary if they make a claim on the bank guarantee. With a bank guarantee, you don't need to pay an upfront deposit to the beneficiary for things like a rental or retention bond.

What is bank guarantee translate in English?

Meaning of bank guarantee in English an agreement made by a bank or other financial organization to pay a debt if the person or company who owes the money cannot pay: A bank guarantee gives you extra authority when dealing with suppliers, and may allow you to avoid having to pay a substantial deposit.

What is a standard letter of guarantee?

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

What is the bank guarantee text?

A guarantee means giving something as security. A bank guarantee is when a bank offers surety and guarantees for different business obligation on behalf of their customers within certain regulations.

What is the standard wording for bank guarantee?

We, the Bank lastly undertake not to revoke this guarantee during its currency except with the previous consent of the CERC in writing. We, the Bank also agree that this guarantee will not be discharged due to change in the constitution of the Bank or __(name of the purchasing entity).

What is a medium-term bank note?

A medium-term note (MTN) usually refers to a note payable that comes with a maturity date that is within five to ten years.

What are the three types of bank guarantees?

Bank guarantees are mostly seen in international business transactions, although they may also individuals may need a guarantee to rent property in some countries. Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warrantee bond guarantee, and a rental guarantee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Medium Term Bank Guarantee?

A Medium Term Bank Guarantee is a financial instrument issued by a bank that guarantees payment to a beneficiary in the event of default by the principal borrower, typically for a duration ranging from one to five years.

Who is required to file Medium Term Bank Guarantee?

Entities or individuals seeking to secure a loan or credit facility, or those participating in contracts that require financial assurance, are typically required to file a Medium Term Bank Guarantee.

How to fill out Medium Term Bank Guarantee?

To fill out a Medium Term Bank Guarantee, one must provide relevant details such as the names and addresses of the parties involved, the guarantee amount, the terms of the guarantee, and an explanation of the conditions under which the guarantee is valid.

What is the purpose of Medium Term Bank Guarantee?

The purpose of a Medium Term Bank Guarantee is to provide assurance to lenders or suppliers that they will receive payment in the event of default, thereby facilitating borrowing and business transactions.

What information must be reported on Medium Term Bank Guarantee?

Information that must be reported on a Medium Term Bank Guarantee includes the names of the guarantor and beneficiary, the amount guaranteed, the term of the guarantee, the purpose of the guarantee, and any conditions or obligations tied to it.

Fill out your medium term bank guarantee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medium Term Bank Guarantee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.