Get the free CONSENT ORDER FDIC-11-308b - fdic

Show details

This document outlines a consent order issued by the FDIC and the Illinois Department of Financial and Professional Regulation regarding compliance management issues at Farmers’ and Traders’ State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consent order fdic-11-308b

Edit your consent order fdic-11-308b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consent order fdic-11-308b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consent order fdic-11-308b online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit consent order fdic-11-308b. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

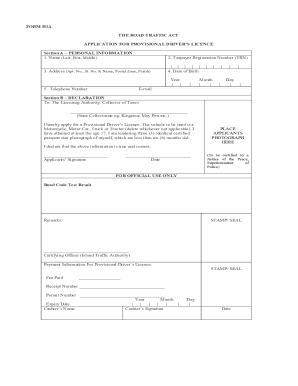

How to fill out consent order fdic-11-308b

How to fill out CONSENT ORDER FDIC-11-308b

01

Start by reading the instructions provided with the CONSENT ORDER FDIC-11-308b carefully.

02

Fill in your personal information at the top of the order, including name, address, and contact details.

03

Provide the name of the financial institution involved in the consent order.

04

Clearly state the specific reasons for the consent order as outlined in the related documents.

05

Ensure all necessary signatures are included, both from the individual and the authorized representatives of the institution.

06

Review the document for completeness and accuracy.

07

Submit the form to the appropriate regulatory body along with any required fees or additional documentation.

Who needs CONSENT ORDER FDIC-11-308b?

01

Any financial institution that has been issued a consent order by the FDIC.

02

Stakeholders involved in the operations of the financial institution, including management and compliance officers.

03

Individuals or entities seeking to understand the regulatory requirements affecting the institution.

Fill

form

: Try Risk Free

People Also Ask about

What does the FDIC do responses?

The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.

What happens when a bank gets a consent order?

Consent orders are used in various scenarios within the banking and financial industry, including but not limited to: Addressing compliance failures with banking regulations. Rectifying violations in money transfer operations. Correcting issues related to AML and Know Your Customer (KYC) procedures.

Are banks MRA public?

This report of examination provides an assessment of the bank and may identify unsafe and unsound practices, supervisory findings, or violations of laws and regulations. It's important to note that the report of examination and the findings therein are confidential and not made available to the public.

Are bank consent orders public?

Since August 1989, the Federal Reserve has made all final enforcement orders public in ance with the Financial Institutions Reform, Recovery, and Enforcement Act of 1989; since November 1990, it has made written agreements public in ance with the Crime Control Act of 1990.

What is a FDIC consent order?

Cease-and-desist orders issued by the FDIC are titled “Consent Order” if the respondent stipulates to the issuance of the order, and titled “Order to Cease and Desist” if issued through litigation following the issuance of a notice of charges, an administrative enforcement hearing, an administrative law judge

What are the different types of enforcement actions?

Formal enforcement actions include cease and desist orders, written agreements, prompt corrective action directives, removal and prohibition orders, and orders assessing civil money penalties.

What are the types of enforcement actions of the FDIC?

Formal actions are notices or orders issued by the FDIC against IDIs or IAPs. Formal actions are legally enforceable. Most notices and final orders are published after issuance, as required by law. Informal actions are voluntary commitments made by an IDI's BOD or an IAP.

What are the main duties of the FDIC?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation's financial system by: insuring deposits; examining and supervising financial institutions for safety and soundness and consumer protection; making large and

Is the FDIC a law?

Yet public support was overwhelmingly in favor. On June 16, 1933, Roosevelt signed the 1933 Banking Act into law, creating the FDIC.

How to find bank consent orders?

You may search the FDIC ED&O database using the Search Form , which enables queries by the following Search Criteria: Order Category, Action Type, Bank City, Bank State, Order Title, Issued Date, Docket Number, and names or certain identifiers of parties to the action, whether financial institutions, affiliated

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONSENT ORDER FDIC-11-308b?

CONSENT ORDER FDIC-11-308b is a regulatory enforcement action issued by the Federal Deposit Insurance Corporation (FDIC) that outlines specific compliance requirements and corrective measures for a financial institution.

Who is required to file CONSENT ORDER FDIC-11-308b?

Financial institutions that have been subject to enforcement actions by the FDIC are required to file CONSENT ORDER FDIC-11-308b as a means of demonstrating compliance with the specified requirements.

How to fill out CONSENT ORDER FDIC-11-308b?

To fill out CONSENT ORDER FDIC-11-308b, the financial institution must provide accurate and complete information as requested in the form, including details about compliance measures, corrective actions taken, and any other pertinent information highlighted in the order.

What is the purpose of CONSENT ORDER FDIC-11-308b?

The purpose of CONSENT ORDER FDIC-11-308b is to address deficiencies identified by the FDIC in a financial institution's operations and to ensure that the institution complies with applicable regulations to promote safe and sound banking practices.

What information must be reported on CONSENT ORDER FDIC-11-308b?

The information that must be reported on CONSENT ORDER FDIC-11-308b includes the financial institution's plan for corrective action, compliance timelines, specific measures taken to resolve identified deficiencies, and progress updates on addressing the issues outlined in the order.

Fill out your consent order fdic-11-308b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent Order Fdic-11-308b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.