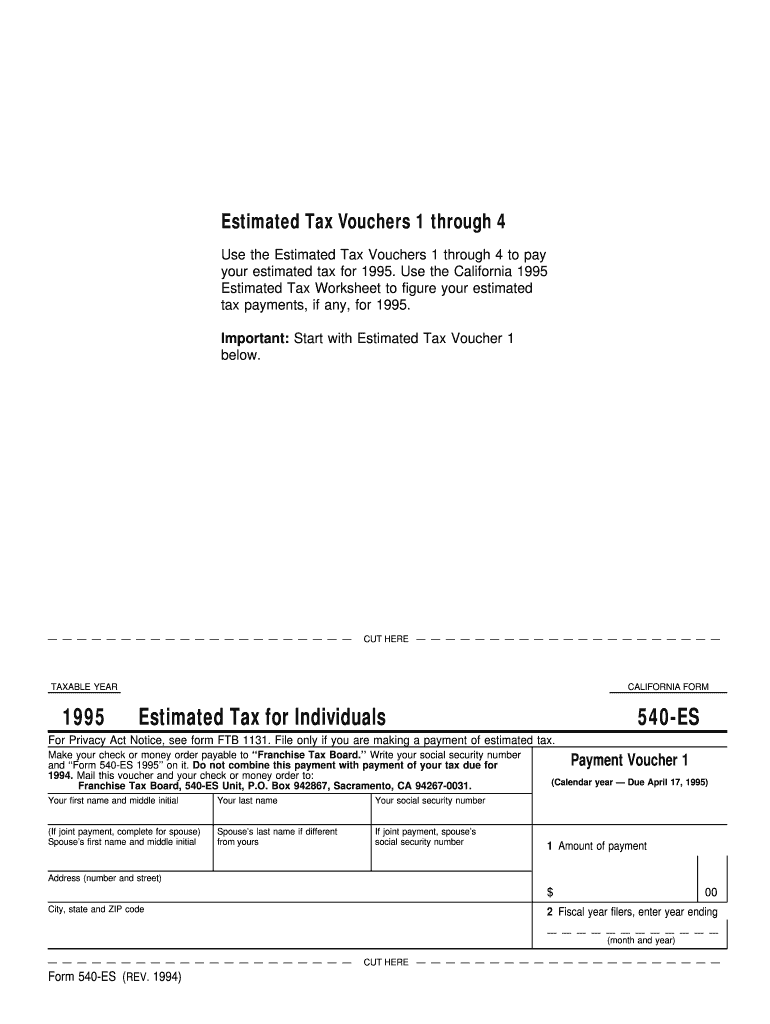

Who needs a form 540-ES?

Form 540-ES is used to report payments of estimated tax by California taxpayers. It doesn’t serve as a money order. It’s an information return requested by California Franchise Tax Board.

What is form 540-ES for?

This is a form for regular quarterly payments of estimated tax in 2016. It is connected to California Resident Income Tax Return, Form 540, which in turn has to be completed using the information from Federal Income Tax Return, Forms 1040, 1040A or 1040EZ.

Is it accompanied by other forms?

As it is a report of payment, it must be sent together with a check or money order to Franchise Tax Board. If filed electronically, follow the instructions at www.ftb.ca.gov.

When is form 540-ES due?

There are 4 payments of estimated tax to be made, therefore there are four due dates for making payments and submitting form 540-ES. The first payment is due on April, 18, 2016; the second — June, 15, 2016; the third — September, 15, 2015; and the fourth — January, 17, 2017.

How do I fill out a form 540-ES?

You will find four forms with due dates printed on them for every payment of estimated tax you have to make in 2016. In each form you should write your name and address, provide the same information for your spouse (if it’s a joint payment), add your initials and SSN or ITIN. In the lower right corner you must enter the correct amount of payment.

Where do I send it?

Paper copies with checks or money orders must be sent to:

Franchise Tax Board

PO Box 942867

Sacramento, CA 94267-0008.