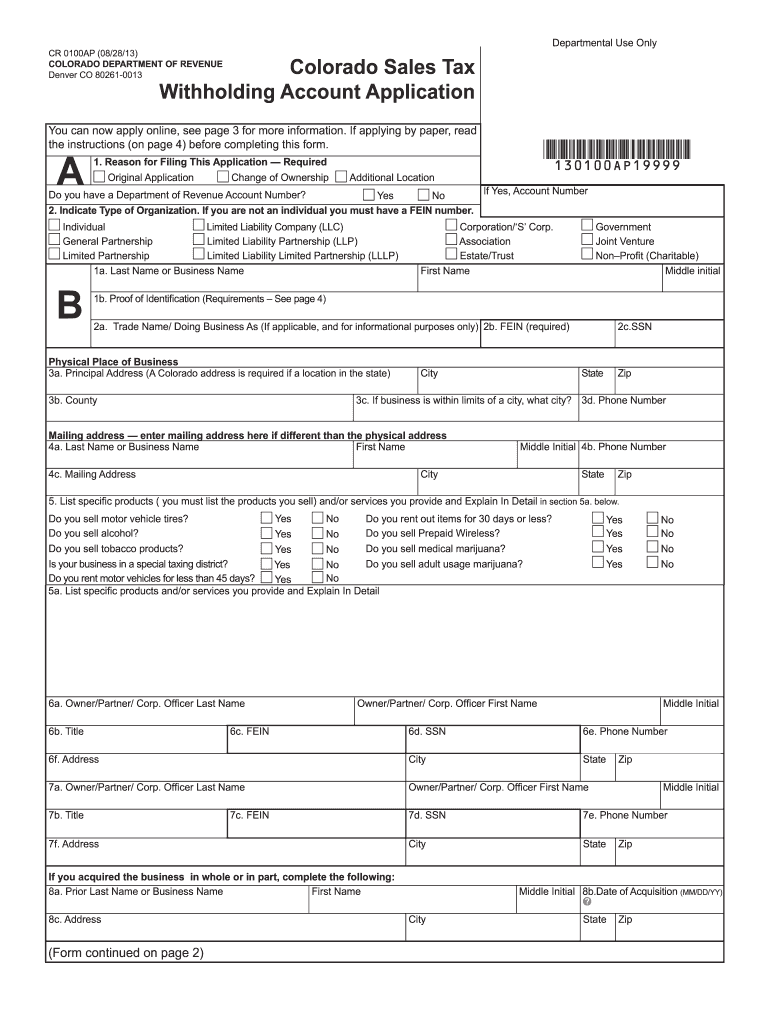

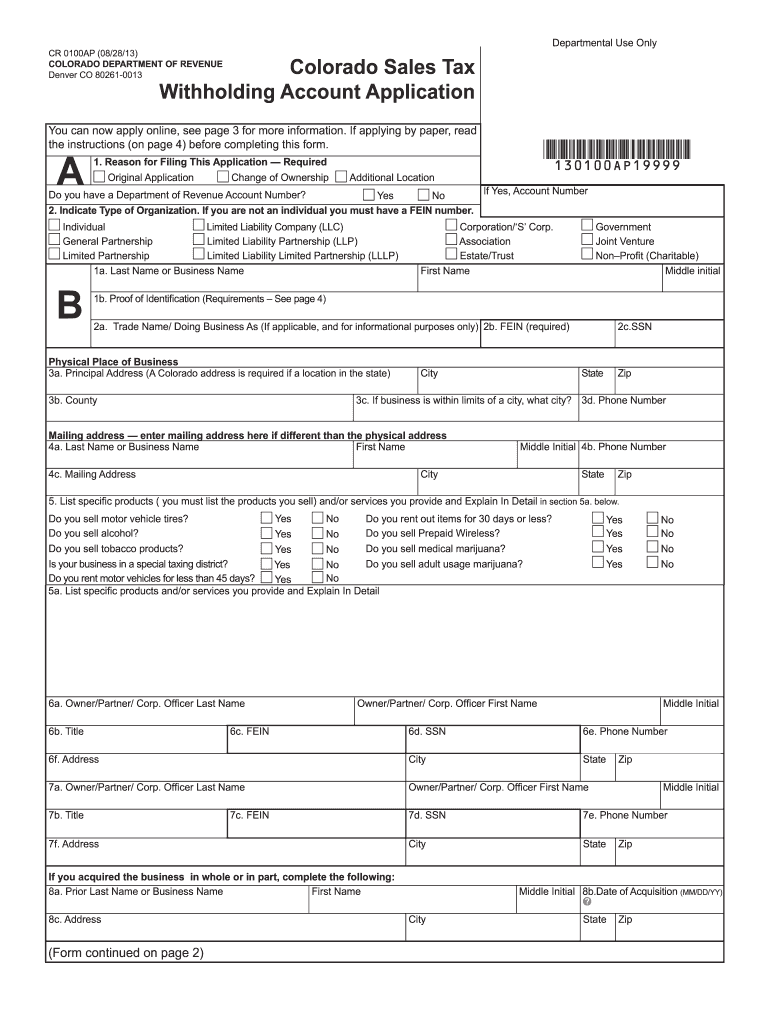

CO CR 0100AP 2013 free printable template

Show details

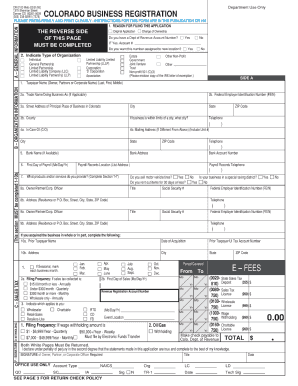

CR 0100 WEB (11/10/10) COLORADO DEPARTMENT OF REVENUE 1375 SHERMAN STREET DENVER CO 80261-0009 2. Indicate Type of Organization Individual General Partnership Limited Partnership Original Application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cr0100 2013 form

Edit your cr0100 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cr0100 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cr0100 2013 form online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cr0100 2013 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO CR 0100AP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cr0100 2013 form

How to fill out CO CR 0100AP

01

Gather all necessary personal information such as your name, address, and contact details.

02

Provide details about the case related to CO CR 0100AP, including case number and court name.

03

Clearly specify the type of request or motion you are filing.

04

State the reasons for the request or motion in a coherent manner.

05

Include any required supporting documentation or evidence.

06

Review the form for completeness and accuracy.

07

Sign and date the form as required.

08

Submit the form to the appropriate court office or tribunal.

Who needs CO CR 0100AP?

01

Individuals who are involved in legal proceedings within the jurisdiction that requires the CO CR 0100AP form.

02

Attorneys representing clients in cases that necessitate this form.

03

Parties seeking modification or specific actions in existing court cases.

Fill

form

: Try Risk Free

People Also Ask about

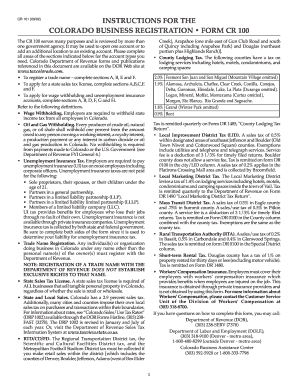

Does Colorado have a state income tax withholding form?

DR 1098. Colorado Withholding Worksheet for Employers – This worksheet prescribes the method for employers to calculate Colorado wage withholding, based on the employee's Colorado form DR 0004 or federal form W-4. Employers must begin using the updated calculation for pay periods beginning on or after January 1, 2023.

How do I find my Colorado withholding account number?

The Colorado Account Number is listed on all letters that have been sent by the Colorado Department of Revenue. The CAN is listed on the right side of the letter with the word "Account."

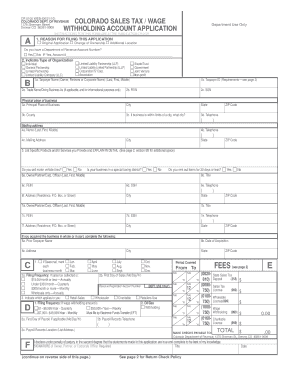

How much is a sellers permit in CO?

How much does it cost to apply for a sales tax permit in Colorado? For in-state sellers, it costs $16 to apply for a Colorado sales tax license. There's also a $50 deposit. For sellers based out-of-state who are applying for a Retailer's Use Tax License, the permit is free.

How do I close my Colorado withholding account?

All withholding tax account types may file the Business Account Closure Form (DR 1108) to close the account. Send the request to the address on the form. The DR 1108 form takes longer to process. Revenue Online closures are effective the next business day.

What is Colorado withholding when moving out of state?

Colorado 2% Withholding (DR 1083) This law affects non-Colorado residents or those parties moving out-of-state and not purchasing another primary residence. The amount, if withheld, shall be the lesser of 2% of the sales price of the property or the net proceeds.

How do I close my withholding account in District of Columbia?

Online through the Agency Website. Call: 410-260-7980 or 1-800-638-2937 Provide: Name, telephone number, Federal Employer Identification Number (FEIN), Central Registration Number (CRN), reason for closing account, and closing date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cr0100 2013 form online?

Easy online cr0100 2013 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out cr0100 2013 form using my mobile device?

Use the pdfFiller mobile app to fill out and sign cr0100 2013 form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out cr0100 2013 form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your cr0100 2013 form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is CO CR 0100AP?

CO CR 0100AP is a tax form used in Colorado for reporting various tax information to the state.

Who is required to file CO CR 0100AP?

Individuals, businesses, or other entities that meet certain criteria established by the Colorado Department of Revenue are required to file CO CR 0100AP, typically related to specific tax obligations.

How to fill out CO CR 0100AP?

To fill out CO CR 0100AP, follow the instructions provided by the Colorado Department of Revenue, which typically include providing personal or business information, tax identification numbers, and completing the designated sections accurately.

What is the purpose of CO CR 0100AP?

The purpose of CO CR 0100AP is to ensure that taxpayers report their taxable income and other relevant information to the state of Colorado for proper assessment and collection of taxes.

What information must be reported on CO CR 0100AP?

CO CR 0100AP requires reporting of personal identification information, income details, deductions, credits, and any other pertinent tax information as dictated by the Colorado Department of Revenue.

Fill out your cr0100 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

cr0100 2013 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.