Get the free EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Po...

Show details

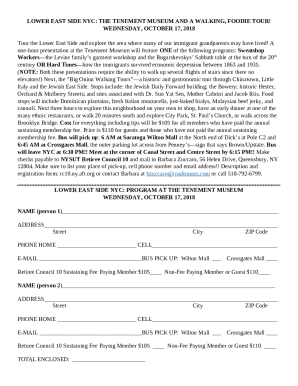

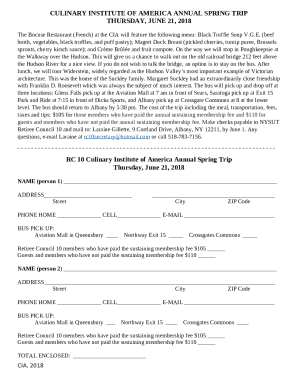

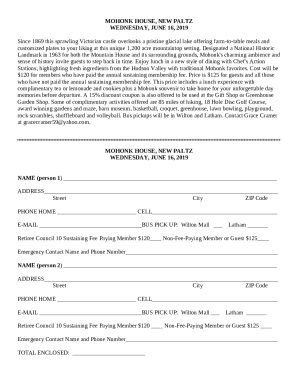

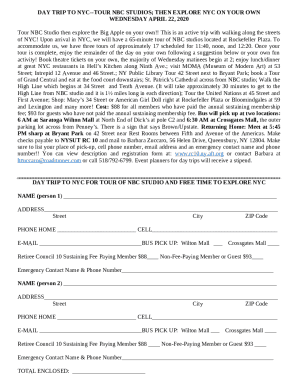

This document is required by the Export-Import Bank to certify the eligibility of exports for Ex-Im Bank support and is to be retained by financial institutions for claims purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eib 9407 exporters certificate

Edit your eib 9407 exporters certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eib 9407 exporters certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eib 9407 exporters certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit eib 9407 exporters certificate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

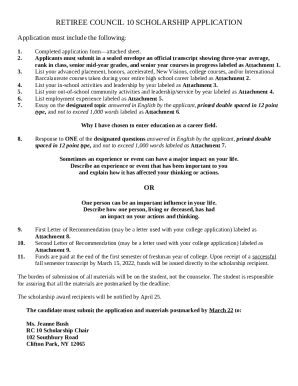

How to fill out eib 9407 exporters certificate

How to fill out EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy

01

Obtain the EIB 94–07 form from the official website or your insurance provider.

02

Fill out your company's name, address, and contact information in the designated fields.

03

Provide the exporter's registration number or tax identification number as required.

04

State the type of goods or services being exported clearly and concisely.

05

Indicate the destination country where the goods or services will be exported.

06

Specify the value of the export transaction.

07

Review the terms and conditions of the short term export credit insurance policy and confirm compliance.

08

Sign the form where indicated to certify that the information provided is accurate.

09

Submit the completed form to your insurance provider along with any additional documentation requested.

Who needs EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

01

Exporters who are seeking insurance coverage for short term credit risk related to international sales.

02

Companies that are engaging in export activities and require protection against buyer default.

03

Businesses looking to facilitate financing for export transactions through insurance policies.

Fill

form

: Try Risk Free

People Also Ask about

What is an export credit insurance policy?

Export credit insurance protects a seller from the risk of nonpayment by a foreign buyer. The insurance usually covers commercial risks such as buyer insolvency, bankruptcy, or default.

What does export credit insurance cover?

ECI generally covers commercial risks (such as insolvency of the buyer, bankruptcy, or protracted defaults/slow payment) and certain political risks (such as war, terrorism, riots, and revolution) that could result in non-payment.

How much is export credit insurance?

Most export credit insurance firms will calculate the cost of export insurance based on a percentage of turnover combined with the level of risk. At Atradius the cost of export credit insurance is typically 0.5% of turnover depending on the risk profile and the spread of risk.

How much does export credit insurance cost?

A: Depending on an exporter's needs and risk exposure, costs may vary from $0.55 to $1.77 per every $100 of invoice value [1]. Our most popular product Express Insurance, for example, allows the exporter to pay $0.65 per every $100 of invoice value for credit terms up to 60 days.

Who provides export credit insurance?

ECI policies are offered by many private commercial risk insurance companies as well as the Export-Import Bank of the United States (EXIM), the government agency that assists in financing the export of U.S. goods and services to international markets.

What is export credit guarantee?

a type of insurance, often given by a government organization, that protects an export company from loss if a foreign buyer does not pay for goods. (Definition of export credit guarantee from the Cambridge Business English Dictionary © Cambridge University Press)

How is trade credit insurance priced?

If you have customers in multiple industries or countries, trade credit insurance companies will rate your risk of bad debt as higher, and the cost of a policy will be higher. You can generally expect to pay about ¼ of a cent on every dollar of your total sales for trade credit insurance coverage.

How much does credit risk insurance cost?

The cost of your credit insurance policy is calculated as a percentage of your turnover, combined with the level of risk in your portfolio. The greater the risk, the higher the premium. Credit insurance typically costs between 0.1% and 0.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

EIB 94–07 is a certificate that exporters must submit to document their intent to use a short-term export credit insurance policy, which protects them from risks associated with international sales.

Who is required to file EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

Exporters who are seeking to obtain short-term export credit insurance and wish to insure their export transactions are required to file EIB 94–07.

How to fill out EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

To fill out EIB 94–07, exporters must provide detailed information regarding their business, goods being exported, the destination country, and the insurance coverage being requested. All sections must be completed accurately to ensure compliance.

What is the purpose of EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

The purpose of EIB 94–07 is to facilitate the underwriting process for export credit insurance by providing detailed information about the exporter and the transaction, ensuring that the risks associated with exporting are adequately assessed.

What information must be reported on EIB 94–07 Exporters Certificate for Use with a Short Term Export Credit Insurance Policy?

Exporters must report their business name, address, the nature of the goods, terms of sale, and details about the buyer, including their creditworthiness and the destination of the shipment on EIB 94–07.

Fill out your eib 9407 exporters certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eib 9407 Exporters Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.