CT W-1QMB 2010 free printable template

Show details

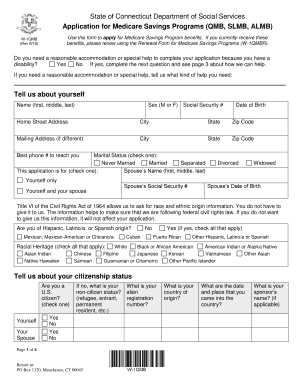

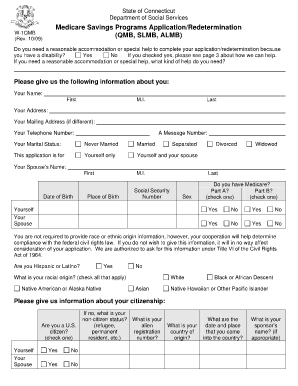

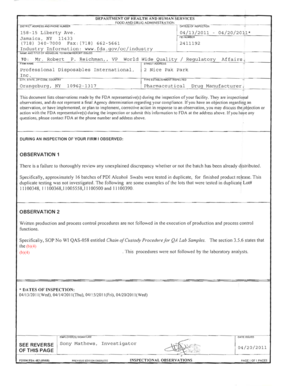

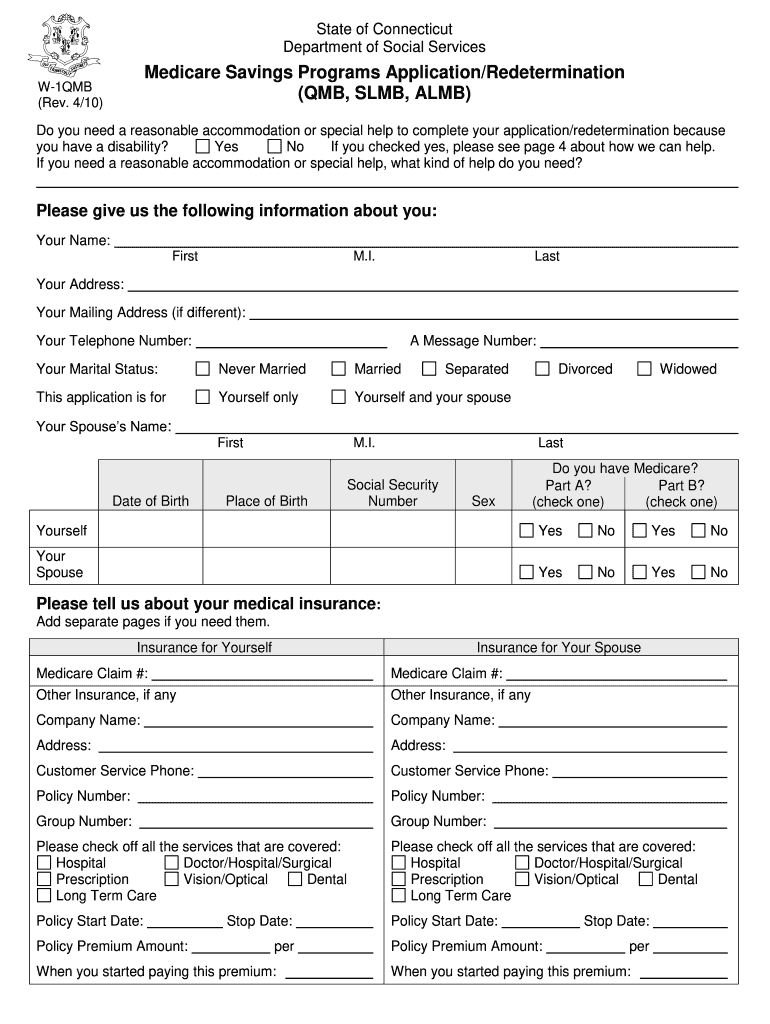

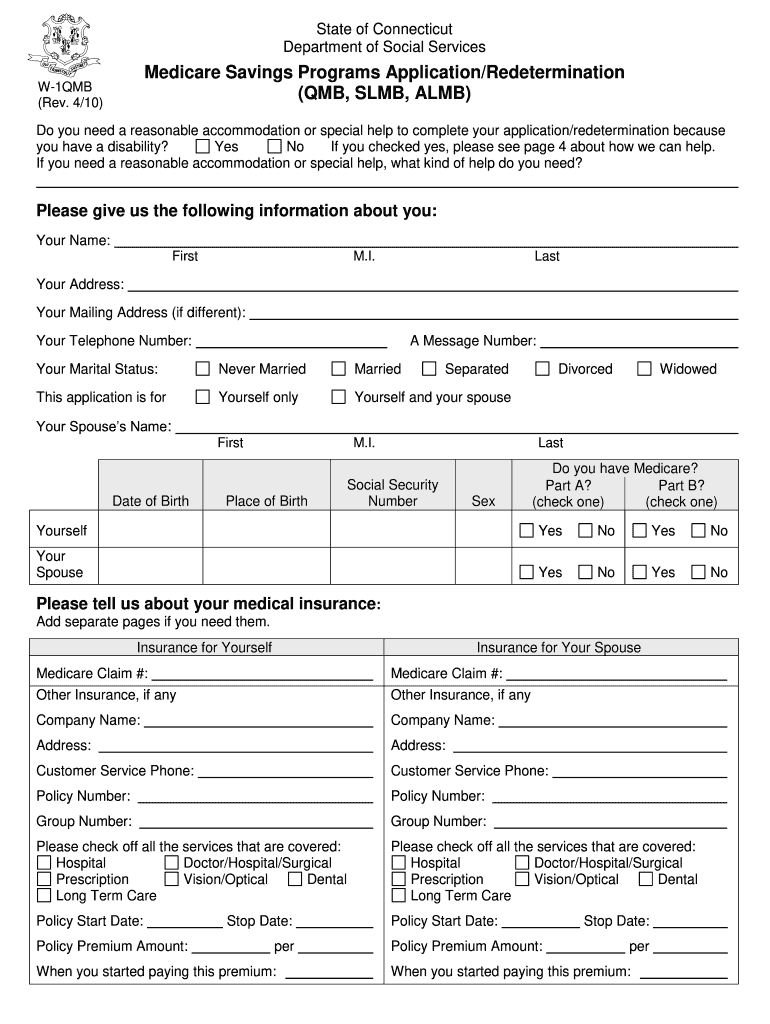

State of Connecticut Department of Social Services W-1QMB (Rev. 4/10) Medicare Savings Programs Application/Redetermination (CMB, SLAB, ALMA) Do you need a reasonable accommodation or special help

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT W-1QMB

Edit your CT W-1QMB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT W-1QMB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT W-1QMB online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT W-1QMB. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT W-1QMB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT W-1QMB

How to fill out CT W-1QMB

01

Start by downloading the CT W-1QMB form from the official website or obtaining a physical copy.

02

Fill in your personal information in the designated sections, including your name, address, and date of birth.

03

Provide details about your income, including the sources and amounts.

04

Specify your household size, including the number of people who live with you and their relationship to you.

05

Review the eligibility criteria and check the box if you meet them.

06

Sign and date the form at the bottom.

Who needs CT W-1QMB?

01

Individuals or couples who are eligible for Medicare and need financial assistance.

02

People who meet specific income guidelines set by the state of Connecticut.

Fill

form

: Try Risk Free

People Also Ask about

Does Social Security count as income for QMB?

Does Social Security count as income for QMB? Yes, Social Security is considered income. If your monthly Social Security check exceeds $1,235 a month for an individual, you will not qualify for the Qualified Medicare Beneficiary (QMB) program in most states.

What is the QMB limit in CT?

Qualified Medicare Beneficiary (QMB): The income limit for QMB is $2,245.04 a month if single and $3,032.07 a month if married. QMB pays for Part A and B cost sharing and Part B premiums. If a beneficiary is required to pay Part A premiums, QMB pays for them, too.

What is the QMB program in Connecticut?

The QMB program works with both Medicare and a Medicare Advantage plans. It will pay the deductibles and co-pays of Medicare Part A and B up to the Medicaid approved rate.

What is the QMB limit in CT 2023?

QMB – this level of extra help pays your Part B premium, all Medicare deductibles and co-insurance. Income levels for QMB are as follows: Individual, $2,390 of gross income per month, couples, $3,220 per month.

What are the income limits for Medicare 2023?

In 2023, your costs for Medicare Parts B and D are based on income reported on your 2021 tax return. You won't pay any extra for Part B or Part D if you earned $97,000 or less as an individual or $194,000 or less if you are a joint filer.

What is the income limit for QMB in CT?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CT W-1QMB?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific CT W-1QMB and other forms. Find the template you need and change it using powerful tools.

Can I sign the CT W-1QMB electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit CT W-1QMB on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share CT W-1QMB on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is CT W-1QMB?

CT W-1QMB is a tax form used in Connecticut that is specifically designed for the reporting of certain withholding tax information for businesses and employers.

Who is required to file CT W-1QMB?

Employers who are required to withhold Connecticut income tax from their employees or payees must file CT W-1QMB.

How to fill out CT W-1QMB?

CT W-1QMB should be filled out by entering the necessary identification information, detailing the amount of Connecticut income tax withheld, and providing the total payments made to employees and other payees.

What is the purpose of CT W-1QMB?

The purpose of CT W-1QMB is to report the amount of Connecticut income tax withheld from payments to employees or payees, ensuring proper compliance with state tax laws.

What information must be reported on CT W-1QMB?

CT W-1QMB requires reporting of the employer's identification information, total wages paid, amount of state income tax withheld, and details regarding the employees or payees.

Fill out your CT W-1QMB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT W-1qmb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.