CT DRS APL-002 2008 free printable template

Show details

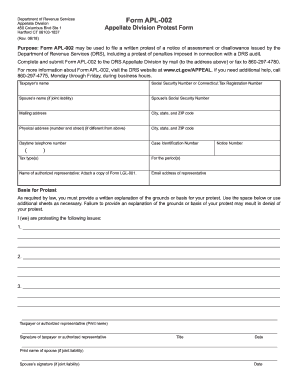

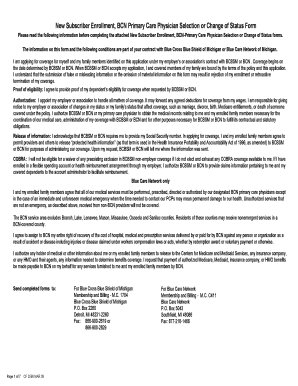

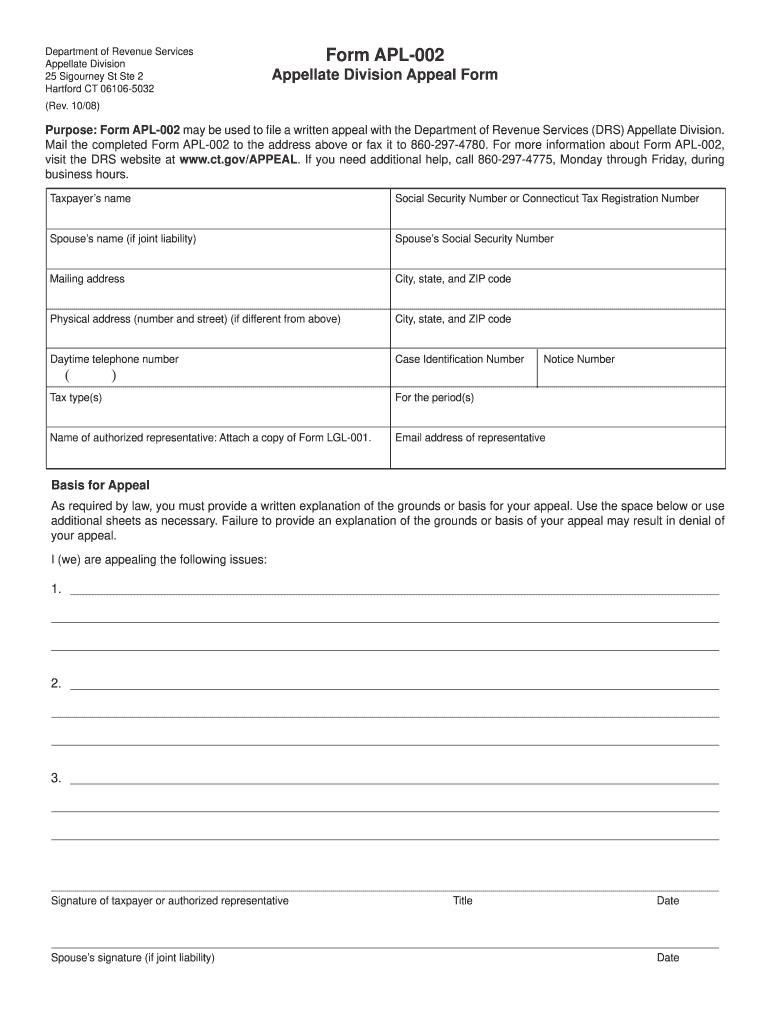

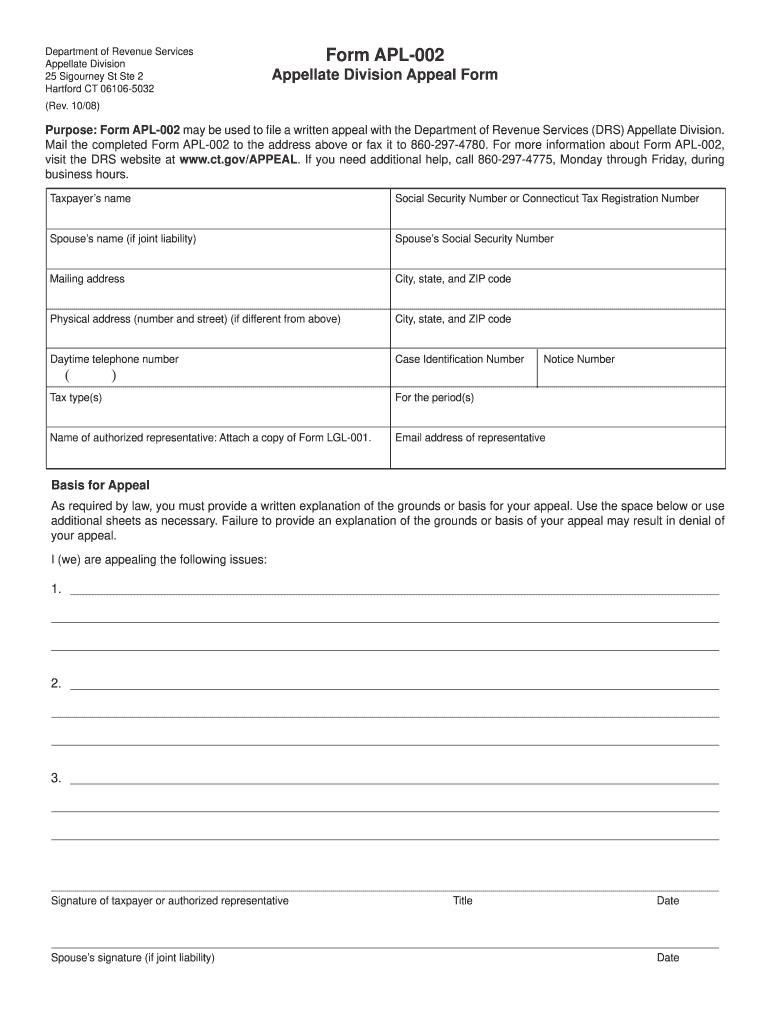

Department of Revenue Services Appellate Division 25 Sigourney St Ste 2 Hartford CT 06106-5032 Form APL-002 Rev. 10/08 Purpose Form APL-002 may be used to le a written appeal with the Department of Revenue Services DRS Appellate Division. Mail the completed Form APL-002 to the address above or fax it to 860-297-4780. For more information about Form APL-002 visit the DRS website at www. ct. gov/APPEAL. If you need additional help call 860-297-4775 Monday through Friday during business hours....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS APL-002

Edit your CT DRS APL-002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS APL-002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS APL-002 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT DRS APL-002. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS APL-002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS APL-002

How to fill out CT DRS APL-002

01

Obtain the CT DRS APL-002 form from the Connecticut Department of Revenue Services website.

02

Carefully read the instructions included with the form to understand the requirements.

03

Fill in the applicant's name in the appropriate field.

04

Provide the applicant's Connecticut address where required.

05

Include any relevant identification numbers, such as Social Security Number or Employer Identification Number.

06

Indicate the specific type of request or exemption being applied for in the designated section.

07

Attach any supporting documents that verify eligibility for the exemption or request.

08

Review the completed form for any errors or omissions.

09

Submit the form by mailing it to the designated address on the instructions.

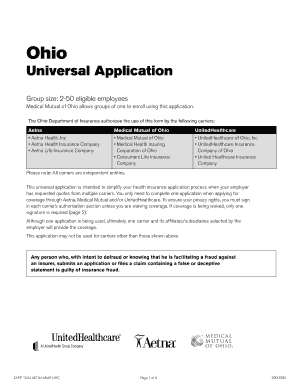

Who needs CT DRS APL-002?

01

Individuals or businesses in Connecticut who are applying for certain tax exemptions or special programs.

02

Tax professionals or accountants assisting clients with tax-related applications.

03

Property owners seeking tax relief or adjustments based on eligibility requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the CT-8822 form?

Use Form CT-8822 to notify the Connecticut Department of Revenue Services (DRS) that you changed your home or business mailing address, or the physical location of your business.

How do I appeal a court decision in CT?

In most (but not all) cases, you must file the appeal within 20 days of the date notice of the judgment or decision is issued by the trial judge or clerk. If notice of the judgment or decision is given orally by the trial judge in open court, the 20 day appeal period begins on that day.

What is the timely filing limit for Medicaid appeal in CT?

The filing deadline is 60 days from the date of service for outpatient claims or 60 days from the date of hospital discharge for inpatient or institutional claims.

Can you appeal a decision you won?

The defendant may appeal a guilty verdict, but the government may not appeal if a defendant is found not guilty. Either side in a criminal case may appeal with respect to the sentence that is imposed after a guilty verdict.

How do I appeal a pistol permit in CT?

If you had been denied a permit and the Board Members vote in your favor, you will need to contact your local police department or First Selectman's office. If you feel you haven't been treated fairly by the Board, you may appeal to Superior court. Refer to Connecticut General Statute 4-183, Appeals to Superior Court.

What are the 3 ways a Court of Appeals may decide an appeal?

In each Court of Appeal, a panel of three judges, called "justices," decides appeals from Superior Courts. The Courts of Appeal can agree with the decision of the Trial Court, agree in part and disagree in part, or disagree and reverse the Trial judge's decision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT DRS APL-002 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing CT DRS APL-002.

Can I edit CT DRS APL-002 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign CT DRS APL-002. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out CT DRS APL-002 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your CT DRS APL-002 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is CT DRS APL-002?

CT DRS APL-002 is a form used by the Connecticut Department of Revenue Services for specific tax-related purposes, often pertaining to tax credits or adjustments.

Who is required to file CT DRS APL-002?

Individuals or businesses in Connecticut who are claiming certain tax credits or adjustments as specified by the state tax regulations are required to file CT DRS APL-002.

How to fill out CT DRS APL-002?

To fill out CT DRS APL-002, provide all requested personal and business information, calculate the applicable credits or adjustments accurately, and ensure all necessary supporting documentation is attached before submitting the form.

What is the purpose of CT DRS APL-002?

The purpose of CT DRS APL-002 is to provide the Connecticut Department of Revenue Services with the necessary information to process and verify tax credit claims or adjustments made by taxpayers.

What information must be reported on CT DRS APL-002?

CT DRS APL-002 must report taxpayer identification information, the type of tax credits or adjustments being claimed, amounts, and any relevant supporting documentation that substantiates the claims.

Fill out your CT DRS APL-002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS APL-002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.