Get the free NCUA Form 4501A – Credit Union Profile - ncua

Show details

This document outlines the changes made to the NCUA Form 4501A, which includes new questions for credit unions regarding employee counts, EEO-1 Survey reporting, and diversity policies as of December

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ncua form 4501a credit

Edit your ncua form 4501a credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ncua form 4501a credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ncua form 4501a credit online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ncua form 4501a credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

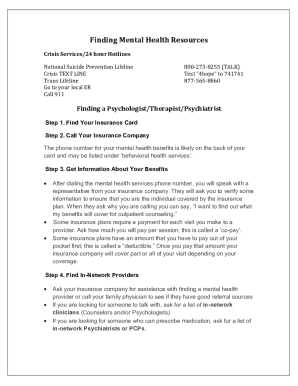

How to fill out ncua form 4501a credit

How to fill out NCUA Form 4501A – Credit Union Profile

01

Begin by downloading NCUA Form 4501A from the NCUA website.

02

Fill out the credit union's name and charter number at the top of the form.

03

Provide the address and contact information of the credit union.

04

Complete the section detailing the credit union’s organizational structure, including the number of members and assets.

05

Indicate the type of services offered by the credit union.

06

Review the section on governance and regulatory compliance.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs NCUA Form 4501A – Credit Union Profile?

01

All federally insured credit unions are required to complete NCUA Form 4501A.

02

Newly chartered credit unions need this form to establish their profile.

03

Credit unions must update this form periodically to reflect any changes in operations or structure.

Fill

form

: Try Risk Free

People Also Ask about

Can banks seize your money if the economy fails?

Banking regulation has changed over the last 100 years to provide more protection to consumers. You can keep money in a bank account during a recession and it will be safe through FDIC and NCUA deposit insurance. Up to $250,000 is secure in individual bank accounts and $500,000 is safe in joint bank accounts.

Will you lose your money if a bank or credit union is robbed or collapses?

FDIC insurance protects customers in the event of a bank failure, not a robbery. Deposits are insured by the FDIC for up to $250,000 per depositor, per insured bank for each account type if your bank goes out of business.

Are credit unions safe from financial crisis?

Credit unions and banks are both insured, with most banks being insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per customer. Most credit unions are similarly insured by the National Credit Union Administration (NCUA) for up to $250,000.

Can credit unions seize your money if the economy fails?

Both the NCUA and FDIC are responsible for insuring funds in the event that a financial institution fails. But are credit unions FDIC insured? Credit unions aren't insured by the FDIC because they are insured by the NCUA. Insures checking, savings, and money market accounts, CDs and IRAs.

Is my money safe in a credit union right now?

If yours does — California Credit Union, Members 1st Credit Union, SchoolsFirst Federal Credit Union, Teachers Federal Credit Union and Schools Federal Credit Union all do — your deposit is as safe at your credit union as it would be at a big bank.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NCUA Form 4501A – Credit Union Profile?

NCUA Form 4501A – Credit Union Profile is a document used by credit unions to provide the National Credit Union Administration (NCUA) with specific information about their operations, management, and financial status.

Who is required to file NCUA Form 4501A – Credit Union Profile?

All federally insured credit unions are required to file NCUA Form 4501A annually to ensure compliance with federal regulations.

How to fill out NCUA Form 4501A – Credit Union Profile?

To fill out NCUA Form 4501A, credit unions should gather relevant financial and operational information, follow the instructions provided on the form carefully, and ensure that all required sections are completed accurately before submitting it to the NCUA.

What is the purpose of NCUA Form 4501A – Credit Union Profile?

The purpose of NCUA Form 4501A is to collect important data from credit unions to assess their performance, monitor the industry, and ensure compliance with regulatory standards.

What information must be reported on NCUA Form 4501A – Credit Union Profile?

NCUA Form 4501A requires information such as the credit union's financial performance metrics, management structure, membership details, and other operational data necessary for regulatory review.

Fill out your ncua form 4501a credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ncua Form 4501a Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.