Get the free Consortium Short Term Advance Application and Promissory Note - fau

Show details

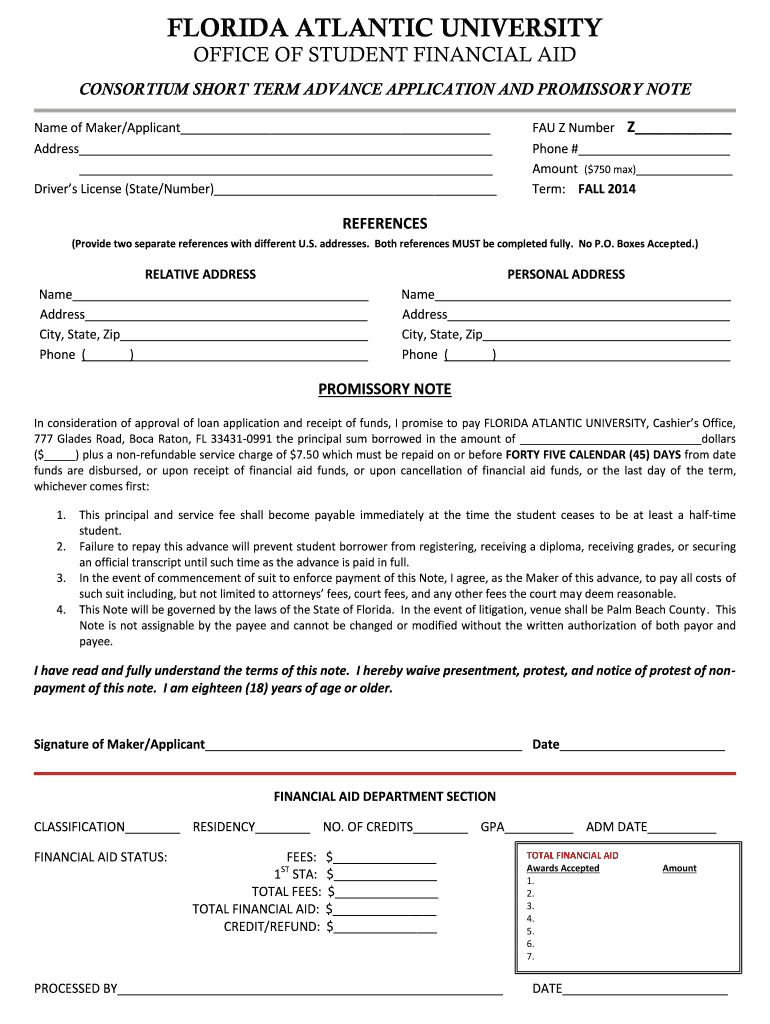

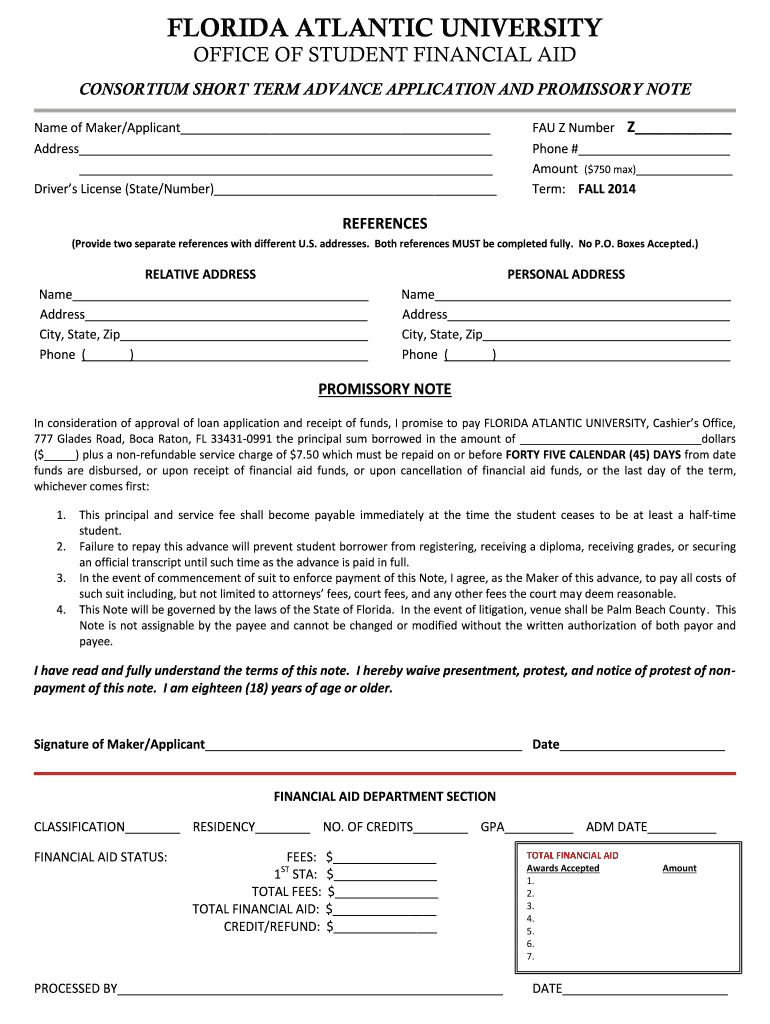

This document serves as an application for a short term cash advance for Florida Atlantic University students to help cover education expenses prior to the disbursement of financial aid funds. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consortium short term advance

Edit your consortium short term advance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consortium short term advance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consortium short term advance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consortium short term advance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consortium short term advance

How to fill out Consortium Short Term Advance Application and Promissory Note

01

Obtain the Consortium Short Term Advance Application and Promissory Note form from the designated source.

02

Fill out your personal information in the designated fields, including name, address, and contact information.

03

Provide details about your academic program, including the name of the institution and your enrollment status.

04

Specify the amount of the advance you are requesting and explain the purpose for which the funds will be used.

05

Review the terms and conditions outlined in the document and ensure you understand your obligations.

06

Sign and date the application and promissory note where required.

07

Submit the completed application and promissory note to the appropriate office or individual as instructed.

Who needs Consortium Short Term Advance Application and Promissory Note?

01

Students who are facing temporary financial difficulties and need immediate funds to cover educational expenses.

02

Individuals enrolled in programs that are affiliated with a consortium of educational institutions.

Fill

form

: Try Risk Free

People Also Ask about

What is the disadvantage of a promissory note?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

Will a promissory note hold up in court?

Some possible disadvantages are: You will likely pay a higher interest rate than for a secured loan. If you are using a promissory note because you don't have a good credit rating, you will likely pay a higher interest rate than if you obtained a commercial business loan from a bank or other institution.

What is an application promissory note?

Updated Dec 18, 2024. Summary•6 min read. A promissory note is a written agreement between a borrower and a lender saying that the borrower will pay back the amount borrowed plus interest. The promissory note is issued by the lender and is signed by the borrower (but not the lender).

What is a short term promissory note?

A promissory note is recorded as a liability. Depending on the terms of repayment, the promissory note could be listed on a balance sheet as a: short-term liability if the note is payable in full within 12 months. long-term liability if the full amount of the note is repayable in more than 12 months.

What is a short note on promissory?

A promissory note is a written promise by one party to make a payment of money at a date in the future. Although potentially issued by financial institutions, other organizations or individuals can use promissory notes to confirm the agreed terms of a loan. In short, a promissory note allows anyone to act as a lender.

How do you fill out a promissory note in English?

A comprehensive promissory note typically includes: Names and contact information of the parties involved. Loan amount. Repayment terms. Interest rate (if applicable) Consequences of default (in case payments are missed) Governing law. Signatures of the borrower and lender.

What is a short term advance FAU?

The Short Term Advance Program assists students in meeting unanticipated educational expenses (i.e. purchasing textbooks) incurred prior to the date financial aid funds are scheduled to disburse. A student may not have more than one (1) Short Term Advance per semester.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consortium Short Term Advance Application and Promissory Note?

The Consortium Short Term Advance Application and Promissory Note is a financial document used by consortiums to request and formalize short-term funding, typically needed to cover immediate expenses or investments.

Who is required to file Consortium Short Term Advance Application and Promissory Note?

Members of the consortium that seek short-term funding for their projects or shared initiatives are required to file the Consortium Short Term Advance Application and Promissory Note.

How to fill out Consortium Short Term Advance Application and Promissory Note?

To fill out the application and promissory note, members must provide specific details such as the amount of the advance requested, the purpose of the funding, repayment terms, and signature acknowledgments from all involved parties.

What is the purpose of Consortium Short Term Advance Application and Promissory Note?

The purpose of the Consortium Short Term Advance Application and Promissory Note is to outline the terms and conditions under which the financial advance is being requested, and to create a legal obligation for repayment.

What information must be reported on Consortium Short Term Advance Application and Promissory Note?

The application and promissory note must report information such as the consortium’s name, the amount of the advance, the intended use of funds, repayment schedule, interest rate if applicable, and the signatures of authorized representatives.

Fill out your consortium short term advance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consortium Short Term Advance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.