Get the free The Credit Union Connection - Loans - ncua

Show details

This document provides an overview of various loan programs offered by multiple credit unions, detailing options for personal loans, agricultural loans, and business loans among others.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form credit union connection

Edit your form credit union connection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form credit union connection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form credit union connection online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form credit union connection. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

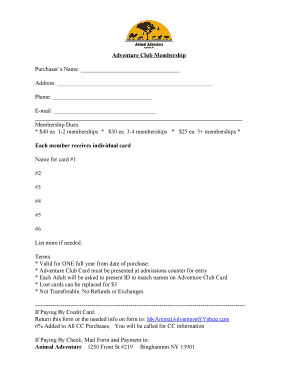

How to fill out form credit union connection

How to fill out The Credit Union Connection - Loans

01

Gather your personal information: Name, address, social security number, and employment details.

02

Prepare your financial information: Income, monthly expenses, and any existing debts.

03

Choose the type of loan you need: Personal loan, auto loan, mortgage, etc.

04

Fill out the application form accurately with all required details.

05

Submit any additional documents requested by the credit union.

06

Review your application for accuracy before final submission.

07

Wait for the credit union to process your application and provide a response.

Who needs The Credit Union Connection - Loans?

01

Individuals looking for a personal loan.

02

People needing financing for a vehicle purchase.

03

Homebuyers seeking mortgage options.

04

Members of the credit union who require financial assistance.

05

Anyone with a specific financial project or need that requires a loan.

Fill

form

: Try Risk Free

People Also Ask about

What credit score is needed to get a loan from a credit union?

Best for easy access PenFed offers low-rate personal loans with no origination fees that can be used for a wide range of purposes, including debt consolidation, credit card refinancing, home improvements, medical expenses, family planning, weddings, and vacations.

What is the easiest credit union to get approved for?

Eligibility requirements for personal loans from credit unions are less strict than a bank's criteria. In particular, a low credit score may not disqualify you from a loan with a credit union because a credit union is more likely to take into account your overall financial circumstances.

Is it hard to get a loan from a credit union?

Depending on the loan type and amount, you could have a decision within days or a few weeks. If your application is denied, ask your credit union loan officer for advice on improving your chances for next time, and work toward further building your credit before applying again.

Which credit union is the easiest to get a loan?

Eligibility requirements for personal loans from credit unions are less strict than a bank's criteria. In particular, a low credit score may not disqualify you from a loan with a credit union because a credit union is more likely to take into account your overall financial circumstances.

What is the minimum credit score for a credit union loan?

Online lenders, community banks and credit unions all offer bad credit loans and work with borrowers across the credit spectrum. That said, you should try your best to avoid certain types of bad credit loans, such as payday and car title loans, because they come with sky-high annual percentage rates (APRs) and fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The Credit Union Connection - Loans?

The Credit Union Connection - Loans is a platform or reporting system designed to facilitate communication and transparency regarding loan activities associated with credit unions.

Who is required to file The Credit Union Connection - Loans?

Credit unions that issue loans are typically required to file The Credit Union Connection - Loans to ensure compliance with regulatory requirements and provide relevant data on their lending activities.

How to fill out The Credit Union Connection - Loans?

To fill out The Credit Union Connection - Loans, credit unions should gather all necessary information related to their loan products, including borrower details, loan amounts, interest rates, and terms, and then input this information into the designated sections of the reporting form.

What is the purpose of The Credit Union Connection - Loans?

The purpose of The Credit Union Connection - Loans is to promote transparency and accountability in lending practices, ensure compliance with regulations, and provide regulators and the public with insights into the lending activities of credit unions.

What information must be reported on The Credit Union Connection - Loans?

The information that must be reported includes borrower identity, loan amounts, interest rates, loan terms, repayment schedules, and any relevant details about loan products offered by the credit union.

Fill out your form credit union connection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Credit Union Connection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.