DE SCT-RTN (Formerly 1100S) 2010 free printable template

Show details

Total Net Income from Delaware Form 1100S Schedule A Column B Line 19 c Total. Add Lines 2 a and 2 b 3. Shareholder s portion of ordinary income loss from Resident Non-Resident from Delaware Form 1100S Schedule A Line 9 STATE MODIFICATIONS 18. Enter in Column B the non-resident shareholder s percentage ownership of those items of income and deduction from Delaware Form 1100S Schedule A Column B. Net interest from U.S. Securities 19. Wage deductio...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE SCT-RTN Formerly 1100S

Edit your DE SCT-RTN Formerly 1100S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE SCT-RTN Formerly 1100S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE SCT-RTN Formerly 1100S online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DE SCT-RTN Formerly 1100S. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE SCT-RTN (Formerly 1100S) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE SCT-RTN Formerly 1100S

How to fill out DE SCT-RTN (Formerly 1100S)

01

Gather necessary information including your employer's name and tax identification number.

02

Complete the top portion of the form with your personal information, including your name, address, and Social Security number.

03

Enter the details of your income, deductions, and credits in the respective sections.

04

Review your calculations for accuracy and ensure all required fields are filled out.

05

Sign and date the form at the bottom.

06

Submit the form to the appropriate tax authority by the specified deadline.

Who needs DE SCT-RTN (Formerly 1100S)?

01

Individuals who have income from self-employment or other non-wage sources.

02

Taxpayers who are required to report certain tax credits or deductions.

03

Those needing to claim a refund on overpaid state taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a Delaware tax return?

File a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

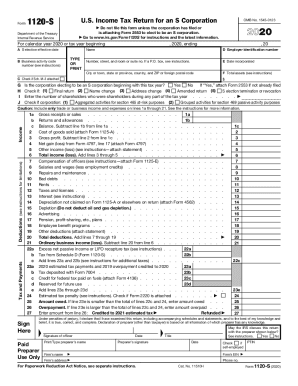

What is form 1100S 2022?

Delaware Form 1100S and its schedules is an information return used to reconcile Federal ordinary income to Delaware distributive income and to pay any additional tax due on behalf of non-resident shareholders for the calendar year 2022 or fiscal year beginning in 2022 and ending in 2023.

Who must file a Delaware corporate tax return?

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

Can I file 1120s online?

More In Tax Pros Providers and Large Taxpayers authorized to participate in the Internal Revenue Service e-file program can file Forms 1120 (U.S. Corporation Income Tax Return), 1120-F (U.S. Income Tax Return of a Foreign Corporation), and 1120-S (U.S. Income Tax Return for an S Corporation) through Modernized e-File.

What is the Delaware tax rate for 2022?

Delaware has a graduated tax rate ranging from 2.2% to 5.55% on income under $60,000. The maximum income tax rate is 6.60% on income of $60,000 or over.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my DE SCT-RTN Formerly 1100S in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign DE SCT-RTN Formerly 1100S and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in DE SCT-RTN Formerly 1100S?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your DE SCT-RTN Formerly 1100S to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out DE SCT-RTN Formerly 1100S using my mobile device?

Use the pdfFiller mobile app to fill out and sign DE SCT-RTN Formerly 1100S. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is DE SCT-RTN (Formerly 1100S)?

DE SCT-RTN, formerly known as 1100S, is a form used in Delaware for reporting the income and activities of S corporations.

Who is required to file DE SCT-RTN (Formerly 1100S)?

S corporations that conduct business in Delaware are required to file the DE SCT-RTN form.

How to fill out DE SCT-RTN (Formerly 1100S)?

To fill out DE SCT-RTN, follow the instructions provided on the form, including entering your federal S corporation tax return information, income, deductions, and any special credits.

What is the purpose of DE SCT-RTN (Formerly 1100S)?

The purpose of DE SCT-RTN is to report the taxable income of S corporations in Delaware and ensure compliance with state tax laws.

What information must be reported on DE SCT-RTN (Formerly 1100S)?

The information reported on DE SCT-RTN includes the corporation's federal tax identification number, gross income, federal taxable income, deduction details, and shareholder information.

Fill out your DE SCT-RTN Formerly 1100S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE SCT-RTN Formerly 1100s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.