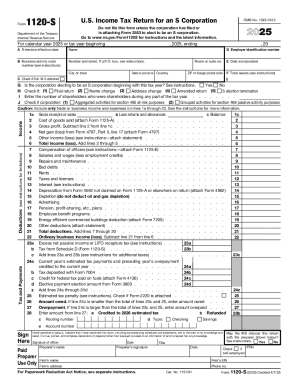

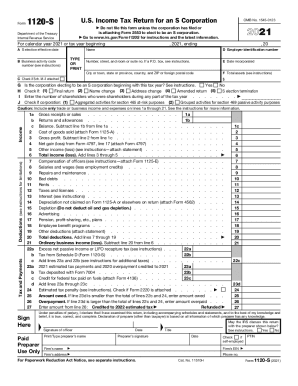

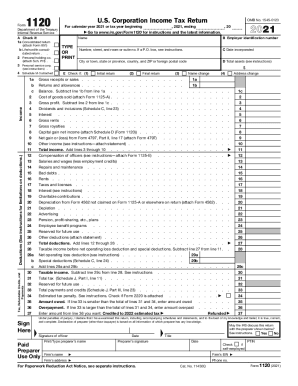

IRS 1120S 2020 free printable template

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

About IRS 1120S 2020 previous version

What is IRS 1120S?

Who needs the form?

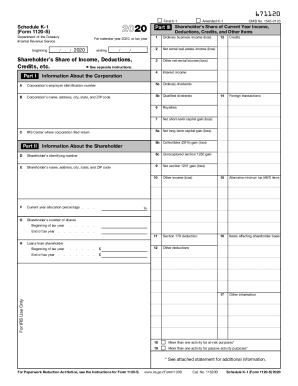

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120S

How can I correct mistakes on my IRS 1120S after filing?

To correct mistakes on your IRS 1120S after filing, you need to submit an amended return using Form 1120S-X. This form allows you to correct any errors such as misreported income or deductions. Ensure that you follow the guidelines provided by the IRS to avoid further issues and keep a copy for your records.

What should I do if I receive a notice from the IRS regarding my 1120S?

If you receive a notice from the IRS regarding your IRS 1120S, read the notice carefully to understand the issue. It may require a response or additional documentation. Prepare your supporting materials and contact the IRS or a tax professional if you need assistance with your response.

How can I verify the status of my filed IRS 1120S?

You can verify the status of your filed IRS 1120S by checking the IRS 'Where’s My Refund?' tool if you expect a refund, or by contacting the IRS directly if you need information on the processing of your return. Familiarize yourself with common e-file rejection codes to troubleshoot any potential issues.

What are common errors to avoid when filing IRS 1120S?

Common errors when filing the IRS 1120S include incorrect EIN, mismatched names and addresses, and math errors. Thoroughly review your return before submission and consider e-filing, which often helps catch mistakes automatically. Ensuring accuracy can prevent delays in processing and potential penalties.

Are there any specific technical requirements for e-filing the IRS 1120S?

Yes, there are specific technical requirements for e-filing the IRS 1120S. Ensure that you use compatible software that meets IRS standards, and check your internet connection and browser settings. Being aware of these requirements before you start will make the e-filing process smoother.

See what our users say