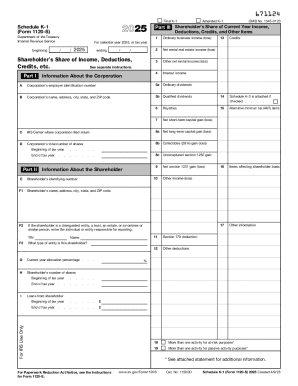

IRS 1120S - Schedule K-1 2020 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

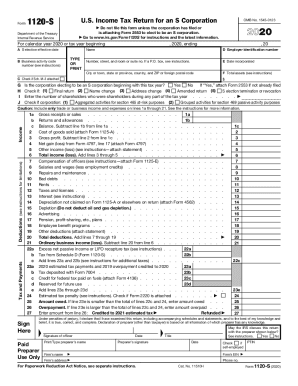

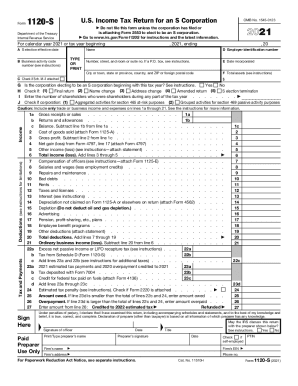

About IRS 1120S - Schedule K-1 2020 previous version

What is IRS 1120S - Schedule K-1?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

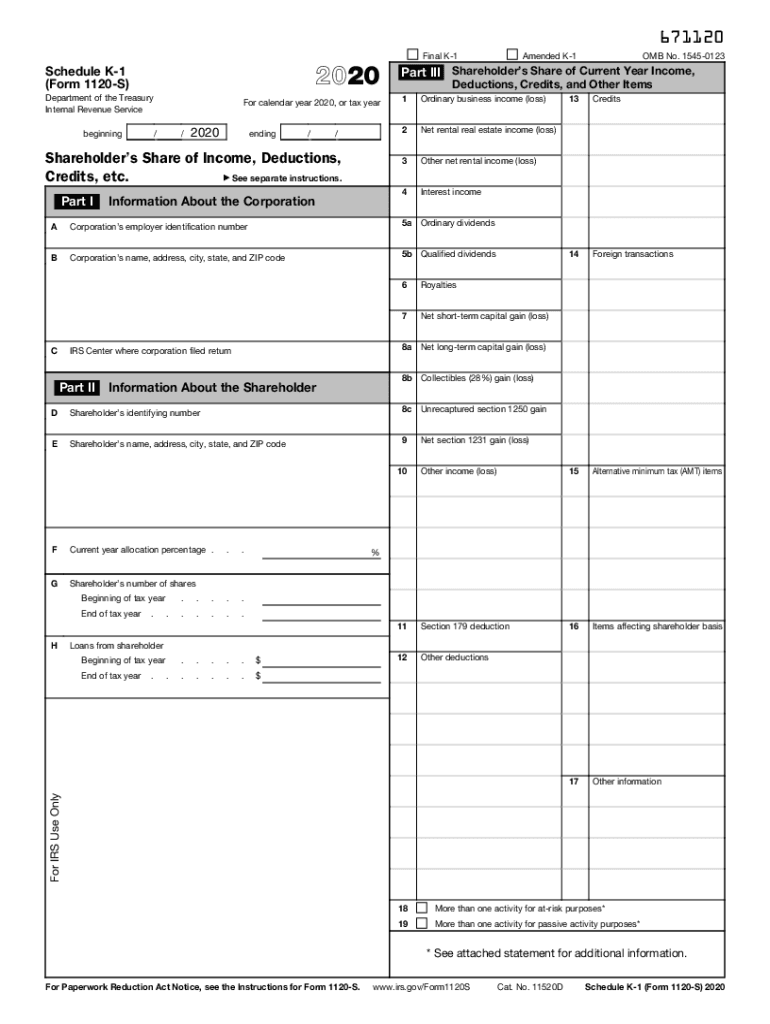

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I find an error on my IRS 1120S - Schedule K-1 after filing?

If you discover an error on your IRS 1120S - Schedule K-1 after submission, you will need to file a corrected version of the form. This may involve preparing a new Schedule K-1 that accurately reflects the correct information and submitting it alongside your amended tax return, if applicable. It's crucial to keep records of both the original and corrected documents for your records.

How can I verify if my IRS 1120S - Schedule K-1 has been processed by the IRS?

To verify the processing status of your IRS 1120S - Schedule K-1, you can use the IRS's online tools, such as their 'Where's My Refund?' application, if you filed for a refund. Additionally, you may consider calling the IRS directly to inquire about the status. Be prepared to provide relevant details, including your identification information and filing year.

Are there any common mistakes I should watch for when filing my IRS 1120S - Schedule K-1?

Common mistakes when filing the IRS 1120S - Schedule K-1 include incorrect Social Security numbers, failing to report all income, or misclassifying income sources. Ensuring the accuracy of the amounts reported and double-checking recipient information can help mitigate errors. Using tax software may also assist in identifying potential issues before submission.

What should I do if I receive an IRS notice regarding my IRS 1120S - Schedule K-1?

If you receive a notice from the IRS concerning your IRS 1120S - Schedule K-1, it is essential to read the notice carefully to understand the issue. Respond promptly according to the instructions provided, and gather any required documentation to support your case. Keeping a copy of the notice and your responses can aid in resolving the matter efficiently.

See what our users say