Get the free SBA Form 1790 - archive sba

Show details

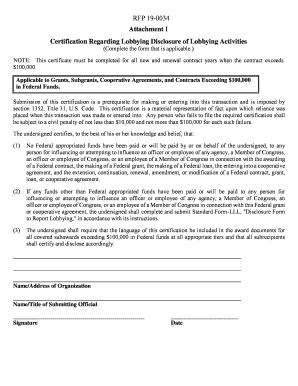

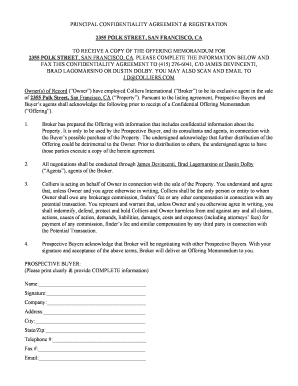

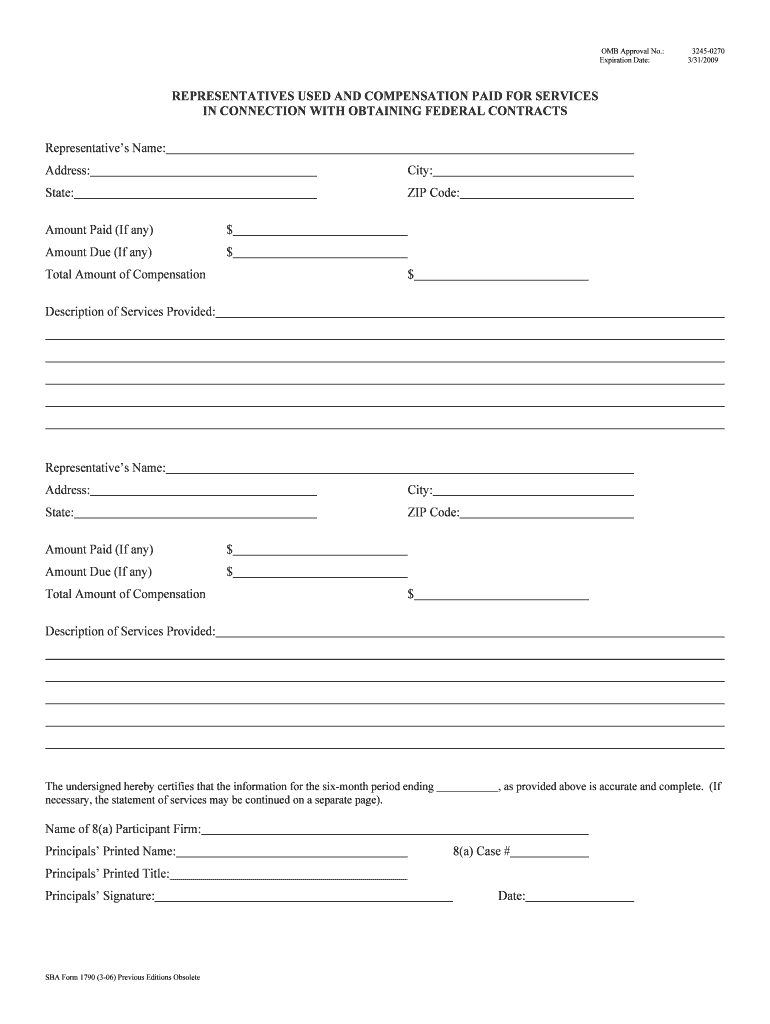

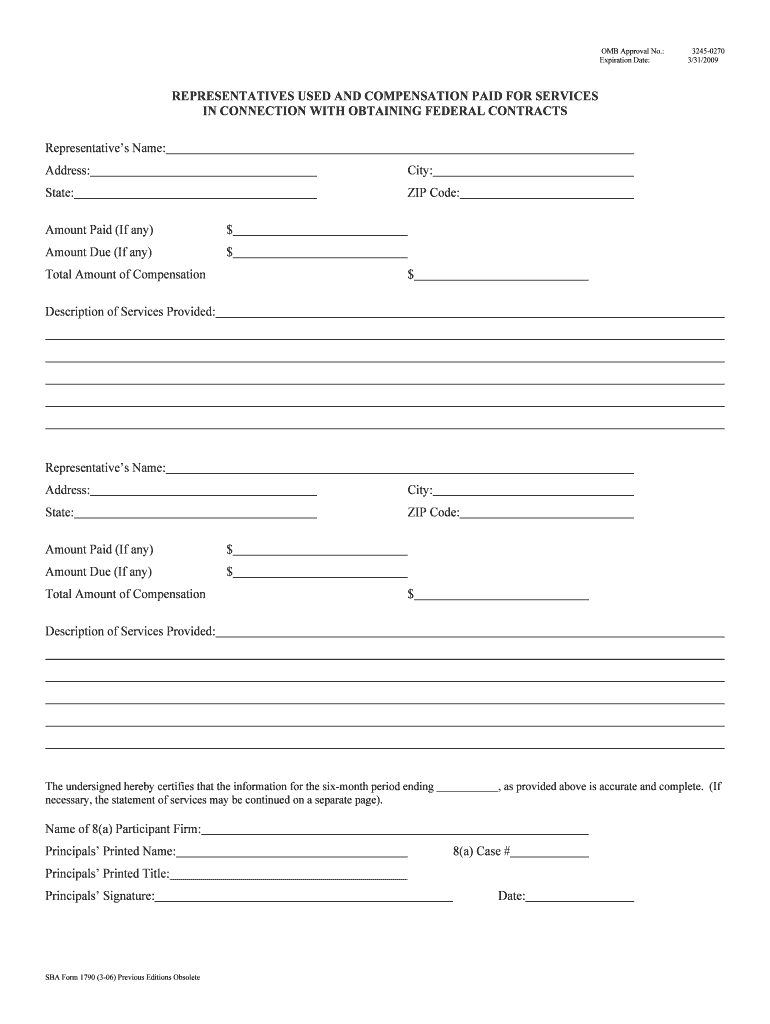

This form is used to report the representatives utilized and compensation paid for services associated with obtaining federal contracts, ensuring compliance with federal regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba form 1790

Edit your sba form 1790 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 1790 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba form 1790 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sba form 1790. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba form 1790

How to fill out SBA Form 1790

01

Obtain SBA Form 1790 from the official SBA website or your local SBA office.

02

Begin by entering your business name and address at the top of the form.

03

Fill out the section regarding the type of business entity (e.g., sole proprietorship, partnership, corporation).

04

Provide the Personal Identification Information (PII) of the owner(s) including names and Social Security Numbers.

05

Complete the financial sections, including revenue figures and any applicable loan information.

06

Indicate the purpose of the loan by selecting the appropriate options provided on the form.

07

Review your entries for accuracy and completeness.

08

Sign and date the form at the designated areas.

09

Make a copy of the filled form for your records before submission.

10

Submit the completed form to the appropriate SBA office.

Who needs SBA Form 1790?

01

Small business owners seeking financial assistance or loans from the SBA.

02

Entrepreneurs looking to access federal funding for startup or expansion projects.

03

Businesses affected by disasters or economic challenges that require federal support.

Fill

form

: Try Risk Free

People Also Ask about

Is the SBA form 1920 still required?

SBA Form 1920 has been retired as of August 1, 2023.

What is a 1920 form?

On SBA Form 1920, the lender must provide information about the loan terms, how the funds will be used, and more. This form helps the SBA make the final decision about whether to guaranty your loan, and about how the loan paperwork will be processed. Even though you aren't personal.

What is SBA Form 1920?

The purpose of this form is to collect identifying information about the Lender, the Small Business Applicant ("Applicant"), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with SBA Loan Program Requirements, as defined in 13 CFR § 120.10.

Who needs to fill out the SBA form 1919?

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business' general operations.

What is SBA Form 172?

SBA Form 172 - SBA Transaction Report on Loan Serviced by Lender. Description: Lenders use this form to enter information related to SBA form 172 Transaction Report on Loan Serviced by Lender.

What is SBA Form 1919 used for?

Form 1919 is required if you're applying for an SBA 7(a) loan. It collects all of the information the SBA needs to perform a complete background check for a potential borrower, including: Your background. Co-owners/co-applicants and other major players involved in running your business.

What is SBA Form 159?

The purpose of Form 159 in the SBA 7(a) loan process is to record any fees getting paid for SBA financing in order to keep lenders from paying related parties additional fees – and then charging you. This keeps the total costs of the loan lower, making affordable loans more of a possibility for small businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

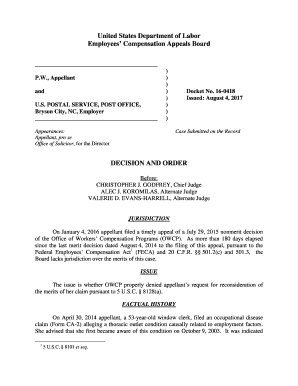

What is SBA Form 1790?

SBA Form 1790 is a financial assistance application used by the U.S. Small Business Administration (SBA) for borrowers applying for economic injury disaster loans.

Who is required to file SBA Form 1790?

Businesses that have suffered economic injury due to a declared disaster and are seeking financial assistance from the SBA must file SBA Form 1790.

How to fill out SBA Form 1790?

To fill out SBA Form 1790, applicants should provide accurate information regarding their business finances, including income, expenses, and disaster impact. The form requires detailed instructions to ensure all sections are correctly completed.

What is the purpose of SBA Form 1790?

The purpose of SBA Form 1790 is to assess the economic injury to businesses and determine eligibility for disaster loans to help them recover financially.

What information must be reported on SBA Form 1790?

Information required on SBA Form 1790 includes the business's revenue, expenses, projected financial impact from the disaster, and other relevant financial data that supports the loan application.

Fill out your sba form 1790 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 1790 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.