Get the free Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement - f...

Show details

Este formulario es requerido para que una institución financiera pueda enviar o recibir artículos electrónicos a través de un Banco de la Reserva Federal. Se utiliza para la inscripción y configuración

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check 21-enabled services fedforward

Edit your check 21-enabled services fedforward form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check 21-enabled services fedforward form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check 21-enabled services fedforward online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit check 21-enabled services fedforward. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check 21-enabled services fedforward

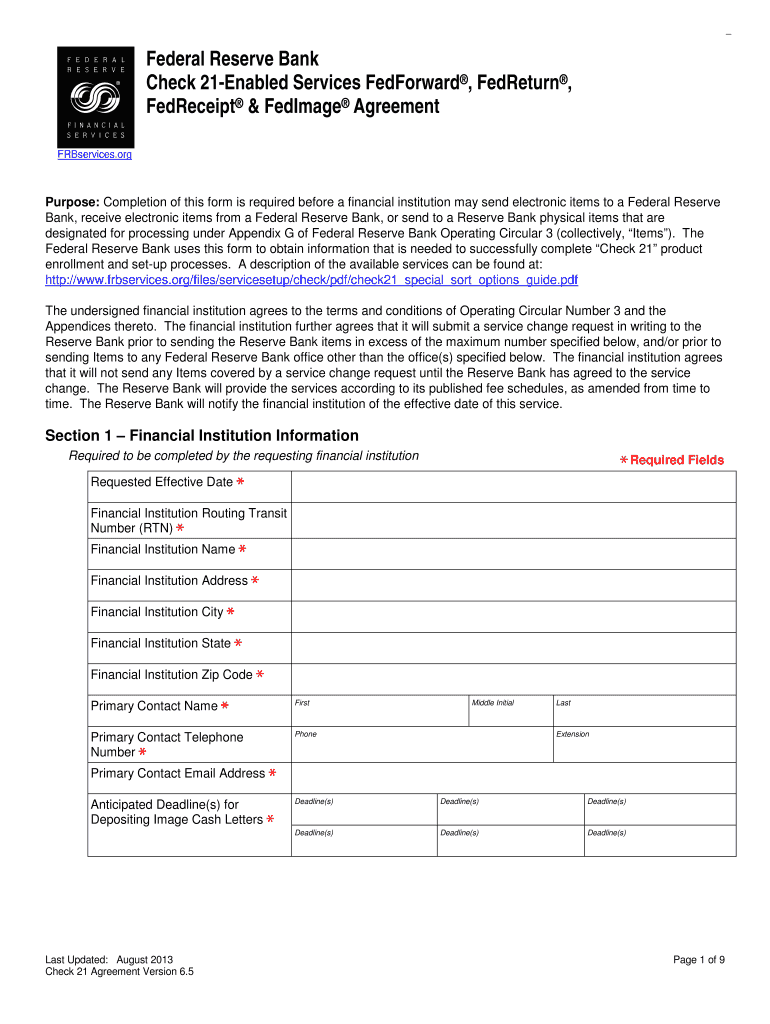

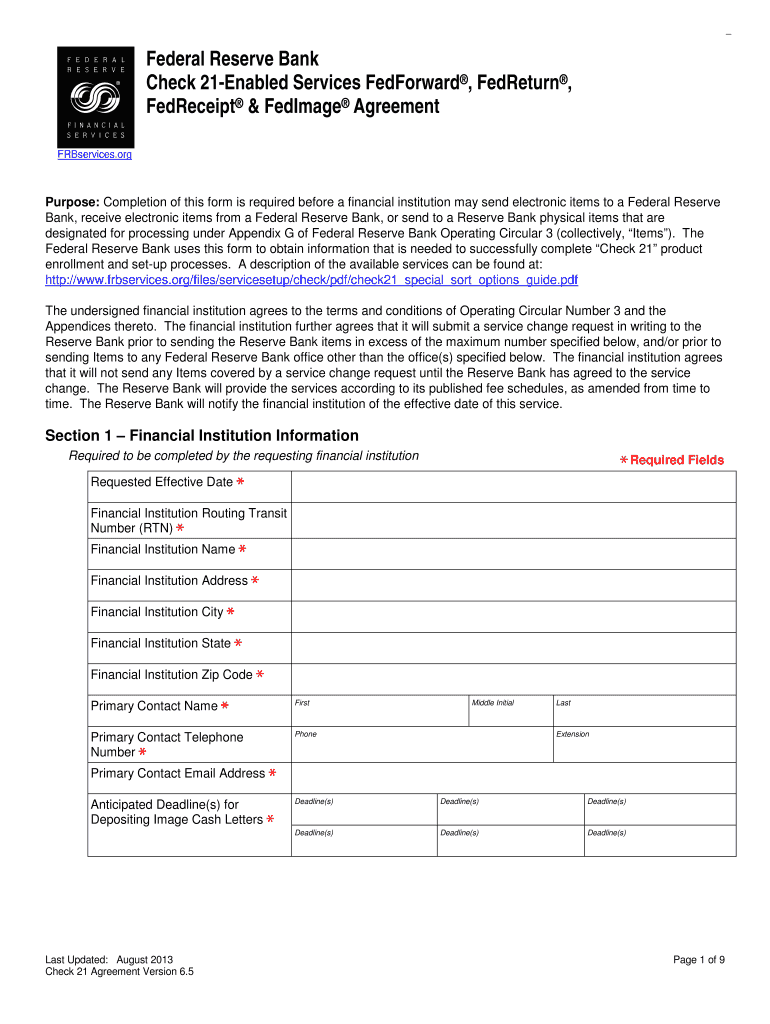

How to fill out Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement

01

Start by gathering all necessary documents related to your business and banking.

02

Access the Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement form.

03

Fill in your business name and contact information in the designated fields.

04

Provide your bank's information including the bank's name and routing number.

05

Specify the services you wish to enroll in: FedForward, FedReturn, FedReceipt, and FedImage.

06

Read through the terms and conditions carefully before signing.

07

Sign and date the agreement at the bottom of the form.

08

Keep a copy of the completed form for your records.

09

Submit the signed agreement to your bank as instructed.

Who needs Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

01

Businesses that process a high volume of checks and require electronic check processing.

02

Banks and financial institutions that offer Check 21 services to their clients.

03

Organizations that want to streamline their check handling processes and reduce operational costs.

04

Any entity looking to improve cash flow through faster check processing.

Fill

form

: Try Risk Free

People Also Ask about

Does the Federal Reserve sort checks?

From here, the federal reserve bank sorts checks by individual bank, and debits the federal reserve account of your particular bank 100 dollars. Finally, the federal reserve finishes up its role in this process by sending your bank your 100 dollar check (or, as another option, the digital image of the check).

Does the Federal Reserve investigate banks?

If consumers have a complaint about a financial institution, they can contact the Federal Reserve. Together with the twelve Federal Reserve Banks, the Board of Governors can answer questions about banking practices and investigate complaints about specific banks under the Fed's supervisory jurisdiction.

What is Check 21 banking?

The Check Clearing for the 21st Century Act, otherwise known as Check 21 allows banks to replace original paper checks with "substitute checks" that are made from digital copies of the originals. Why was Check 21 created? Check 21 was created to reduce the time, risks and costs associated with paper check processing.

How does the Check 21 amendment to regulation CC help banks and consumers?

The Act facilitates electronic check exchange by enabling banks to sort and deliver checks electronically and, where necessary, to create legally equivalent substitute checks for presentment to banks that have not agreed to accept checks electronically.

Does the Federal Reserve get involved in check processing?

The Federal Reserve Banks offer item processing, settlement and adjustments services to help manage your check clearing needs. Forward items, including commercial checks, Treasury checks, and Postal Money Orders, can be deposited in a single cash letter.

Does the Federal Reserve process checks?

The Federal Reserve Banks' Check Services offer you a suite of electronic and paper check processing options to support all of your needs. Based on deposit deadlines, level of sorting, and credit availability your financial institution can select among a variety of processing options.

What role does the Federal Reserve play check?

It conducts the nation's monetary policy, promotes financial system stability, supervises and regulates financial institutions, fosters payment and settlement system safety and efficiency, and promotes consumer protection and community development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

The Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement is a contractual agreement that allows financial institutions to utilize electronic check processing capabilities enabled by the Check 21 Act, which facilitates the electronic transmission of check images and related data.

Who is required to file Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

Financial institutions, including banks and credit unions, that provide Check 21 services or engage in the electronic processing and transmission of checks are required to file the Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement.

How to fill out Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

To fill out the agreement, institutions must provide their banking information, describe the services they will utilize (FedForward, FedReturn, FedReceipt, and FedImage), and ensure they include all required signatures and dates as specified in the agreement form.

What is the purpose of Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

The purpose of the agreement is to establish terms and conditions for the use of Check 21 services, ensuring compliance with legal requirements and facilitating the efficient processing of checks through electronic means.

What information must be reported on Check 21-Enabled Services FedForward, FedReturn, FedReceipt & FedImage Agreement?

The information that must be reported includes the institution's details, specific services being used, any fees associated with these services, and compliance measures that will be adhered to during operation.

Fill out your check 21-enabled services fedforward online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check 21-Enabled Services Fedforward is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.