IRS 5500-EZ 2015 free printable template

Show details

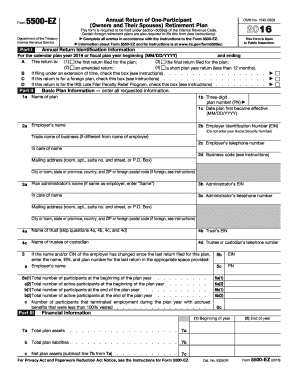

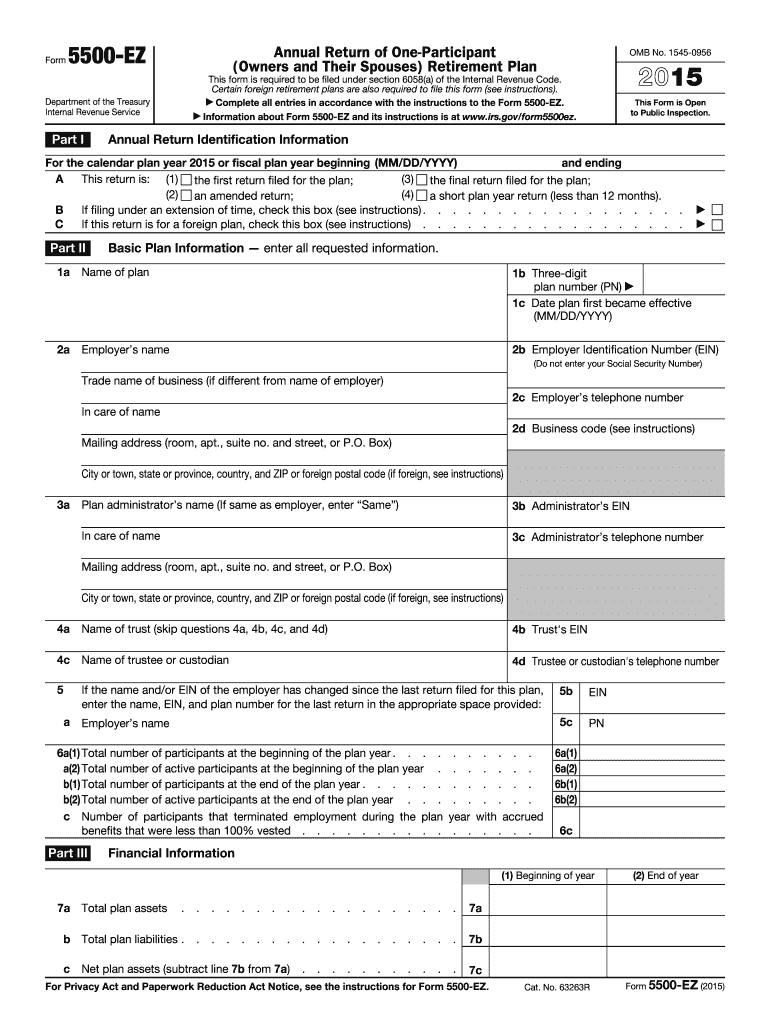

Cat. No. 63263R Form 5500-EZ 2015 Page Continued Contributions received or receivable from Amount 8a b Participants. Information about Form 5500-EZ and its instructions is at www.irs.gov/form5500ez. Department of the Treasury Internal Revenue Service Part I OMB No. 1545-0956 This Form is Open to Public Inspection. Annual Return Identification Information For the calendar plan year 2015 or fiscal plan year beginning MM/DD/YYYY and ending A This return is 1 the first return filed for the plan 3...the final return filed for the plan 2 an amended return 4 a short plan year return less than 12 months. Form 5500-EZ Annual Return of One-Participant Owners and Their Spouses Retirement Plan This form is required to be filed under section 6058 a of the Internal Revenue Code. Certain foreign retirement plans are also required to file this form see instructions. Complete all entries in accordance with the instructions to the Form 5500-EZ. B If filing under an extension of time check this box see...instructions. C If this return is for a foreign plan check this box see instructions. Basic Plan Information enter all requested information* 1a Name of plan 1b Three-digit plan number PN 1c Date plan first became effective MM/DD/YYYY 2a Employer s name 2b Employer Identification Number EIN Do not enter your Social Security Number Trade name of business if different from name of employer 2c Employer s telephone number In care of name 2d Business code see instructions Mailing address room apt....suite no. and street or P. O. Box City or town state or province country and ZIP or foreign postal code if foreign see instructions 3a Plan administrator s name If same as employer enter Same 3b Administrator s EIN 4a Name of trust answering 4a 4b 4c and 4d is optional 4b Trust s EIN 4c Name of trustee or custodian 4d Trustee or custodian s telephone number If the name and/or EIN of the employer has changed since the last return filed for this plan enter the name EIN and plan number for the...last return in the appropriate space provided 5b EIN 5c PN a 6a 1 Total number of participants at the beginning of the plan year. b 2 Total number of active participants at the end of the plan year. c Number of participants that terminated employment during the plan benefits that were less than 100 vested. year with accrued 6a 1 6a 2 6b 1 6b 2 6c Financial Information 1 Beginning of year 7a b Total plan liabilities. 7b Net plan assets subtract line 7b from 7a 7c 2 End of year c Total plan assets...For Privacy Act and Paperwork Reduction Act Notice see the instructions for Form 5500-EZ. 8b Others including rollovers. 8c Employers. Plan Characteristics Enter the applicable two-character feature codes from the List of Plan Characteristics Codes in the instructions Part V Compliance and Funding Questions Yes No During the plan year did the plan have any participant loans If Yes enter amount as of year end. Is this a defined benefit plan that is subject to minimum funding requirements If Yes ...complete Schedule SB Form 5500 and line 11a below.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

How to fill out IRS 5500-EZ

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

To edit Form 5500-EZ, download a blank or previously completed version from the IRS website or another reliable source. Use a suitable PDF editing tool, such as pdfFiller, to input your information clearly. Ensure that all required fields are filled out correctly, as inaccuracies can lead to processing delays.

How to fill out IRS 5500-EZ

Filling out IRS Form 5500-EZ involves several steps for accurate completion. First, provide your plan information, including the name and address of the plan sponsor. Next, include the plan year, and total plan assets to comply with reporting requirements. Finally, review all information for accuracy prior to submission.

About IRS 5500-EZ 2015 previous version

What is IRS 5500-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 5500-EZ 2015 previous version

What is IRS 5500-EZ?

IRS Form 5500-EZ is a document that must be filed by certain retirement plans, specifically one-participant plans and small businesses, to report financial information about employee benefit plans. This form serves as a streamlined version of the comprehensive Form 5500 designed for full reporting by larger plans.

What is the purpose of this form?

The purpose of IRS Form 5500-EZ is to satisfy the reporting requirements of the Employee Retirement Income Security Act (ERISA) for retirement plans. By submitting this form, sponsors provide the IRS with necessary information about the plan's operations and financial condition.

Who needs the form?

Employers that maintain a one-participant retirement plan or a foreign plan with U.S. participants are required to file IRS Form 5500-EZ. This includes solo 401(k) plans and simplified employee pension (SEP) plans that meet specific criteria laid out by the IRS.

When am I exempt from filling out this form?

Plans are exempt from filing IRS Form 5500-EZ if they have fewer than 100 participants at the beginning of the plan year and meet certain conditions. Additionally, if a plan follows specific directives from the IRS, such as being terminated, the filing requirement may be waived.

Components of the form

IRS Form 5500-EZ consists of several key sections which include basic plan information, financial data, and information regarding plan sponsors. Each section must be carefully filled out to ensure that accurate and complete information is reported.

What are the penalties for not issuing the form?

Failure to file IRS Form 5500-EZ or filing inaccuracies can result in substantial penalties. The IRS imposes a flat fee of $250 per day for failures, up to a maximum of $150,000. Know that these penalties can accumulate quickly, emphasizing the importance of timely and accurate submission.

What information do you need when you file the form?

When filing IRS Form 5500-EZ, you will need your Employer Identification Number (EIN), plan sponsor information, plan year dates, and asset information. Additional data, such as financial statements or valuations, may also be required depending on your plan's structure.

Is the form accompanied by other forms?

IRS Form 5500-EZ may need to be accompanied by financial statements, particularly for larger one-participant plans. Ensure that all supplementary forms are included to streamline the filing process and prevent delays.

Where do I send the form?

IRS Form 5500-EZ should be sent to the Department of Labor (DOL) for review and processing. The mailing address is specified in the form's instructions, depending on whether you are submitting via mail or electronically. Ensure that you retain confirmation of your submission for your records.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been great for what I have used it for so far.

I AM NOT A BILLER, SO IT TAKES ME TIME TO GET IT RIGHT.

I never used this type of form fill in before, I just completed a JHA for my company and it seemed to work fine. Thanks

I have found all of my documents super quick!

When going from preview back to editable view all imputed info disappeared. Not sure why that happened but I selected cancel and all info reappeared.

As a new user, I found the software easy to use even without taking the tour.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.