Get the free fdic payee information for automatic deposit of payment

Show details

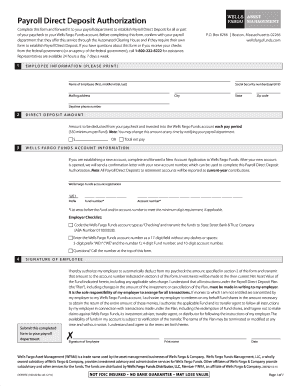

Federal Deposit Insurance Corporation PAYEE INFORMATION FOR AUTOMATIC DEPOSIT OF PAYMENT INSTRUCTIONS Complete and return this form to the Federal Deposit Insurance Corporation FDIC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fdic payee information for

Edit your fdic payee information for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fdic payee information for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fdic payee information for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fdic payee information for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fdic payee information for

Point by point instructions for filling out fdic payee information:

01

Begin by gathering all the necessary information, such as the recipient's legal name, address, and bank account details.

02

Fill out the payee's legal name accurately in the designated field. Double-check for any spelling errors.

03

Enter the payee's complete address, including street, city, state, and ZIP code, ensuring it matches their official records.

04

Provide the payee's bank account details, including the bank's name, routing number, and the account number.

05

If required, specify the type of account (e.g., checking or savings) the payee has with the bank.

06

Include any additional information requested by the FDIC payee form, such as the payee's taxpayer identification number (TIN) or social security number.

07

Review the completed information for accuracy and completeness before submitting it.

08

Submit the filled-out FDIC payee information form through the designated channel or to the appropriate department.

09

Retain a copy of the submitted form for your records.

Who needs fdic payee information for:

01

Individuals or entities who are due to receive funds from the Federal Deposit Insurance Corporation (FDIC).

02

Payment beneficiaries who have qualified for various FDIC programs, such as insurance dividends or claims.

03

Financial institutions or vendors providing services to the FDIC, requiring payee information for payment processing.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you have more than 250k in the bank?

Bottom line. Any individual or entity that has more than $250,000 in deposits at an FDIC-insured bank should see to it that all monies are federally insured. It's not only diligent savers and high-net-worth individuals who might need extra FDIC coverage.

What are the two primary methods the FDIC uses to handle a failed bank?

Overview of the Resolution Process Typically, uninsured depositors, creditors, and shareholders are not protected against losses in order to meet the least cost requirement. The FDIC normally uses two main resolution methods: (1) purchase and assumption transactions and (2) deposit payoffs.

Is FDIC insurance per account or person?

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

What are the two types of payment methods FDIC can adopt to honor customer deposits when a bank fails?

In the unlikely event of a bank failure, the FDIC acts quickly to protect insured depositors by arranging a sale to a healthy bank, or by paying depositors directly for their deposit accounts to the insured limit.

What does FDIC do when a bank fails?

Historically, the FDIC pays insurance within a few days after a bank closing, usually the next business day, by either (1) providing each depositor with a new account at another insured bank in an amount equal to the insured balance of their account at the failed bank, or (2) by issuing a payment to each depositor for

How does FDIC insurance work with multiple accounts at same bank?

The FDIC adds together all single accounts owned by the same person at the same bank and insures the total up to $250,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fdic payee information for online?

The editing procedure is simple with pdfFiller. Open your fdic payee information for in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my fdic payee information for in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your fdic payee information for right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the fdic payee information for form on my smartphone?

Use the pdfFiller mobile app to complete and sign fdic payee information for on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is fdic payee information for?

FDIC payee information is used to report the identity of individuals or entities who receive payments from FDIC-insured institutions, ensuring regulatory compliance and proper tracking of financial transactions.

Who is required to file fdic payee information for?

FDIC-insured banks and financial institutions are required to file FDIC payee information for any payments made to payees that meet certain threshold criteria or are part of specified transactions.

How to fill out fdic payee information for?

To fill out FDIC payee information, one must provide details such as the payee's full name, address, taxpayer identification number, and the amount of the payment along with the purpose of the transaction.

What is the purpose of fdic payee information for?

The purpose of FDIC payee information is to ensure transparency in financial transactions, facilitate tax compliance, and assist in monitoring for illegal activities such as money laundering or fraud.

What information must be reported on fdic payee information for?

Information that must be reported includes the payee's name, address, social security number or employer identification number, the amount paid, and the nature of the payment or transaction.

Fill out your fdic payee information for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fdic Payee Information For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.