Get the free Standard Homeowners Filings - insurance arkansas

Show details

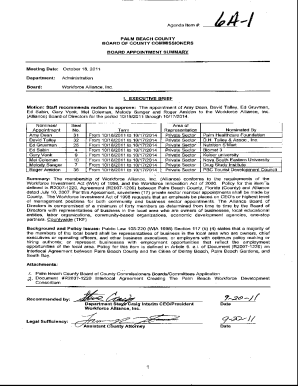

This document outlines the filing details for the adoption of the ISO HO 2000 homeowners forms and endorsements by Republic Underwriters Insurance Company in Arkansas.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard homeowners filings

Edit your standard homeowners filings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard homeowners filings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standard homeowners filings online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard homeowners filings. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard homeowners filings

How to fill out Standard Homeowners Filings

01

Gather all necessary documents including proof of ownership, prior insurance policy details, and personal identification.

02

Locate the Standard Homeowners Filings form on the relevant insurance website or through your agent.

03

Complete the form with accurate personal information, including your name, address, and contact details.

04

Provide information about your home, such as its size, age, and construction type.

05

Disclose any prior claims or damages that have occurred on the property.

06

Review the completed form for accuracy and completeness.

07

Submit the form either online or through your insurance agent, as per instructions provided.

Who needs Standard Homeowners Filings?

01

Anyone who owns a home and is seeking homeowners insurance coverage.

02

Homeowners looking to switch insurance providers or update their current policy.

03

Individuals applying for mortgage loans that require proof of homeowners insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is covered by the standard homeowners policy?

Standard homeowners policies provide coverage for disasters such as damage due to fire, lightning, hail and explosions. Those who live in areas where there is risk of flood or earthquake will need coverage for those disasters, as well.

What are the six coverage areas of a standard homeowners insurance policy?

Generally, a homeowners insurance policy includes at least six different coverage parts. The names of the parts may vary by insurance company, but they typically are referred to as Dwelling, Other Structures, Personal Property, Loss of Use, Personal Liability and Medical Payments coverages.

What is not covered under a regular homeowners policy?

Earthquake, flood, mold, earth movement, and “wear and tear” are some of the perils that are usually excluded. When an insurer writes your homeowners coverage, the insurer is legally obligated to offer you earthquake coverage for an additional premium.

What are the requirements for homeowners insurance?

No states have laws mandating homeowners insurance, but, if you finance your home, your lender will typically require a home insurance policy. The standard coverages for homeowners insurance are generally the same in all states.

What does a standard homeowners insurance policy cover?

Homeowner's insurance gives you financial protection against damages to your house, a home loss due to natural disasters, theft, and other unfortunate accidents.

Who has the best homeowners insurance?

Best home insurance companies at a glance CompanyAnnual rateSatisfaction rating** Best overall: Amica $1,830 679 Best large company: State Farm $2,427 643 Best regional company: North Star Mutual $2,159 Not rated Best coverages: Erie $2,055 6742 more rows • Feb 12, 2025

What does standard coverage cover?

When buying auto insurance, there are two main types of coverage to choose from: A Standard Policy usually provides minimum liability coverage (which will protect your assets) and uninsured motorist limits of $15,000 per person/$30,000 per accident for bodily injury, and $5,000 for property damage.

What coverage is not included in a standard homeowners policy?

In general, a standard homeowner's insurance policy usually does NOT cover the following perils: Dogs & Pet Liabilities (It Depends) Normal Wear and Tear. Intentional Loss & Neglect.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Standard Homeowners Filings?

Standard Homeowners Filings refer to a set of documents and forms that homeowners are required to submit to their local government or applicable authority to report owning a residential property, including details about the property and its usage.

Who is required to file Standard Homeowners Filings?

Homeowners who own residential properties, and may include landlords or property managers who oversee rental properties, are typically required to file Standard Homeowners Filings.

How to fill out Standard Homeowners Filings?

To fill out Standard Homeowners Filings, homeowners should obtain the correct forms from their local authority, provide accurate property information such as address, ownership details, and any relevant financial data, and then submit the completed forms as per the local filing guidelines.

What is the purpose of Standard Homeowners Filings?

The purpose of Standard Homeowners Filings is to provide local authorities with essential information about residential properties, which helps in taxation, urban planning, regulatory compliance, and ensuring the proper upkeep of community standards.

What information must be reported on Standard Homeowners Filings?

Standard Homeowners Filings typically require reporting information such as the property address, owner’s name, contact information, property type, usage, and any applicable financial details such as mortgage information and property value.

Fill out your standard homeowners filings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Homeowners Filings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.