KY DoR 42A803(D) K-3 2006 free printable template

Show details

42A803 D 8-06 EMPLOYER S RETURN OF INCOME TAX WITHHELD Commonwealth of Kentucky DEPARTMENT OF REVENUE NAME AND ADDRESS K-3 FOR OFFICIAL USE ONLY AMENDED RETURN Period Beginning Period Ending Return Due Account No. A As Originally Reported or Adjusted B Correct Amount Total Number of Employees This Period B Correct Amount 1. Total wages paid this period. 2. Kentucky income tax withheld ANNUAL RECONCILIATION 3. Previous period adjustments or credits. paid for the year. 4. Net tax due. Period...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign kentucky employers income tax

Edit your kentucky employers income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky employers income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kentucky employers income tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kentucky employers income tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

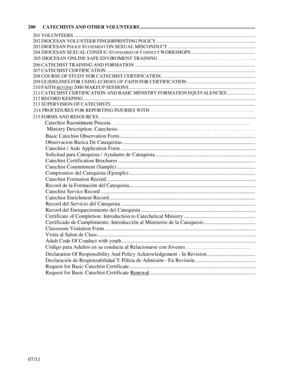

KY DoR 42A803(D) K-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kentucky employers income tax

How to fill out KY DoR 42A803(D) K-3

01

Obtain the KY DoR 42A803(D) K-3 form from the Kentucky Department of Revenue website or your local tax office.

02

Fill in your personal information such as name, address, and Social Security number at the top of the form.

03

Include the details of your income sources, ensuring that each source is accurately listed.

04

Report any deductions or credits you are eligible for on the designated lines of the form.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form at the bottom before submitting it to the appropriate tax authority.

Who needs KY DoR 42A803(D) K-3?

01

Individuals or businesses that are required to report certain types of income in Kentucky.

02

Taxpayers who have received income from partnerships, S corporations, or trusts that is subject to individual taxation.

03

Anyone needing to calculate their tax liability based on the income reported on the KY DoR 42A803(D) K-3.

Fill

form

: Try Risk Free

People Also Ask about

What is Ky withholding tax?

Form K–4—Kentucky Withholding Certificate Kentucky recently enacted a new flat 5% income tax rate. Due to this change all Kentucky wage earners will be taxed at 5% with an allowance for the standard deduction.

What form is employers income tax withheld in Kentucky?

Form K-5. Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

What is withholding tax on paycheck?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.

Is Kentucky a mandatory withholding state?

Kentucky Revised Statute Chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Employers must withhold the income tax of the employees receiving "wages" as defined in Section 3401(a) of the Internal Revenue Code.

How is Kentucky withholding tax calculated?

Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

Does Kentucky have a state income tax withholding form?

If you meet any of the four exemptions you are exempted from Kentucky withholding. However, you must complete this form and file it with your employer before withholding can be stopped. You will need to maintain a copy of the K-4 for your permanent records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit kentucky employers income tax online?

The editing procedure is simple with pdfFiller. Open your kentucky employers income tax in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the kentucky employers income tax in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your kentucky employers income tax in seconds.

How do I complete kentucky employers income tax on an Android device?

Use the pdfFiller app for Android to finish your kentucky employers income tax. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is KY DoR 42A803(D) K-3?

KY DoR 42A803(D) K-3 is a tax form used in Kentucky for reporting certain types of income, credits, and other tax-related information for partners in partnerships and shareholders in S corporations.

Who is required to file KY DoR 42A803(D) K-3?

Partnerships and S corporations doing business in Kentucky are required to file KY DoR 42A803(D) K-3 to report income, deductions, and credits allocated to their partners or shareholders.

How to fill out KY DoR 42A803(D) K-3?

To fill out KY DoR 42A803(D) K-3, you need to gather the necessary financial information from the partnership or S corporation, complete the sections on income, deductions, credits, and distributions, and ensure it is signed by an authorized representative.

What is the purpose of KY DoR 42A803(D) K-3?

The purpose of KY DoR 42A803(D) K-3 is to provide the Kentucky Department of Revenue with accurate information regarding the distributed income, deductions, and credits from partnerships and S corporations to their respective partners or shareholders for tax purposes.

What information must be reported on KY DoR 42A803(D) K-3?

KY DoR 42A803(D) K-3 must include information such as entity identification, partner or shareholder identification, income allocated, deductions claimed, credits, and any distributions made to the partners or shareholders.

Fill out your kentucky employers income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kentucky Employers Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.