KY DoR 42A803(D) K-3 2008 free printable template

Show details

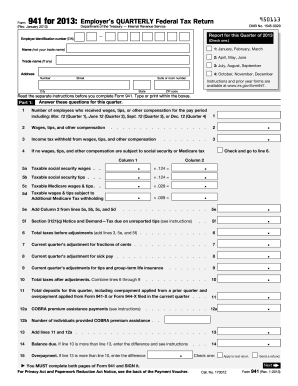

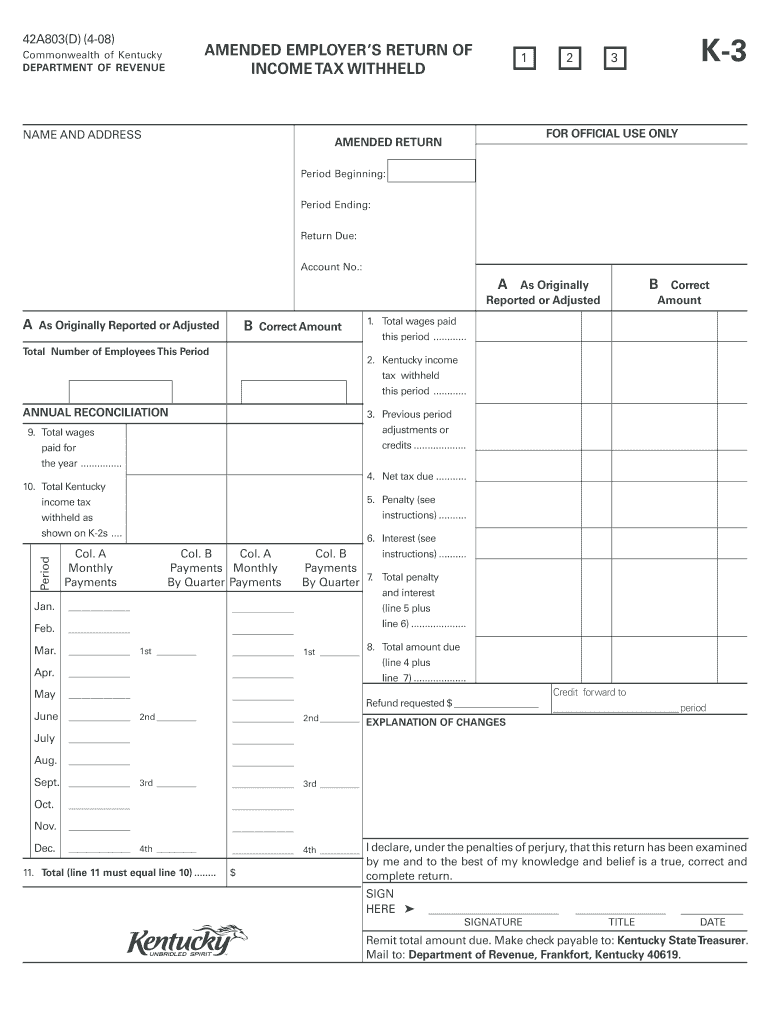

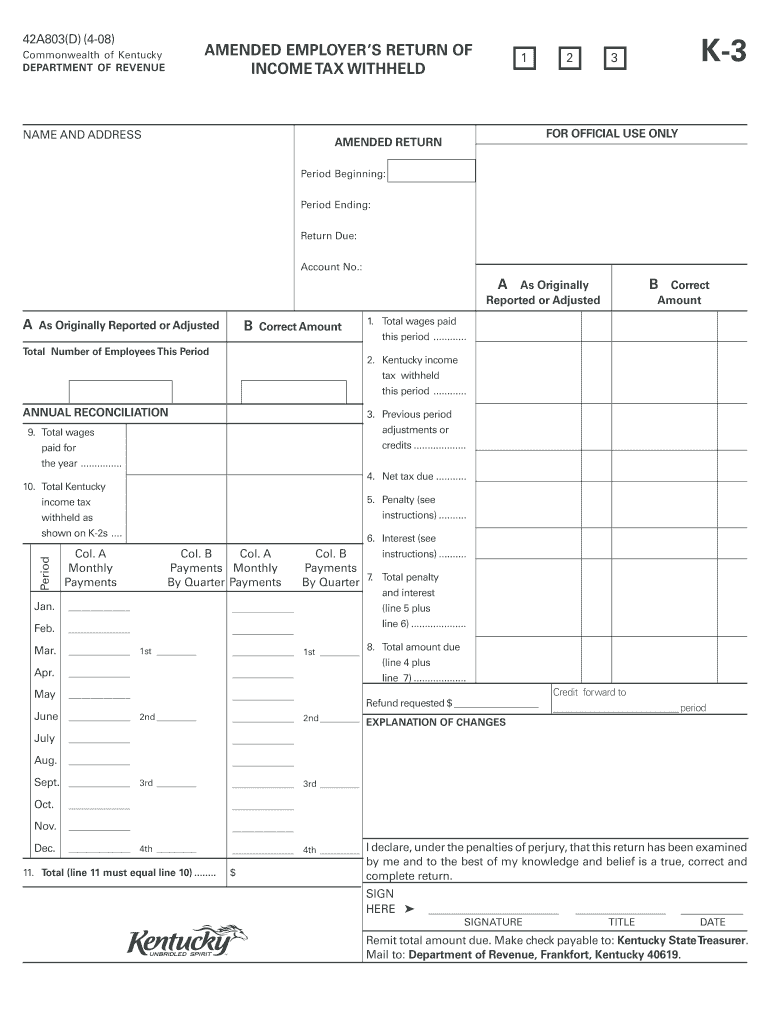

42A803 D 4-08 AMENDED EMPLOYER S RETURN OF INCOME TAX WITHHELD Commonwealth of Kentucky DEPARTMENT OF REVENUE NAME AND ADDRESS K-3 FOR OFFICIAL USE ONLY AMENDED RETURN Period Beginning Period Ending Return Due Account No. A As Originally Reported or Adjusted B Correct Amount Total Number of Employees This Period B Correct Amount 1. Total wages paid this period. 2. Kentucky income tax withheld ANNUAL RECONCILIATION 3. Previous period adjustments or credits. paid for the year. 4. Net tax due....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 42A803D K-3

Edit your KY DoR 42A803D K-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 42A803D K-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 42A803D K-3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KY DoR 42A803D K-3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 42A803(D) K-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 42A803D K-3

How to fill out KY DoR 42A803(D) K-3

01

Obtain the KY DoR 42A803(D) K-3 form from the Kentucky Department of Revenue website.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate your taxpayer identification number if you have one.

04

Complete the income sections by reporting all applicable income sources as instructed.

05

Calculate your deductions and enter the amounts in the designated sections.

06

Review the instructions for any additional information required for specific credits or adjustments.

07

Sign and date the completed form to certify that the information provided is accurate.

Who needs KY DoR 42A803(D) K-3?

01

Taxpayers who are required to report certain income or adjustments for Kentucky state tax purposes.

02

Individuals or businesses that have specific tax obligations under Kentucky law.

Instructions and Help about KY DoR 42A803D K-3

Fill

form

: Try Risk Free

People Also Ask about

How is Ky state income tax calculated?

Annual wages minus the Kentucky standard deduction equals annual Kentucky wages. Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

What is Ky income tax rate?

Kentucky Tax Rates, Collections, and Burdens Kentucky has a flat 4.50 percent individual income tax rate. There are also jurisdictions that collect local income taxes.

Where is Ky state tax return?

To obtain a previous year(s) refund status, please call (502) 564-4581 to speak to an examiner. Prior year and amended return processing may require in excess of 20 weeks to complete.

What states have no state income?

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

Does KY have state income?

Kentucky imposes a flat income tax. This differs from the federal income tax, which has a progressive tax system (higher rates for higher income levels). The state income tax rate is 5% regardless of income.

Does KY have state income tax?

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax rate is five (5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KY DoR 42A803D K-3 directly from Gmail?

KY DoR 42A803D K-3 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete KY DoR 42A803D K-3 online?

With pdfFiller, you may easily complete and sign KY DoR 42A803D K-3 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out KY DoR 42A803D K-3 using my mobile device?

Use the pdfFiller mobile app to fill out and sign KY DoR 42A803D K-3 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is KY DoR 42A803(D) K-3?

KY DoR 42A803(D) K-3 is a form used in Kentucky to report partnership and fiduciary income, deductions, gains, and losses for tax purposes.

Who is required to file KY DoR 42A803(D) K-3?

Partnerships, limited liability companies (LLCs) treated as partnerships, and certain estates or trusts that have income to report must file KY DoR 42A803(D) K-3.

How to fill out KY DoR 42A803(D) K-3?

To fill out KY DoR 42A803(D) K-3, gather information on income, deductions, and credits, complete the sections accurately, and ensure that all reported amounts match federal filings.

What is the purpose of KY DoR 42A803(D) K-3?

The purpose of KY DoR 42A803(D) K-3 is to provide the Kentucky Department of Revenue with a detailed account of the income and financial activity of partnerships and fiduciaries for state tax collection.

What information must be reported on KY DoR 42A803(D) K-3?

KY DoR 42A803(D) K-3 requires reporting of income, losses, deductions, credits, and other relevant financial information pertaining to the partnership or fiduciary.

Fill out your KY DoR 42A803D K-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 42A803D K-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.