IN SF 4162 2011 free printable template

Show details

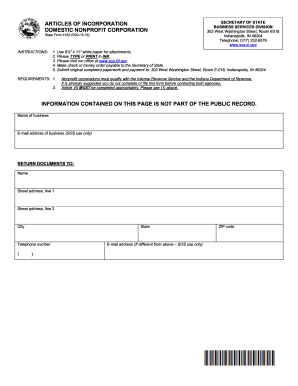

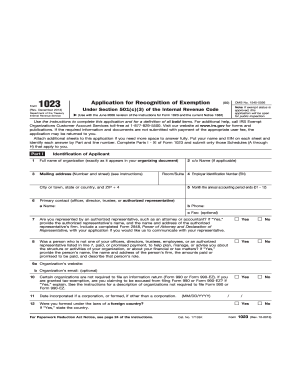

Reset Form ARTICLES OF INCORPORATION FOR A NONPROFIT CORPORATION State Form 4162 (R11 / 2-11) Corporate Form No. 364-1 (October 1984) Approved by State Board of Accounts, 1995 NOTES: 1. Nonprofit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN SF 4162

Edit your IN SF 4162 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN SF 4162 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN SF 4162 online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN SF 4162. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN SF 4162 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN SF 4162

How to fill out IN SF 4162

01

Obtain the IN SF 4162 form from the official source.

02

Fill in the personal information section, including name, address, and contact details.

03

Complete the specific sections relevant to your purpose for submitting the form.

04

Review the instructions provided on the form for any additional requirements.

05

Sign and date the form at the designated area.

06

Submit the completed form either electronically or by mail as directed.

Who needs IN SF 4162?

01

Individuals or organizations required to report specific information to the government.

02

Those seeking to apply for benefits or services that necessitate the completion of this form.

03

Anyone under obligation to provide information as per regulatory or legal requirements.

Fill

form

: Try Risk Free

People Also Ask about

How much is an Indiana business entity report?

How much does the Indiana business entity report cost? The cost to file a business entity report is $50 online. The state encourages people to submit the report electronically, and the costs are the same for LLCs and corporations.

Where do I find my Indiana Secretary of State Control number?

Use the Business Information Search to find entity information, including the Secretary of State Control Number. The control number is displayed in the left column of the search results list and at the top of the Business Entity Detail form in the blue heading bar.

How do I find out who owns an LLC in Indiana?

To lookup a business entity (Corporation, LLC, Limited Partnership) in Indiana, you will need to go to the Secretary of State's Website. You may be able to search by Name or Client ID Number.

What are the benefits of an LLC in Indiana?

Limited Liability Company - An LLC is a formal association that combines the advantage of a corporation's limited liability and the flexibility and single taxation of a general partnership. An LLC has members rather than shareholders. A member enjoys protections from the liabilities and debts of the LLC.

What happens if you don t file a business entity report in Indiana?

If you don't file your Indiana Business Entity Report within 60 days after your due date, your business may be administratively dissolved or revoked. Indiana doesn't charge late fees.

How do I find out if an LLC is in the US?

Verifying LLC Status In many states, the secretary of state's office maintains a searchable corporate database. To confirm a company's LLC status, call the secretary of state's office or visit the website. In states like Arizona, out-of-state companies must register with the state before they can do business there.

Do you have to renew LLC every year in Indiana?

License Duration/Renewal Date Public Adjuster licenses are subject to annual renewal with expiration dates of December 31st of each year. An updated bond must be submitted with renewal.

How do I check if the company name I want is already taken?

Check Trademark for your proposed name --> Check Trademark This website is maintained by the Office of the Controller General of Patents, Designs & Trade Marks, Department of Industrial Policy & Promotion, Ministry of Commerce & Industry.

How do I reserve a business name in Indiana?

If you don't want to form your LLC right now, you can reserve the business name. You'll need to file an application by using Indiana's INBIZ online filing system. Once the application is processed, your name will be reserved for 120 days. If you're forming your business right away, you don't need to reserve a name.

Does Indiana require an annual report?

Why Is an Indiana Annual Report Required? Annual reports are required by statute in nearly every state. They provide state agencies with updated information on the entities registered in their state. Your company is required to file annual reports to maintain good standing and continue operating.

How do you check if an LLC name is taken in Indiana?

To check a business name for availability, please log into your INBiz account and click Online Services. Under the Secretary of State section, select Name Reservations. Enter the desired name and click Check availability.

What is Indiana business entity report?

What is an Indiana business entity report? An Indiana business entity report must be filed every other year with the Indiana Secretary of State. The purpose of the report is to provide necessary information, like contact information, to the state. Filing a business entity report is an ongoing responsibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IN SF 4162 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IN SF 4162, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get IN SF 4162?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IN SF 4162 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete IN SF 4162 on an Android device?

Complete your IN SF 4162 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IN SF 4162?

IN SF 4162 is a form used for reporting specific financial information by individuals or entities to ensure compliance with federal regulations.

Who is required to file IN SF 4162?

Individuals or entities that meet certain financial thresholds or engage in specific activities as defined by federal regulations are required to file IN SF 4162.

How to fill out IN SF 4162?

To fill out IN SF 4162, gather the required financial information, complete each section of the form accurately, and submit it according to the provided instructions.

What is the purpose of IN SF 4162?

The purpose of IN SF 4162 is to collect essential financial information necessary for regulatory compliance and oversight.

What information must be reported on IN SF 4162?

Information that must be reported on IN SF 4162 includes financial balances, transaction details, and any relevant financial activities that fall under the reporting requirements.

Fill out your IN SF 4162 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN SF 4162 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.